Obama told the G8 that the "World has Staved Off Economic Disaster." So, it's all good now. You are safe to jump back in the pool. If there was still risk, he couldn't have said that in front of world leaders, right?

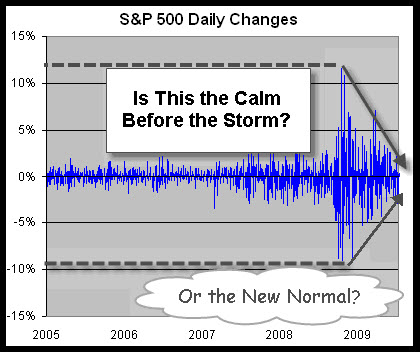

Is This the New Normal … Or Just the Calm Before the Storm?

Here is a chart that shows how volatility has reduced recently. Putting on my curmudgeon hat for a moment, I remember the old trader's adage that lack of volatility begets volatility.

That chart whispers "beware the calm before the storm" to me. Others may see a return to normal. What do you think?

A Look At the Markets.

The markets have given back close to 25% of their recent gains in the last four weeks. In many respects that was a healthy move. The news has been bad enough that I expected a bigger and steeper downswing.

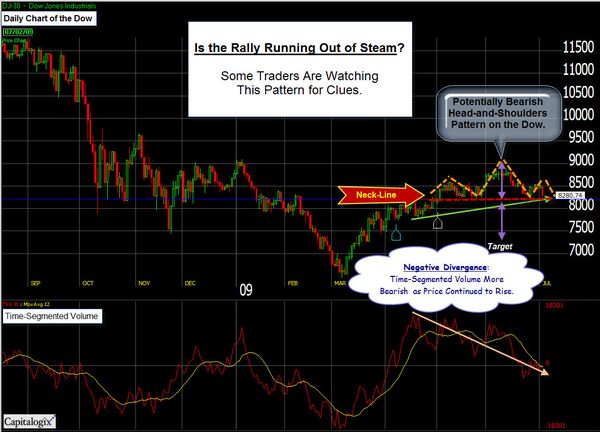

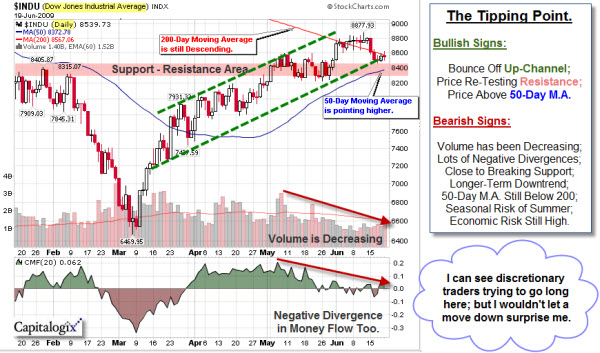

Also, there's been a lot of talk about the potential of a head and shoulders top. But when you look at a composite of the five U.S. Equity Indices (shown in the bottom-half of the chart, below), we haven't broken the neckline, yet.

In addition, the 200-day moving average (red line) continues to provide support. If we don't have a sustained break beneath this level, the 200-day moving average will act as support. Click the chart to see a full-size image.

With that said, sentiment is getting more bearish, and the move down

has not created a spike in the VIX. So, again, there are clues that lead me to suspect that we might be witnessing the calm

before the storm. Earnings Season is starting; and a move down would trigger the head-and-shoulders topping pattern and the 200-day moving average would become overhead resistance. And fear would increase … you get the picture.

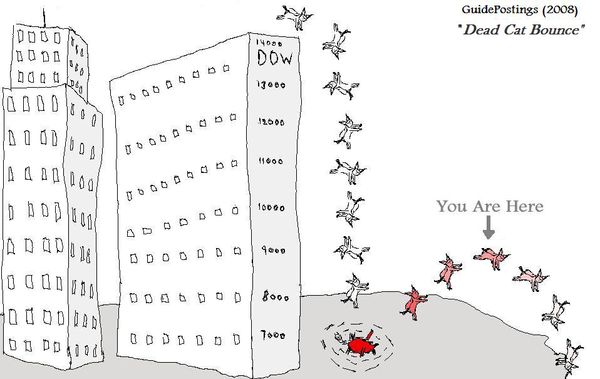

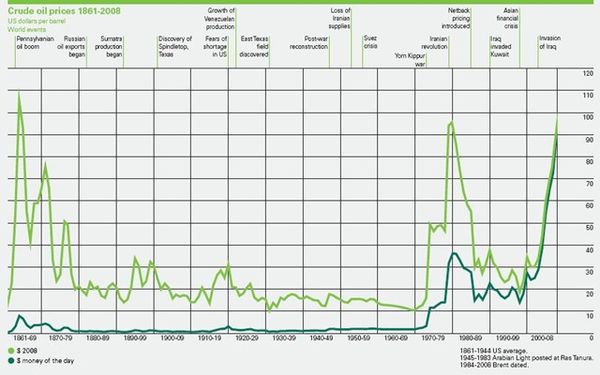

Sometimes, the right picture can be worth a thousand words.

So short-term, a bounce wouldn't surprise me. Nonetheless, a bigger correction still seems likely.

Business Posts Moving the Markets that I Found Interesting This Week:

- Businessman Pays $2.1 million for Lunch with Buffet; Banks More (DigitalJournal)

- 11 Places With a Worse Economy Than Ours. (USNews)

- Currency Funds Crushed on Dearth of Market Trends. (Bloomberg)

- The Dollar's role in the global economy is Safe From the Yuan, for Now (WSJ)

- Ex-Goldman Sachs Employee Arrested Stealing Secret Trading Codes. (StreetInsider)

- Citadel Sues Firm Linked to Alleged Goldman Software Theft. (FinAlternatives)

- Mark Cuban on Business Models: Succeed with Free, Die by Free. (BlogMaverick)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Stephen Hawking: Humans Have Entered a New Stage of Evolution. (Daily Galaxy)

- China Embraces the 24-Hour News Cycle; Will They Soon Regret It? (Forbes)

- Amazon Patents Detail Kindle Advertising Model. (MediaPost)

- Twitter Not Happy With The Name Tweet In Third-Party Applications. (DigitalJournal)

- Emotional Robots: Will We Love Them Or Hate Them? (NewScientist)

- Coaching Tip – Applying the Art of Sprinting to Life. (GeniusCatalyst)

- Social Security Number Code Cracked, Study Claims. (Federal News)

- More Posts with Lighter Ideas and Fun Links.