How does that compare to what you expected?

Trading Tools

-

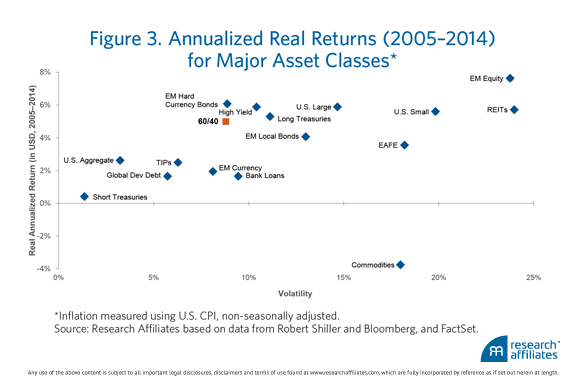

Annualized Returns for Major Asset Classes

Research Affiliates takes a look back at the last ten years and calculates the annualized return of a classic 60% equity / 40% fixed income portfolio versus 16 pure asset classes on their own.The 60/40 portfolio generated 7.2% annual returns (nominal) from 2005 through the end of 2014, edging out 9 of the 16 asset classes in their data set and with significantly less volatility than most as well.via Research Affiliates. -

Here Are Some Links For Your Weekend Reading

Déjà vu?

Here are some of the posts that caught my eye. Hope you find something interesting.

- 5 Tips for Finding Flow: A High Performance User's Guide for the New Year. (Forbes)

- Science Says This Personality Trait Predicts Job Performance. What's your guess? (BI)

- Why Airlines Want to Make You Suffer. (NewYorker)

- CIA Predictions for 2015 from the Year 2000. (Business Insider)

- Coming Data Deluge Means You’ll Know Anything You Want, Anytime, Anywhere. (SingularityHub)

- 10 Legendary Investment Rules from Legendary Investors. (Zero Hedge)

- Big Banks Manipulate Physical Market Prices | The Big Picture. (Ritholtz)

- Information in Financial Markets: Who Gets It First? (Papers)

- High-Frequency Trading Payoff Tied to News. (MarketWatch)

- Oil Companies’ Predicament: Who Should Cut Production? (Wall Street Journal)

-

Here Are Some Links For Your Weekend Reading

Déjà vu?

Here are some of the posts that caught my eye. Hope you find something interesting.

- 5 Tips for Finding Flow: A High Performance User's Guide for the New Year. (Forbes)

- Science Says This Personality Trait Predicts Job Performance. What's your guess? (BI)

- Why Airlines Want to Make You Suffer. (NewYorker)

- CIA Predictions for 2015 from the Year 2000. (Business Insider)

- Coming Data Deluge Means You’ll Know Anything You Want, Anytime, Anywhere. (SingularityHub)

- 10 Legendary Investment Rules from Legendary Investors. (Zero Hedge)

- Big Banks Manipulate Physical Market Prices | The Big Picture. (Ritholtz)

- Information in Financial Markets: Who Gets It First? (Papers)

- High-Frequency Trading Payoff Tied to News. (MarketWatch)

- Oil Companies’ Predicament: Who Should Cut Production? (Wall Street Journal)

-

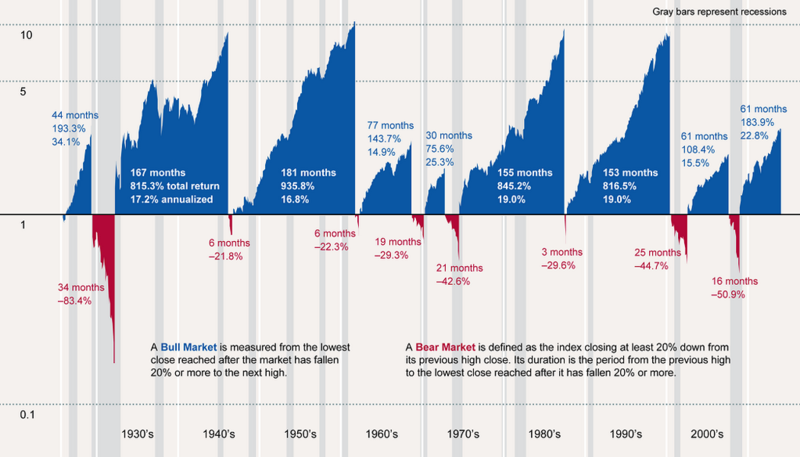

Chart Showing U.S. Bull and Bear Markets Since the 1920s

At this point, the S&P 500 is up over 200% from its March 2009 low.

