The "invisible hand" is becoming replaced with a much more easily seen and felt version, and I suspect people are not only noticing … but adjusting.

At this point, I'm not sure if people (or the "market") want more or less intervention. For example, The Financial Times reports that the Fed minutes released last week fueled recovery fears because the meeting notes raise questions about whether the Fed has ruled out large-scale asset purchases. (FT)

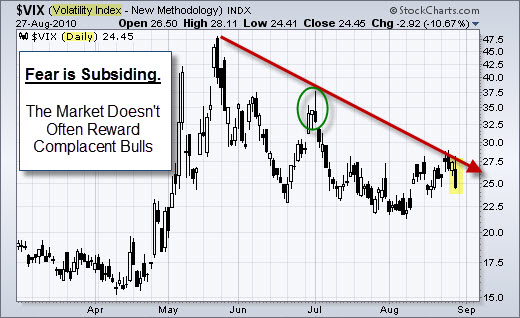

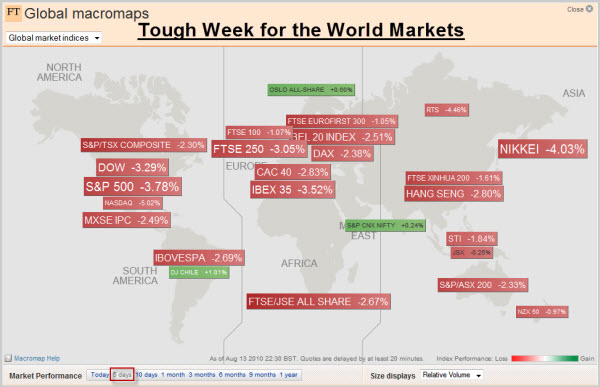

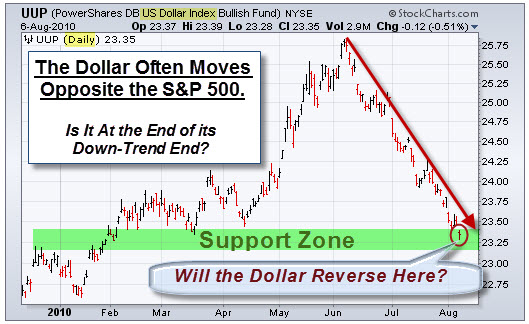

Apparently, the powers-that-be still have some things in their bag-of-tricks. Early last week I posted a Tweet saying that big market drops on low volume have been the trigger for Plunge Protection activity. Not to disappoint, we got the requisite ramp-up. The question is whether we'll get real follow-on buying?

Market Commentary.

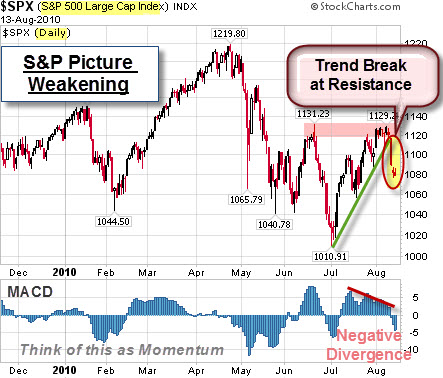

Last week was technically stronger than I originally thought. Why? Because both the S&P 500 and Nasdaq indices moved above their 20-, 50- and 200-day exponential moving averages. That isn't a common technical happening. Getting through a single moving average often proves difficult; so getting through all three major moving averages at once is something worth noting. Now let's see the reaction.

The short-term average is below the mid-term average, which is still below the long-term average. In English, that means we are probably still in a down-trend. Consequently, I'll be watching the resistance zone market by the pink highlight. If bears mount a challenge to the recent push higher, that would be a likely spot for the reversal. Otherwise, a break above that level could easily test the May highs.

How Does Employment Effect the Outlook?

It is a little ironic to talk about this on Labor Day weekend; nonetheless, we got more bad employment data last week. The best I can say about it is that it wasn't met with selling.

