It's a puzzle. Is this yet another bear-market bounce, or the start of something more meaningful? It was just the second gain in 10 weeks; but the 12% rise from 12-year lows was enough to start the debate.

The usually bearish, and quite well-respected, Doug Kass suggested that we might be seeing a "generational low" here. Personally, I'm skeptical. But when Doug Kass and Warren Buffet agree, I'm going to try and see what they see.

Also note that tech is leading, and the financials are doing reasonably well, right now, too. For a sustained rally, that is as it should be. Nonetheless, the proof will be in the follow-through.

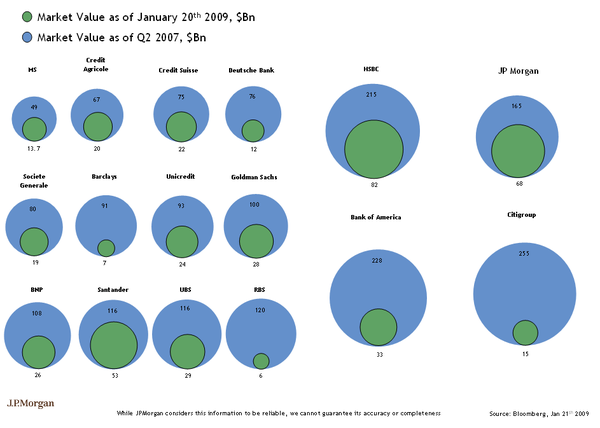

With that in mind, here is a chart of the Banking Index from Bill Luby's VIX and More. It shows that we've had one-week rallies several times since August. A bigger move might be an important sign?

Also note that the major US Equity Indices are rallying into the overhead resistance created by the November lows. And that is where we start the week.

There's a joke amongst traders: The Trading Gods allow you to buy the low-tick then sell the high-tick … once. After that, you're free to do the opposite as often as you want.

Note that there is a kernel of truth in most good humor … and if you haven't seen Jim Cramer on the Daily Show, it's worth watching.

Here are a Few of the Business Posts Moving the Markets that I Found Interesting This Week:

- Global Stimulus Coordinated Effort Shot Down. (The Daily Beast)

- China’s Leader Says He Is ‘Worried’ Over U.S. Treasuries. (NYTimes)

- Outsmarting Wall Street? How Quants Tried to Model The Physics of Money. (NYTimes)

- AIG Paying $165 Million in Bonuses After Federal Bailout. (NYTimes)

And, Here are a Few More Lighter Ideas and Fun Links:

- What does one TRILLION dollars look like? (PageTutor)

- The Unsaid Reason VCs May Not Back You: Resource Efficiency (Mark Peter Davis)

- Time Management in the Age of Social Media. (BusinessWeek)

- Twitter Has A Big Month, Grows To Over 8 Million U.S. Users (SocialTimes)