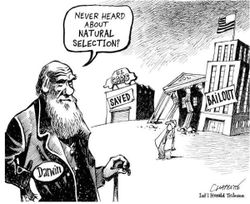

A Different Form of Rescue for G.M., Through Bankruptcy.

President Obama will push General Motors into bankruptcy protection on Monday, making a risky economic and political bet that by nationalizing the onetime icon of American capitalism, he can save the company as a much smaller automaker that is competitive.

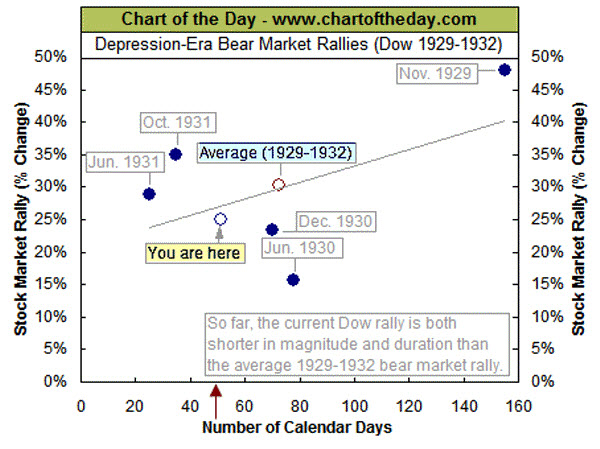

Still, The Market's Rally Persists.

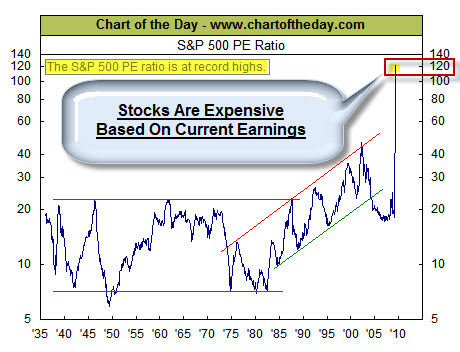

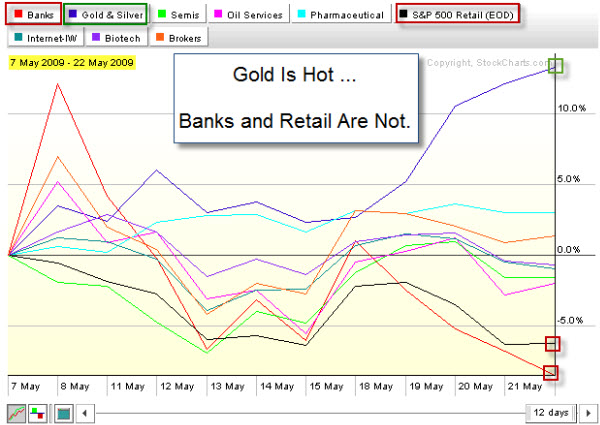

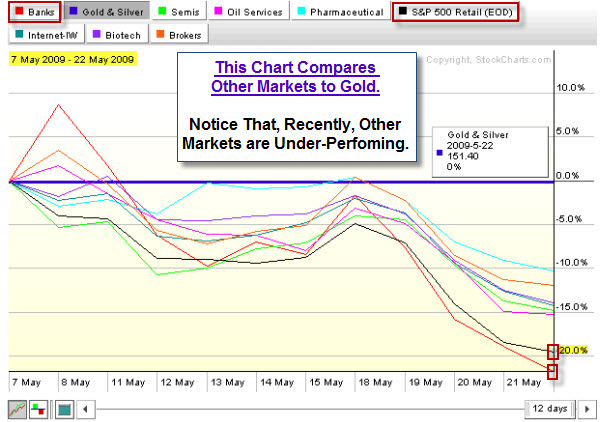

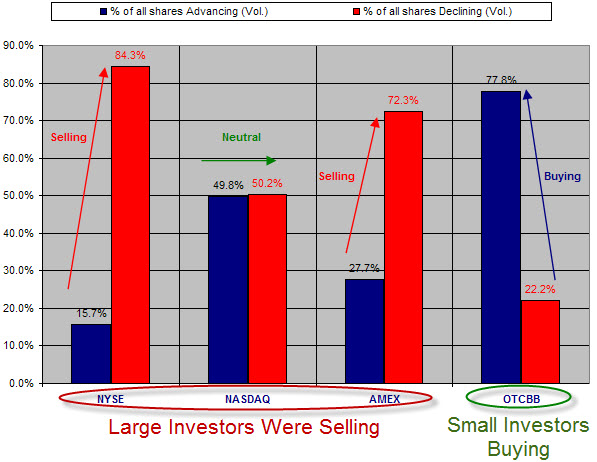

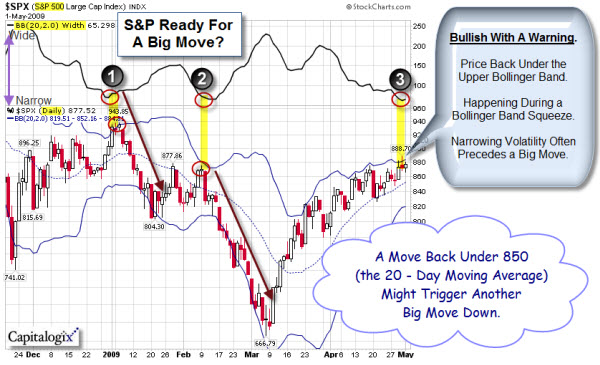

The Markets continue to hold-up well three months into the rally. From my standpoint, I'd like to see a pull-back. However, the action has seemed relatively healthy considering the circumstances.

