Last year, I talked with the CEO of CB Insights about how Fintech was disrupting the value chain of financial services.

Since then, it's become even easier to see how disruptors are changing every industry, and becoming leaders in their fields.

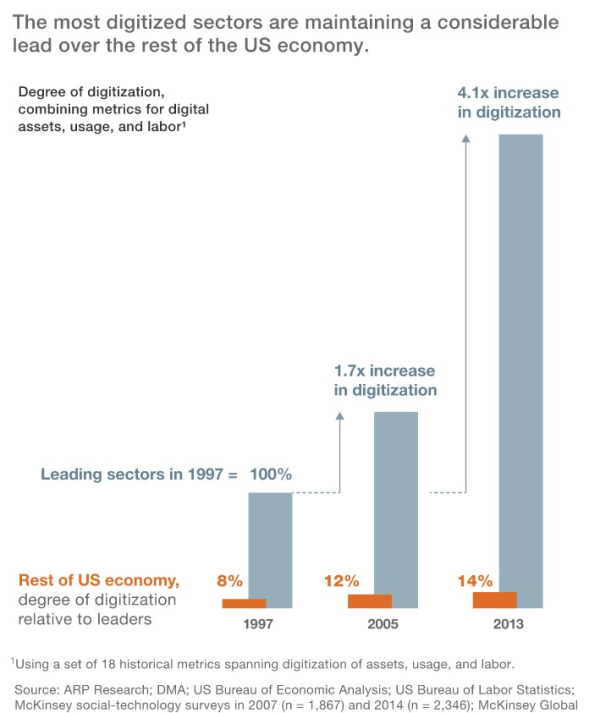

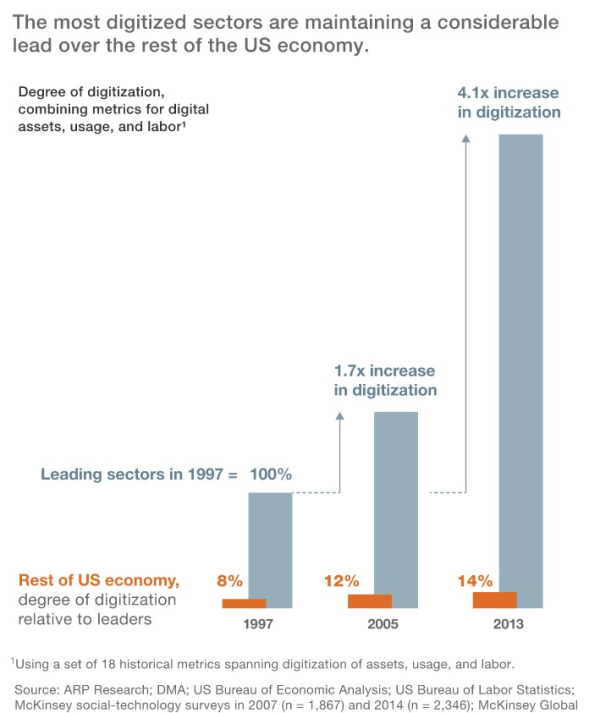

via McKinsey

via McKinsey

Companies like Lyft, Tesla, and Netflix changed paradigms and are now leading the pack, but what industries are next?

Looking at a report by McKinsey&Company, we find that the 5 industries with the least digitization account for 34% of GDP and 42% of all employees.

- Agriculture and Hunting

- Construction

- Hospitality

- Healthcare

- Government

via Quora

But, being less digitized than competitors, alone, isn't enough to indicate it's ready for disruption:

How Regulated Is The Industry?

Heavily regulated industries mean that any company that can find a way around current regulations and tax structures can become an effective competitor fast … i.e Lyft and Tesla

Is There Too Much Competition Already?

How many competitors are in the space? Is there spare capacity, or does the current model waste resources? Think taxis waiting for customers or empty seats on airplanes.

Can it Be Automated?

Lot's of industries and tasks are ready and waiting to be automated – and only haven't been due to the cost of switching to new technology.

To put it another way – are you solving a customer headache while lowering costs for you and the customer?

The only constant is change, and digitization and automation are only increasing the rate of change. The type, quality, and the number of jobs being offered are changing rapidly.

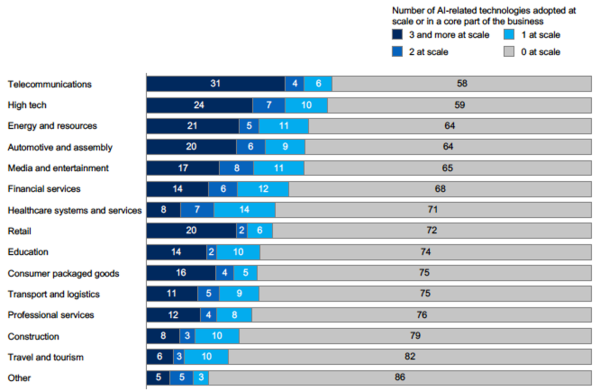

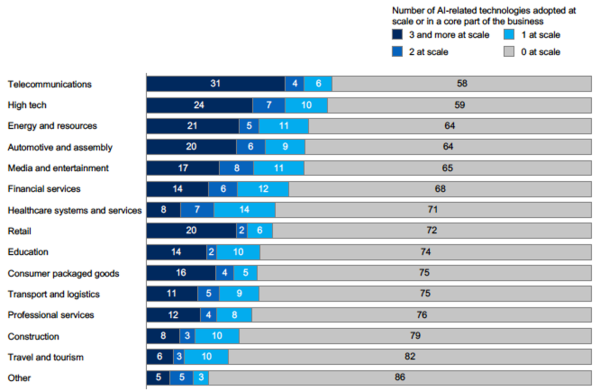

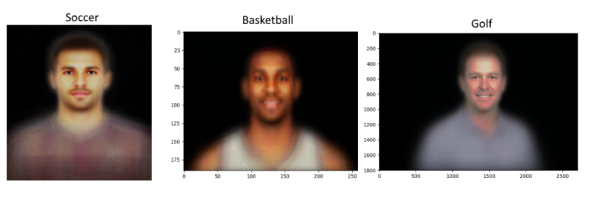

As digitization increases so does adoption of AI-related technologies.

McKinsey Institute via Vox

AI is coming, disruption is coming.

It's no longer possible, it's not even just probable, it's inevitable

This interactive graph tells you if your job is automation proof, and what percentage of your job can be automated.

What industry do you think is next?

via

via