Since I'm spending the holidays in Asia, I thought I'd share a few lighter things this week.

First up is the Elf-Yourself site from JibJab. And my wife says I can't dance.

Click here to make one yourself.

Second, here is something I look forward to each year. Uncle Jay sings the year in review.

Market Commentary.

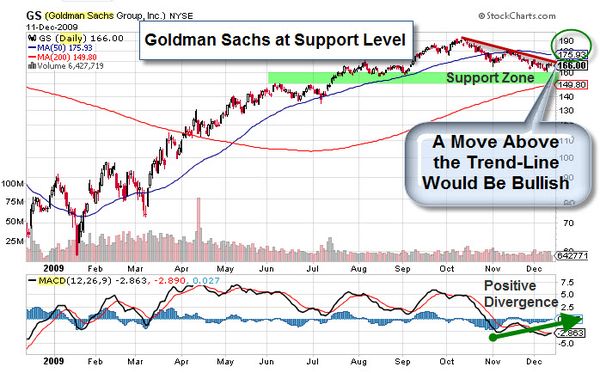

At the end of each year, the big financial media outlets typically conduct roundtables to get outlooks from key players in the financial markets. Over the past few years, the individuals that run the best financial blogs and websites have become key players in their own rights, and their opinions are highly regarded by millions of loyal readers. This year, Bespoke asked twelve popular financial blogs/websites to respond to the same 25 questions regarding their 2010 outlooks as well as their take on 2009.

The responses were thought-provoking, and hopefully they will help you form your opinions on what is to come for financial markets in the year ahead.

Best Wishes for a happy holiday season and for a prosperous New Year.

Business Posts Moving the Markets that I Found Interesting This Week:

- Is the Recession Really A Depression? (ZeroHedge)

- One in Four Children on Food Stamps, One in Eight Overall. (GlobalEconomicAnalysis)

- 77% of Small Businesses Plan No Raises in 2010. (Financial-Planning)

- U.S. Foreclosures to Reach Record 3.9 Million in 2009 (Bloomberg)

- What's the Real Purpose & Risks Of Quantitative Easing? (WSJ)

- Physics Envy: Finance's Search for the Laws Of Human Behavior? (FT)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- The 10 Questions You Should Never Stop Asking. (Forbes)

- Founder of Salesforce.com Explains How to Start a Business. (Economist)

- Which IT Projects are Right for the Cloud? (Computerworld)

- Why Vegetarians Might Want To Think Twice Before Eating Tomatoes. (DigitalJournal)

- Will Science Allow Us to End Aging by 2029? (H-Plus)

- Russia's Highest Court Rules Against Religious Freedom. (DigitalJournal)

- More Posts with Lighter Ideas and Fun Links.