As the holiday season begins, I was thinking about my father.

I love him and miss him … but, truth be told, I teased him mercilessly about being technologically challenged (especially around the holidays, when I'd buy him a new gadget – only to roll on the floor laughing while watching him try to figure it out).

Karma is a bitch! My Dad used to say "whatever you make fun of me for … will happen to you."

I didn't yet realize how fast the world was changing … or how quickly I'd find it hard to keep up.

In 2015 I wrote an article about this titled "A Look Back at The Future".

It's only four years later … and somehow my realizations seem out-dated.

It's not just me, it's everyone!

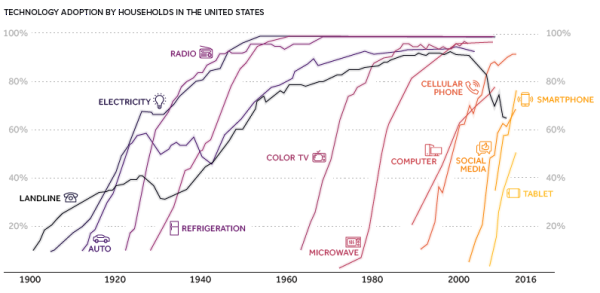

Realize that human perception is linear, but technological growth isn't.

As technology progression evolves and quickens, it is going to get harder to keep up.

Check out this video from 1974 … It shows Arthur C. Clarke making some impressive guesses about the future of technology.

Now that we're here, it may not seem like an impressive prediction … but how cool was it that Arthur C. Clarke believed a computer would fit on a desk in 1974?

Do you think that you can predict what a computer will look like in 2034?

Artificial Intelligence, quantum computing, augmented reality, neuro-interfaces, etc. are all going to change the face and nature of computing and perhaps life itself.

We live in exciting times!

Onwards.

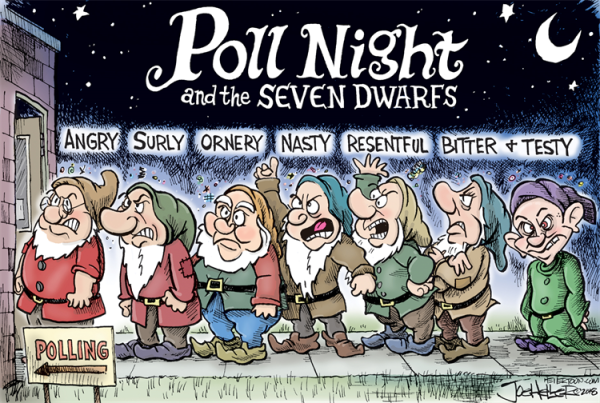

via

via

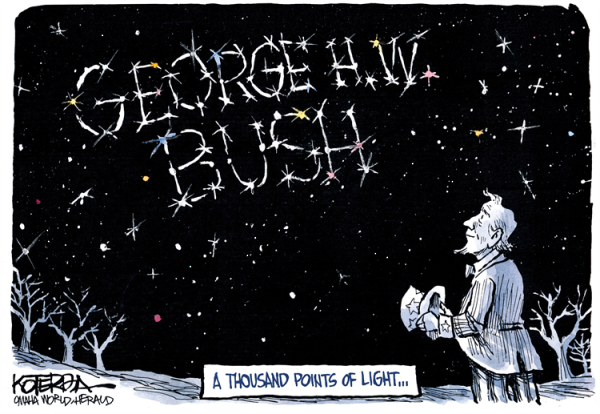

via

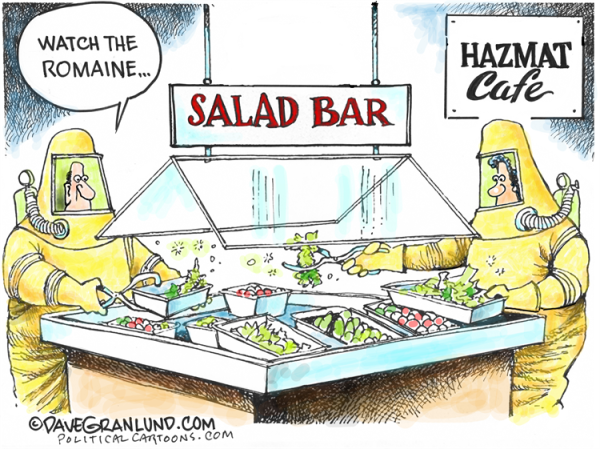

via  via

via