I use Google without thinking. It is a habit or a reflex. That is about to change; at least for some types of information.

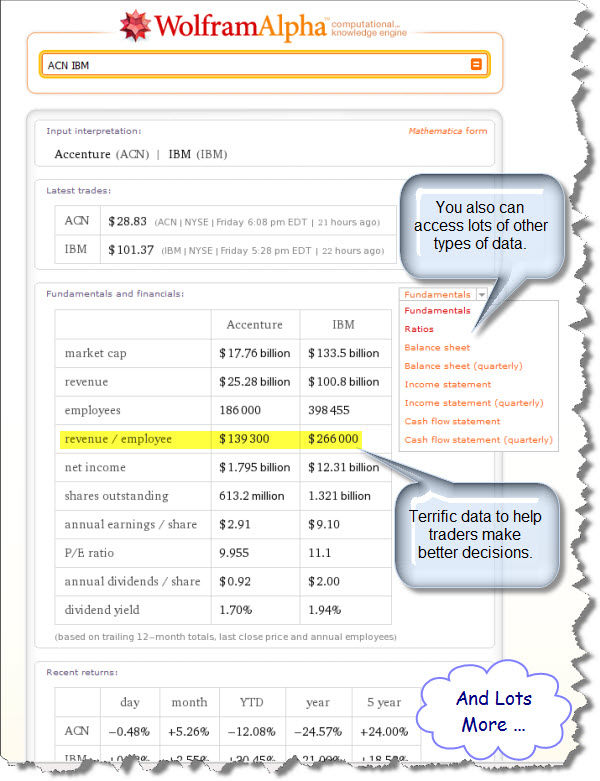

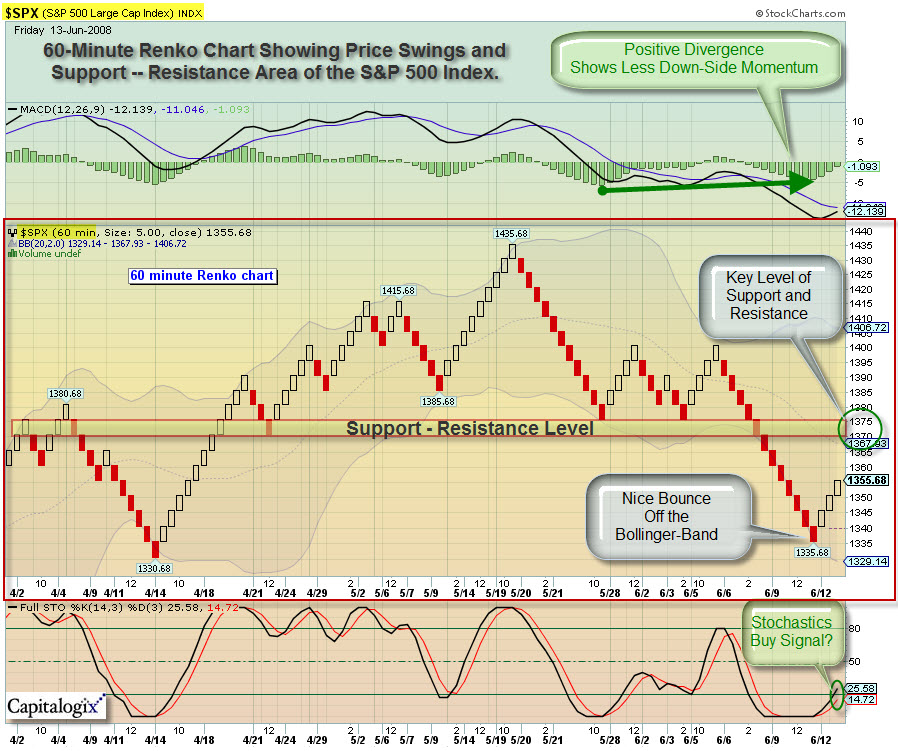

They call it a "Computational Knowledge Engine" – but my tests tell me it does a lot more than what that means to me. For example, here is a comparison of Accenture and IBM.

Here is a link to a brief demo. Take a look … I bet you shake your head and smile. Progress is a beautiful thing.

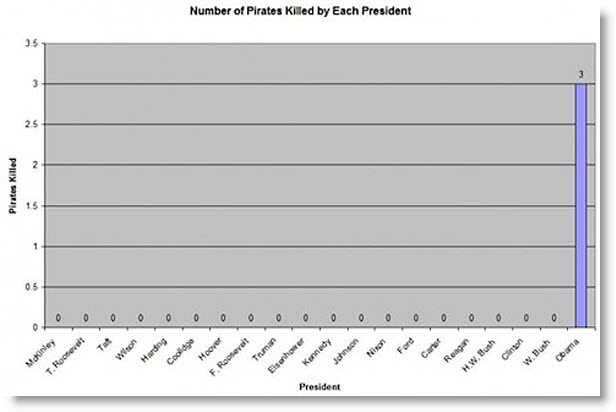

It does a lot more than calculate how many days you've been alive, amortize a mortgage, or tell you the flying time from Dallas to Paris. Apparently the folks at Wolfram have a sense of humor too. Here are some example searches that demonstrate that:

- Where Are You?

- How much wood could a woodchuck chuck if a woodchuck could chuck wood?

- What’s the speed of an unladen swallow?

- How many roads must a man walk down before you can call him a man?

Here is a summary of some more of the hidden tidbits from Mashable.

Strangely, it doesn't know what a "computational knowledge engine" is … I guess that makes it more human. It is easier to know lots of stuff than to be self-aware.