This bull market has lasted 68 months, which seems like a long time … until you compare it to the length and strength of other bull runs.

This chart shows the history of Bull and Bear Markets in the U.S.

via @jerrykerns.

The blue areas represent past bull market durations and returns (total and annualized). The red areas represent past bear markets.Note: this chart is a little dated – it was originally published in May.Nonetheless, it is a good reminder of the bigger picture. -

Chart Showing U.S. Bull and Bear Markets Since the 1920s

At this point, the S&P 500 is up over 200% from its March 2009 low.

This bull market has lasted 68 months, which seems like a long time … until you compare it to the length and strength of other bull runs.

This chart shows the history of Bull and Bear Markets in the U.S.

via @jerrykerns.

The blue areas represent past bull market durations and returns (total and annualized). The red areas represent past bear markets.Note: this chart is a little dated – it was originally published in May.Nonetheless, it is a good reminder of the bigger picture. -

Here Are Some Links For Your Weekend Reading

Hope you are having a Happy New Year!

Here are some of the posts that caught my eye. Hope you find something interesting.

- How to Form a Habit: A Scientific Approach. (Sqwiggle)

- What Peter Drucker Knew About 2020. (Harvard Business Review)

- The Unusual Books That Shaped Billionaires and Prodigies. (Tim Ferriss)

- Kermit the Frog Gives a TEDx Talk, and Twitter Loves It. (TED)

- Why Sadness Lasts Longer Than Other Emotions. (BPS Research Digest)

- 2014 Portfolio Review: What Strategies Worked & What Didn’t? (PragCap)

- David Tepper Warns 2015 Is Poised To Be Like 1999. (ValueWalk)

- Saudis Tell Shale Industry It Will Break Them; Plans to Keep Pumping. (NakedCap)

- The Leading Robo-Advisers Now Manage $19 Billion and Continue to Grow. (BI)

- Florida Becomes 3rd Largest State Following CA & TX, NY Drops to 4th; Political Implications. (Global Economic Analysis)

-

Here Are Some Links For Your Weekend Reading

Hope you are having a Happy New Year!

Here are some of the posts that caught my eye. Hope you find something interesting.

- How to Form a Habit: A Scientific Approach. (Sqwiggle)

- What Peter Drucker Knew About 2020. (Harvard Business Review)

- The Unusual Books That Shaped Billionaires and Prodigies. (Tim Ferriss)

- Kermit the Frog Gives a TEDx Talk, and Twitter Loves It. (TED)

- Why Sadness Lasts Longer Than Other Emotions. (BPS Research Digest)

- 2014 Portfolio Review: What Strategies Worked & What Didn’t? (PragCap)

- David Tepper Warns 2015 Is Poised To Be Like 1999. (ValueWalk)

- Saudis Tell Shale Industry It Will Break Them; Plans to Keep Pumping. (NakedCap)

- The Leading Robo-Advisers Now Manage $19 Billion and Continue to Grow. (BI)

- Florida Becomes 3rd Largest State Following CA & TX, NY Drops to 4th; Political Implications. (Global Economic Analysis)

-

What Happens to the Best Old Traders?

I visited the trading floor of the CME this week with Bobby Schwartz.

Notice his badge number. He used to be one of the largest volume traders on the exchange.

While there, Bobby quickly slipped into his old rhythm, and I had a chance to experience his old persona. He showed me the hand signals he used on the floor. It was complex, fast-moving, and cool to see.

