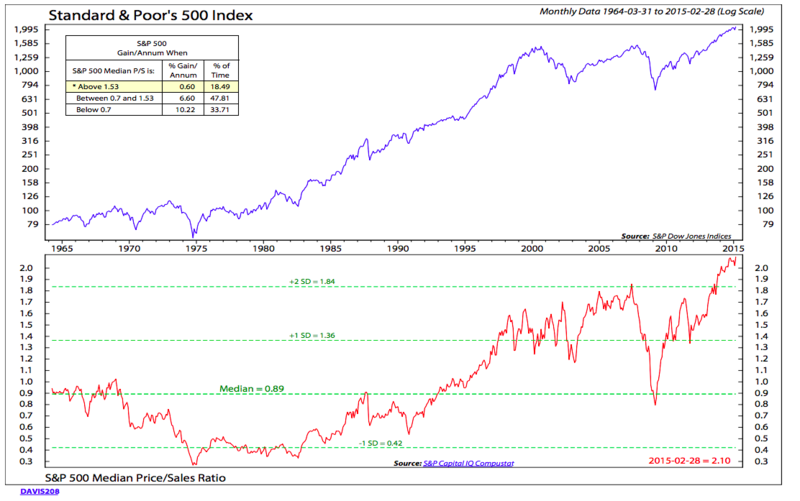

For what it is worth, the median stock in the S&P 500 is the most expensive it has even been. Moreover, many valuation indicators are now at "the highest ever, except 2000".

Perhaps when the economy is truly booming, that might make sense … or be considered a good sign.

At this point, it is more likely a good sign for short-sellers.

Traders understand that the prevailing trend has been up (and will remain that way, despite logic or argument, until price proves otherwise).