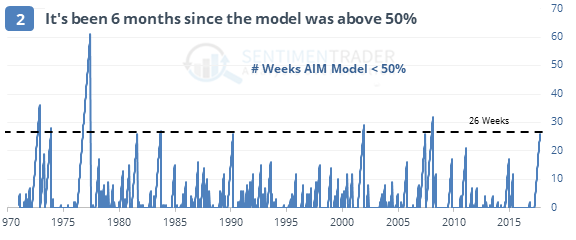

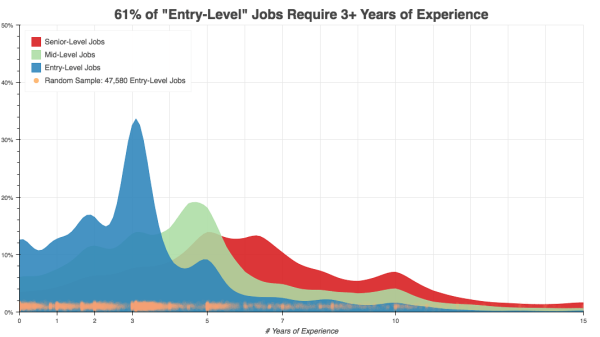

We often hear millennials complaining about today's job climate.

How can I get job experience if I can't even get a job to get experience?

Is there any validity to that belief system?

Apparently, yes.

According to TalentWorks, after analyzing a random sample of over 95,000 job listings they discovered that 61% of full-time "entry-level" jobs require 3+ years of experience.

via TalentWorks

via TalentWorks

Turns out "Experience Inflation" is a real thing. Brings context towards the shift away from traditional education I mentioned a couple months ago.

TalentWorks also found that three, five, and eight years are the magic numbers for upgrading your job title.

Mid-level jobs open up to you after five years, and senior level jobs open up after eight.

I guess Millennials get a pass on this one … just this once.

With that said, we've had great success with the few high school interns we hired. Perhaps the passion and interest that caused them to look for serious work, so early, was a great way for them to get experience (and an early indicator of true talent)?

via

via