A few weeks ago, I shared an article about annual planning (and how Capitalogix does it.)

This week, I want to discuss setting and meeting goals.

I'm a big-picture guy, and I spend a lot of my time thinking about longer-term possibilities, but it's also important to think about your strategy for the coming year. I tend to break that up by Quarters. Lower timeframes than that are more tactical, and I consider that short-term planning or scheduling.

I think of it like using a map. To find the best route, you must start by figuring out where you are and where you want to be.

Activity, alone, isn't as important as many people hope. Think of it this way … from where you are, there are infinite potential paths – but motion in a particular direction isn't "progress" if it doesn't take you toward your desired destination.

The right action is far more valuable than merely taking action … and that means beginning with the end in mind. You are unlikely to hit the target if you aren't aiming at it.

Resolutions only work if you actually "want" to make them happen. It's one thing to hope that something happens; it's another to commit to making it happen.

With that said, here are some tips.

- Focus on What You Want.

- Focus on Why You Want It.

- Focus on Ways You Might Get it.

- Focus on Evidence of Progress.

Below, I'll take you through an example of each of the four steps.

Moving Towards a Solution, Rather Than Suffering From the Problem.

Like many people, I have three distinct collections of clothes: my "fat clothes," what I'm currently wearing, and my aspirational wardrobe. This personal reality reflects how our current state often sits between where we've been and where we want to go. Before I started getting healthy, my first instinct was to think, "I need to lose weight." Knowing that "you're fat" isn't helpful … my head quickly translated that to something a tad more positive yet generic, like: "I choose to be healthy and vital and to live a healthy lifestyle."

Blah, blah … They are just words. What I needed was something specific, measurable, and actionable. How about: "I will lose 15 pounds and stop eating after dinner?" OK, but that isn't inspiring, and there isn't much for me to do. I can do better than that—and I need to—if I want to commit to the outcome.

Figure-Out a Big Enough WHY, Rather Than Worrying about the HOW's.

This post isn't about health and fitness; it is about the mindset and techniques for setting empowering goals and plans in any situation.

So, while I could list many ways to lose weight (and I might even remember to do some of them), leveraging a driving force creates momentum. In other words, the first step in "Doing" is knowing WHY you want something.

I really do want to be healthy, fit, and vital (it sure beats the alternatives), and I want to have the energy and confidence to live and enjoy my life fully. The world is my playground, and I want to take advantage of more opportunities to play with family and friends. However, to do those things, I must find better and more sustainable ways to live a healthy lifestyle.

The WHYs are just as important for business goals, too.

Focus on Potential Solutions Rather than Problems or Challenges.

Obstacles Exist. The bad news: I don't eat fish, and I don't like vegetables (unless French Fries are vegetables). My joints aren't close to healthy from years of violent contact sports. I rarely get 7 hours of sleep, and being the CEO of a startup is stressful. The good news: none of those things matter, and even if they did, it just would mean that I have a lot of room for progress.

It is natural to focus on obstacles, but most obstacles are surmountable—with a big enough WHY, I might even choose to start eating vegetables. Instead of dwelling on limitations, use them as a reminder to focus on potential solutions. They are beacons pointing the way.

How do you do it? To focus on solutions, you can make two action-based lists: one is of things To-Do … and another is of things Not-To-Do.

Here are some of the sample To-Do Items:

- I will drink more water than coffee.

- I will stretch or do basic calisthenics on days I don't go to the gym.

- I will make a healthy shake as a meal replacement rather than a snack or mini-meal.

- I will focus on relaxation and meditation as much as I focus on strength & physical exercises.

Here is the actionable list of Not-To-Do Items.

- I will not buy bigger pants or wear stretchy pants because of an expanding waistline.

- I will not eat snacks out of their container – and will portion out what I want first.

- I will not compare my current level of fitness to what I used to be able to do. Instead, I will focus on my actions and improvement.

Create Healthier Habits.

It is easy to follow a routine. So, here's another tip … make your routine better. Here are some examples of things you could do to make 'being healthier' happen with less effort.

- Pre-sort your vitamins into daily doses, and keep them by the coffee machine.

- Buy healthy snacks, like fruit, raw nuts, or organic energy bars (instead of chips).

- Enjoy listening to music or a book/podcast during your "exercise time." Dedicating time to something doesn't mean you can't be multitasking.

- Choose to walk the dogs or park at the end of the parking lot, so you get to walk.

- Meet with friends at the gym or a hiking spot rather than at a bar or restaurant.

You get the idea. Get in the habit of looking for ways to create better habits. What habits could you alter slightly to make a big difference? Which things can you automate or outsource?

For three books about the subject, I recommend Tiny Habits by B.J. Fogg, Willpower Doesn't Work by Benjamin Hardy, or Atomic Habits by James Clear.

Focus on Your Progress.

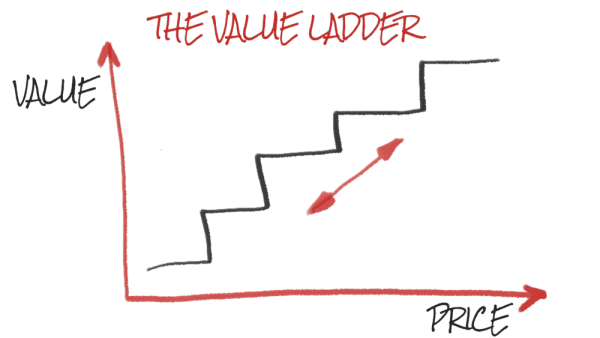

In this case, it really is about the journey. Instead of tracking how far you have to go … notice how far you've come. Utilize an internal locus of control. It is about creating energy, momentum, and a sense of possibility. You may have a big, hairy, audacious goal in mind. That's fine, as long as you realize that reaching each milestone along the way is still an accomplishment.

- Find shoes that don't hurt your feet.

- Pick a gym or a personal trainer that you enjoy.

- Run more than two laps without stopping.

It doesn't matter what they are … they all count as long as you know you are moving in the right direction.

Summary

The point of this exercise was not really to focus on fitness. These techniques and goal-setting tools work in any situation. The principles are:

- First, determine what you want and why it is important. Then, focus on only the few things that are truly important to you.

- Second, find something you can do right now that will move you in the right direction.

- Third, notice which things create (rather than take) energy. Spend your time on those, and automate or create routines to take care of the rest.

- Fourth, plan forward but measure backward. Set milestones so that you can recognize and celebrate your progress.

In my business, this translates to having a mission and vision – defining what we want, why it's important, and the basic strategy to achieve it. Then, we create yearly "Big 3" goals that move us toward that long-term vision. Then, the team creates SMARTs (goals that are specific, measurable, attainable, relevant, and timely) and KPIs (key performance indicators) or OKRs (Objectives and Key Results) that measure evidence of success. Doing those things lets the team know where to spend their time and whether they're on the right track.

It isn't magic, but it works.

Hope this helped.

If you're interested, here are a few more articles I've written on health and longevity.

Onwards!

Reddit via

Reddit via

via

via