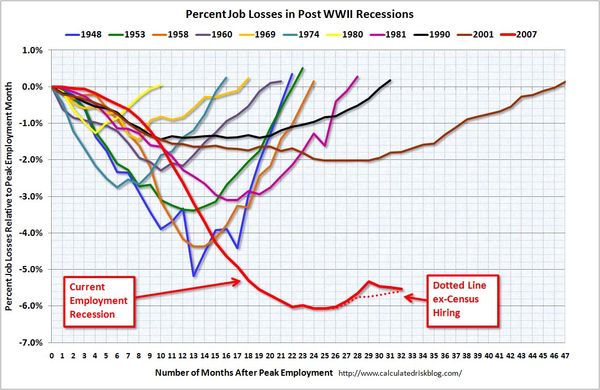

First, we'll look at the percent of job losses during various recession. The following chart shows that our current job situation stands out and speaks for itself. This chart also highlights the effects of census hiring as well as the extremely weak hiring in this recovery.

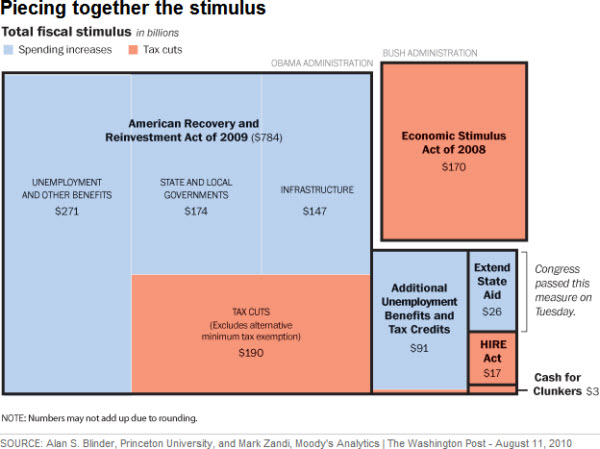

The dotted lines tell the real story about how pathetic the jobs recovery has been so far. Bear in mind it has taken $$ Trillions in stimulus to produce this.

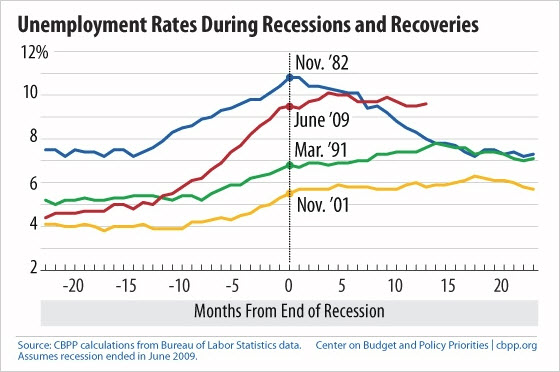

Second, the chart below shows the unemployment rates during recessions and recoveries. Notice that there has not been any recovery in the labor market. Unemployment has actually deteriorated when compared to the end of past recessions.

According to the Pragmatic Capitalist, without a recovery in the labor markets, it’s impossible to say that the economy is rebounding. As of now, the outlook remains negative.

However, without sellers, that increasingly visible hand can continue to push the markets higher. As summer (and slow trading) comes to an end, it will be interesting to see what happens next.

Business Posts Moving the Markets that I Found Interesting This Week:

- Another Example of How Nouriel Roubini Earned His "Dr. Doom" Title. (Atlantic)

- The Rise of the PermaBears In the Face of Recessions & Ballooning Debts. (NYTimes)

- Sign of the Times: Foreclosures of Million-Dollar-Plus Luxury Homes Rising. (LATimes)

- Why Wall Street Is Deserting Obama. (Dealbook)

- China’s Central Bank Chief Rumored To Have Defected (Forbes)

- More Posts Moving the Markets

Lighter Ideas and Fun Links that I Found Interesting This Week

- The Secret to Having Happy Employees — Fire the Unhappy Ones. (BossBlog)

- Google Voice Usage Shows 10MM Calls In Its First Week. (GoogleVoiceBlog)

- Inside Top-Secret America: A Peek Into the Vastness. (Alternet)

- The Power of Choice & Why It Doesn't Always Bring What We Want. (Wharton)

- Ancient Greek Sayings: Time Passes, Yet So Much Stays The Same. (HistoryDept)

- More Posts with Lighter Ideas and Fun Links.