In 2016, I wrote a variation of this article focused on trading … but it's even more relevant today as I spend more time talking with entrepreneurs and AI enthusiasts.

There are many lucky people in the business world. Perhaps they made a good decision at the right time – and are now on top of the world. There's nothing wrong with luck. But, the goal is to make sure your success isn't predicated on it. Why? Because you might get lucky once, but it's unlikely you'll get lucky every time.

Luck favors the prepared … and those who understand the difference between skill and luck.

First, let's talk about luck. Think about a nationwide coin-flipping contest. Initially, each citizen is paired up with another for a contest. The winner goes on to the next round. Think how many rounds you would need to win to be City Champion, State Champion, Regional Champion, etc.

At the end, someone would have won many coin-flip contests. Assuming they didn't cheat, they were lucky … but does the winner have an edge? If so, what could it be?

If you followed the contest from beginning to end, I'm sure you could imagine the finalists doing articles or interviews about how their mindfulness practice gives them an edge … Or, the law of attraction …. Or, how the power of prayer is the difference.

Meanwhile, sometimes, the most straightforward rationale provides the best explanation. Somebody had to win that contest – and luck was the reason.

Finding The Edge

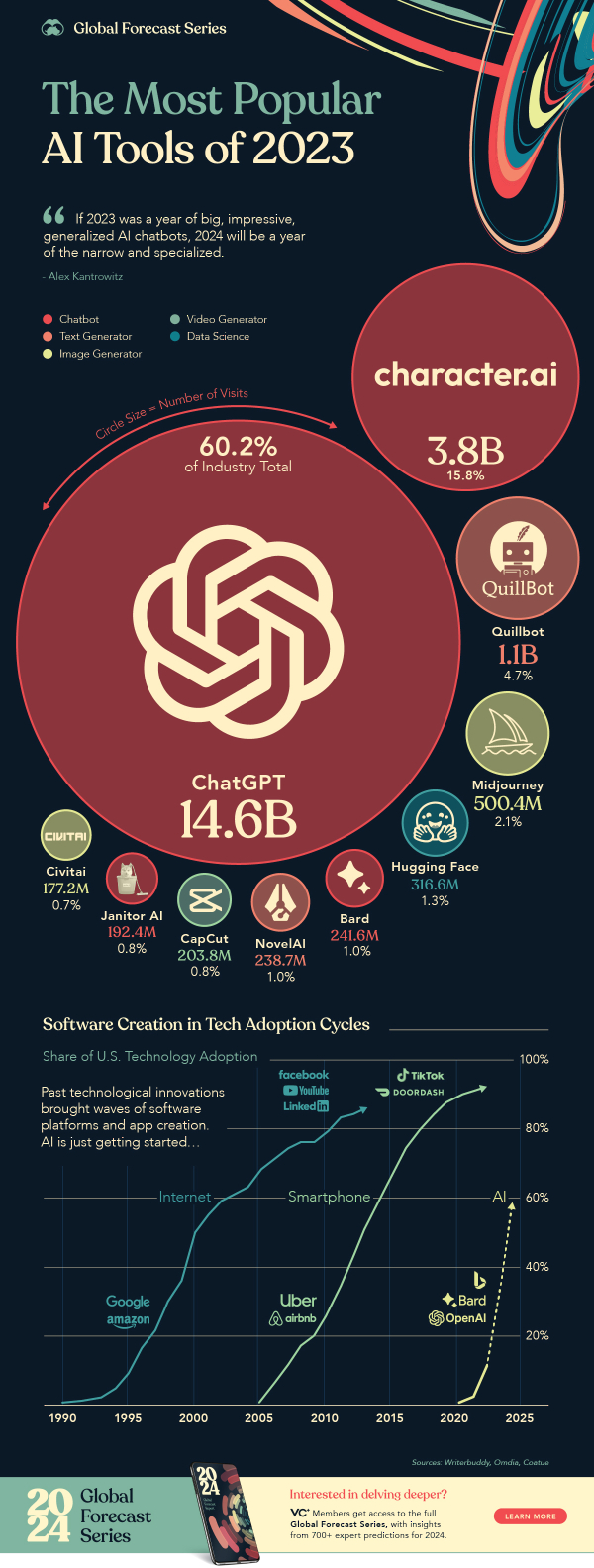

Likewise, just because a product or business makes money doesn't prove it has an edge. For example, at OpenAI's Developers Conference last week, they announced several new models and internally created tools that cannibalize or obsolete many tools or businesses built on their platform. Meanwhile, they also announced several new models and tools that will help create new businesses. But, the app developers who have been made redundant are out of luck.