On one hand, the mastery was undeniable. On the other hand, it's a reminder how fast things change. It doesn't matter how good you are, or what your edge was … times change, markets change, and so does what a trader must do to make money consistently.

Bobby is a great example of that. He now runs one of the largest IBs and has shown, many times, that adapting quickly is the way to survive – and thrive.

-

What Happens to the Best Old Traders?

I visited the trading floor of the CME this week with Bobby Schwartz.

Notice his badge number. He used to be one of the largest volume traders on the exchange.

While there, Bobby quickly slipped into his old rhythm, and I had a chance to experience his old persona. He showed me the hand signals he used on the floor. It was complex, fast-moving, and cool to see.

On one hand, the mastery was undeniable. On the other hand, it's a reminder how fast things change. It doesn't matter how good you are, or what your edge was … times change, markets change, and so does what a trader must do to make money consistently.

Bobby is a great example of that. He now runs one of the largest IBs and has shown, many times, that adapting quickly is the way to survive – and thrive.

-

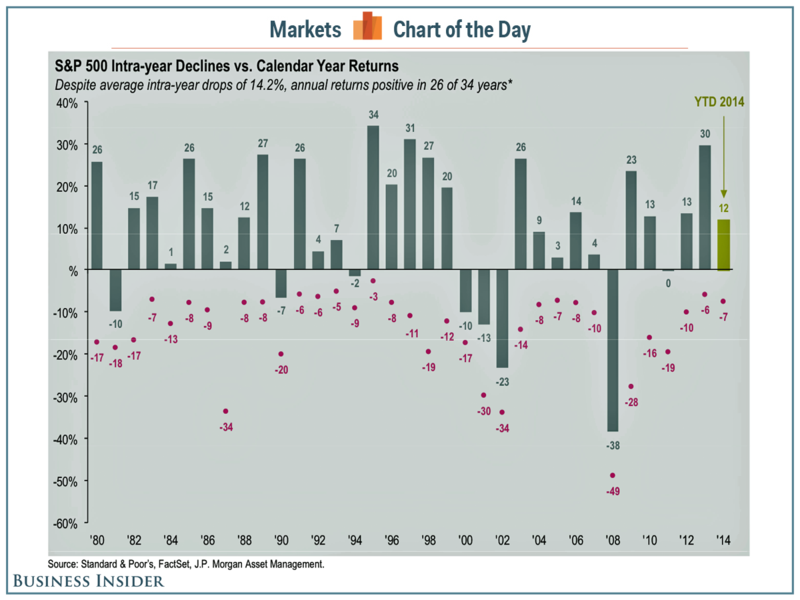

There’s Usually Some Pain to Endure On the Road to Good Market Returns

No matter how you look at it, big stock market sell-offs happen regularly.

For example, we've seen two violent sell-offs in the second half of 2014. The first came when the S&P 500 quickly tumbled 9.8% from its then all-time high of 2,019 on Sept. 19 to as low as 1,820 on Oct. 15. The second came when the S&P plunged 5.1% from 2,079 ion Dec. 5 to 1,972 on Dec. 16.

Buy and Hold investors must stomach significant drawdowns to get their returns — even in 'good' years.

This chart shows S&P 500 intra-year declines compared with calendar year returns. The bars represent year-end returns since 1980, while the purple dots mark each year's market low.

Business Insider via JP Morgan Asset Management.

Basically, you have to understand that 10-15% pull-backs are normal (perhaps even healthy) for the market.

For reference, here are market correction averages and their historic frequency. Since 1900, we've seen:

- 5% market corrections: 3x per year.

- 10% market corrections: Once per year.

- 20% market corrections: Once every 3.5 years.

Interesting.And yet, the S&P often recovered those losses and then some.Importantly, these big sell-offs often occur during years when the markets head higher.

Despite average intra-year drops of 14.2%, annual returns have been positive in 26 of 34 years.

Bottom line: Sell-Offs happen. And sometimes they're big … But they're normal. So, stay calm and carry on.

Best wishes for a Happy New Year!