Did you buy the new iPhone?

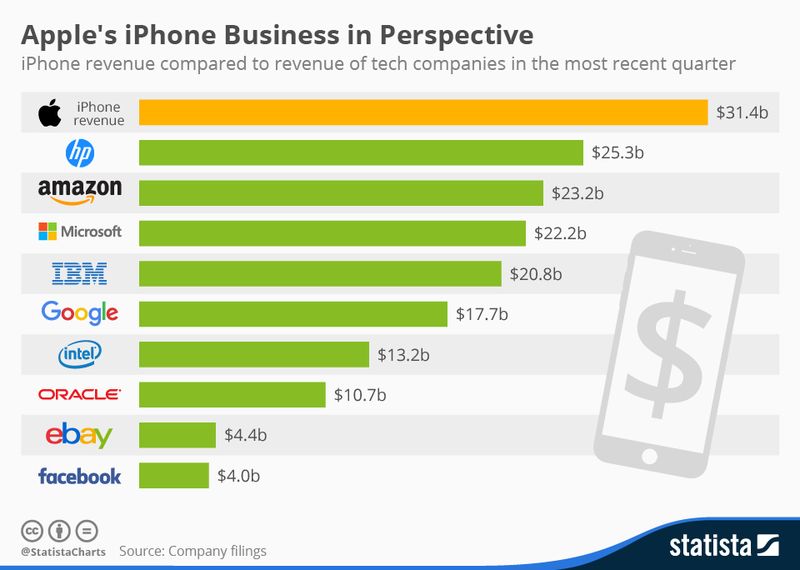

The scope and scale of Apple's iPhone business creates an amazing competitive advantage.

It is Apple’s largest cash cow … and accounted for 69 percent of the company’s revenue in the 2014 holiday quarter.

But how big is BIG? This chart compares Apple's iPhone revenue (by itself) to the total revenue of other tech companies in the most recently reported fiscal quarter.

via Statista.

For context, in the past Quarter, Apple generated more revenue selling iPhones than Google, eBay and Facebook did combined.