I saw the same thing with the rush of .com companies in the late '90s. The ones that made it are now the underpinning of a new era, but they climbed out of a sea of failed businesses that might have even been better businesses – they were just unlucky (e.g., Betamax vs. VHS).

Simply relying on whether something is profitable NOW means you have both the chance that you have an edge – and also that you got lucky.

If it isn't just a matter of winning, how do we know if we're skillful? In trading, we would call this alpha. We are searching for clues to help find systems with an edge … or at least have an edge in certain market conditions.

Unfortunately, I can't give you the one rule to follow to identify skill vs. luck, but it's much easier to find the answer if you're asking yourself the question.

Internally, we've built validation protocols to help filter lucky systems and systems that can't repeat their results on unseen data.

It is exciting as we solve more of the bits and pieces of this puzzle.

What we have learned is that one of the secrets to long-term success is (unsurprisingly) adaptability.

What that looks like for us is a library of systems ready to respond to any market condition – and a focus on improving our ability to dynamically select the systems that are "in-phase". The secret isn't predicting the future, but responding faster – and more reliably – to changing environments.

From a business perspective, this looks like being willing to adapt to and adopt new technologies without losing track of a bigger 'why' like we talked about in last week's article.

A Practical Example

When we first wrote on this, one of Capitalogix's advisors wrote back to see if they understood the coin-flipping analogy.

The odds of flipping a coin and getting heads 25 times in a row is roughly 1-in-33 million. So if we have 33 million flippers and 100 get 25 heads in a row, statistically that is very improbable. We can deduce that group of 100 is a combination of some lucky flippers, but also that some have a "flipping edge." We may not be able to say which is which, but as a group our 100 will still consistently provide an edge in future flip-offs.

Well, that is correct. If we were developing coin-flipping agents, that would be as far as we could go. However, we are in luck because our trading "problem" has an extra dimension, which makes it possible to filter out some of the "lucky" trading systems.

Determining Which are the Best Systems.

There are several ways to determine whether a trading system has a persistent edge. For example, we can look at the market returns during the trading period and compare and contrast that with trading results.

This is significant because many systems have either a long or short bias. That means even if a system does not have an edge, it would be more likely to turn a profit when its bias aligns with the market.

You can try to correct that bias using math and statistical magic to determine whether the system has a predictive edge.

It Is a Lot Simpler Than It Sounds.

Imagine a system that picks trades based on a roulette spin. Instead of numbers or colors, the wheel is filled with "Go Long" and "Go Short" selections. As long as the choices are balanced, the system is random. But what if the roulette wheel had more opportunities for "long" selections than "short" selections?

This random system would appear to be "in-phase" whenever the market is in an uptrend. But does it have an edge?

One Way To Calculate Whether You Have An Edge.

Let's say that you test a particular trading system on hourly bars of the S&P 500 Index from January 2000 until today.

- The first thing you need is the total net profit of the system for all its trades.

- The second thing you need to calculate is the percentage of time spent long and short during the test period.

- Third, you need to generate a reasonably large population of entirely random entries and exits with the same percentage of long/short time as your back-tested results (this step can be done many times to create a range of results).

- Fourth, use statistical inference to calculate the average profit of these random entry tests for that same test period.

- Finally, subtract that amount from the total back-tested net profit from the first step.

According to the law of large numbers, in the case of the "roulette" system illustrated above, correcting for bias this way, the P&L of random systems would end up close to zero … while systems with real predictive power would be left with significant residual profits after the bias correction.

While the math isn't difficult … the process is still challenging because it takes significant resources to crunch that many numbers for hundreds of thousands of Bots.

The good thing about RAM, CPU cycles, and disk space is that they keep getting cheaper and more powerful.

Conclusion

It is relatively easy to measure the wins and losses (and luck versus skill) of trading systems. It can be complicated, but ultimately, it's just math. The logic of the example also applies to adopting technology, starting a business, or transforming from a product-based to a platform-based business model, etc.

In most situations, the secret is to figure out what data is incumbent to your industry as well as what data you're creating. Figure out how to analyze it. Figure out how to do that consistently, autonomously, and efficiently. Then … test.

It's not sexy, and it's not complicated.

We live in a ready, fire, aim era. The speed of innovation is staggering, and the capital and energy needed to create an app or start a business is less than ever before … and a bias for action is powerful.

Luck and a bias for action will take you further than most – but it still won't take you far enough.

So, I'll leave you with the question…

If you're reading this, you've almost certainly been lucky … but have you been skillful?

via

via