The chart below shows a daily view of the S&P 500 since its March lows. I marked the obvious Bull and Bear cases for your review. A sustained break-out to the upside would be significant here.

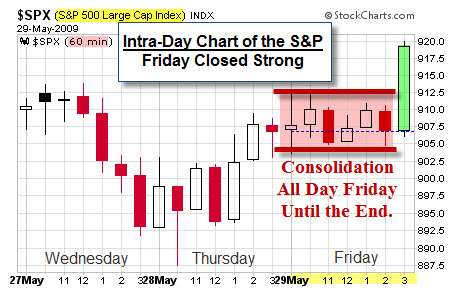

I don't normally post intra-day charts; however, Friday was interesting. We spent the day bouncing within a tight range … then somebody started buying. I hear people reference the "Boys" or the "Plunge Protection Team", or explain the push as "End-of-Month Window Dressing" or "Short-Covering." Here is an hourly chart showing Wednesday, Thursday, and Friday.

From my perspective, all it means was there was a lack of sellers. Let's see if they come back in June.

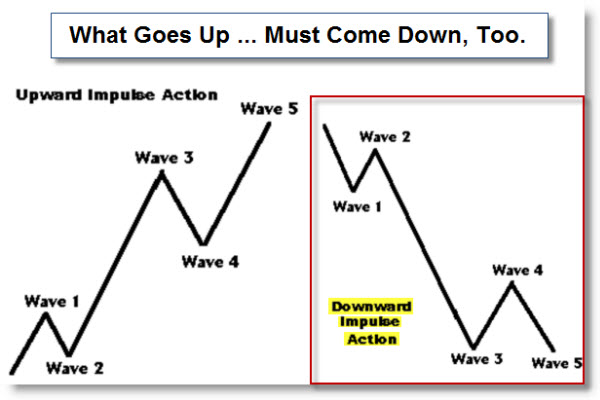

What Goes Up, Must Come Down: Or Does It?

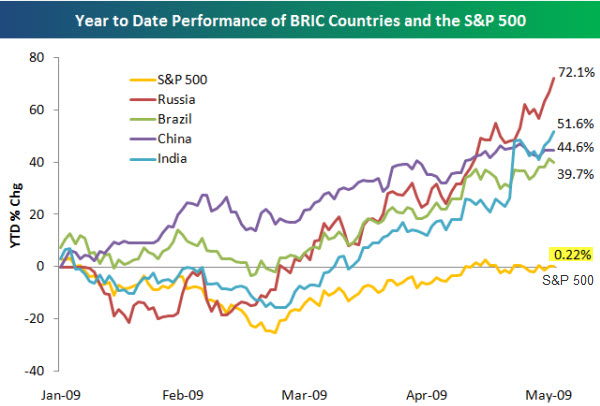

The rally did not just happen here in America. This chart, from Bespoke, shows how far the fast growing developing countries have come this year.

When I see charts like this, one part of me thinks, "look how far they've come"; and another part of me thinks, "look how far they are likely to fall."

Business Posts Moving the Markets that I Found Interesting This Week:

- Sell In May? Not This Time … as the Rally Continued. (Seeking Alpha)

- Many Hedge Funds Caught Short by the Rally, Still Have Not Fully Bought-In. (WSJ)

- Will Money Flow Back Into The Markets, Or Will The Sidelines Stay Crowded? (WSJ)

- Economists Disagree Whether A Sustainable Recovery Has Begun. (Market Oracle)

- Hulbert's Contrarian Take On Consumer Confidence. (MarketWatch)

- Tivo Posts Loss As Its Growth Slows. (NYTimes)

- Dell Warns PC Market Hasn't Hit Bottom; Suffers 63% Drop In Quarterly Profit. (WSJ)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Susan Boyle's Final Performance on the "Britain's Got Talent" Final. (YouTube)

- The Science of Voodoo – How Mind Attacks Body. (New

Scientist) - Shark Tank: New Reality Show Where Entrepreneurs Pitch To VCs. (WSJ Blogs)

- Is Cloud-Computing a Myth or a Worthy Goal? (Forbes)

- New Form of Warfare? Mysterious Computer Virus Strikes FBI. (ZDNet)

- Thought Provoking Article about Author-Strategist, Jim Collins. (NYTimes)

- How IBM Plans To Win Jeopardy! With

Natural-Language Processing. (Tech Review) - More Posts with Lighter Ideas and Fun Links.