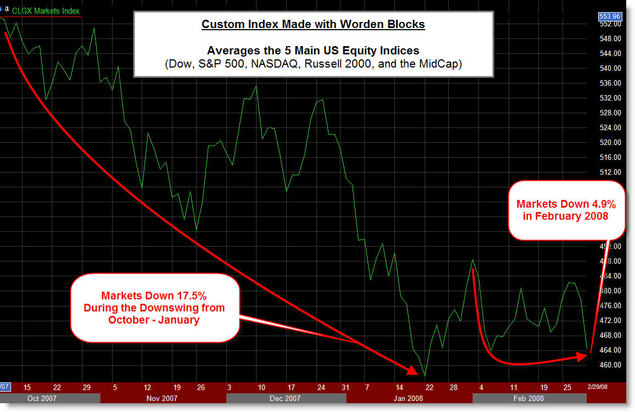

tried to rally several times. Unfortunately for the Bulls, none of

these attempts worked. And Friday's move down was the worst for the

market in a year-and-a-half.

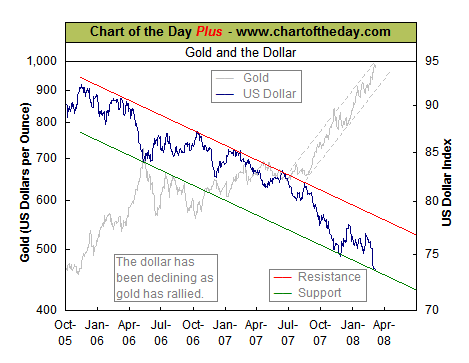

So the headlines are "another week

of a weak dollar, rising oil prices and falling markets." One of the

key take-aways, from my perspective, is that the Markets are not

responding as resiliently to bad economic data as they had a few weeks

ago.

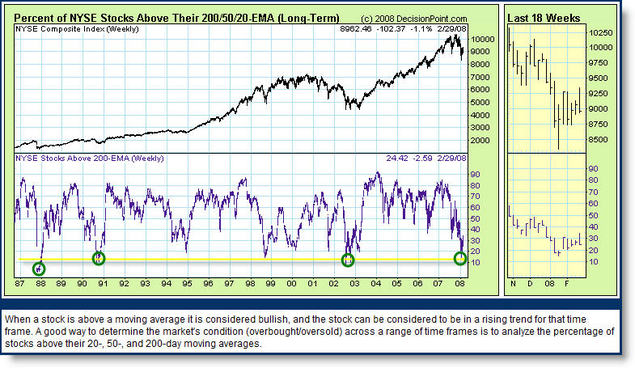

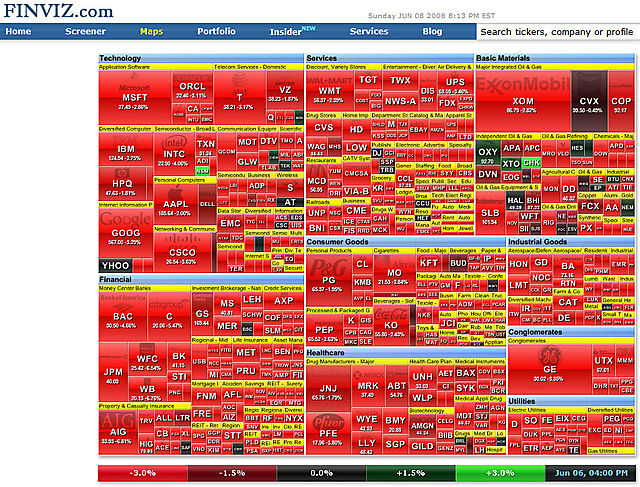

You don't have to look much farther than this chart from FinViz.com.

Also, something I'm hearing more of are questions about whether you can trust the government's economic numbers? Some people are

saying that key measures have been distorted lately.

Some things that caught my eye this week:

- The weekly newsletter from StockCharts.com had some interesting insights.

- The International Monetary Fund published research on Herding Behavior in Markets.

- Self-Motivation & Other Hyper-Intentional Mistakes from the Financial Philosopher.

- Why the sky-rocketing VIX may not be so bearish, from VIX and More.