There are few certainties in life … according to Benjamin Franklin:

"Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes."

According to the ancient Greek philosopher Heraclitus:

"Change is the only constant in life"

He's also quoted as saying "everything changes and nothing stands still."

Maybe he didn't pay his taxes.

Change is a constant, yet, it's often hard to see the forest for the trees.

It seems like just yesterday that my son, Zach, was making sand castles on the beach – or wearing silly t-shirts. Now, he's 26, the soft spot on his head has filled in enough to consider him an adult – and he is generally unrecognizable from that kid on the beach at the Jersey Shore.

On a day-by-day basis, I rarely noticed the change. However, looking at old pictures makes it obvious that there was massive growth and progress.

So, what did I notice? Sometimes it was what a great kid, or how loving, he had been. Other times, it was almost the opposite. Or, perhaps, I noticed that he didn't eat vegetables, or that he drove with a heavy foot. In any case, what I focused on is what my life seemed filled with, to me. And it was mostly about the moment. The bigger picture was lost (or hidden) behind the small things that make up the fabric of our life (or at least our perception of our life).

It is human nature. Survival of the fittest rewarded a focus on avoiding predators or other dangers … as well as recognizing the opportunity to eat.

Thousands of years later, fear and greed still drive more than we like to admit. It is also a big part of the engine that drives our markets.

It is all about perspective, isn't it?

We are where we are. It doesn't really matter how or why we got there. We are here. And little-by-little we won't be here anymore.

If you are looking at the country or the economy, realize that it took years to get here. Simply changing a regime won't flip a switch. Some changes happen in slow-motion.

Or, perhaps from our perspective, some changes appear to happen in slow-motion … but what others see as change, you see as symptoms of the root cause.

From different vantage points, the rate of change can seem different.

The same can be said for changes in a person or changes in a business. It's easy to see the gap between where you are and where you'd like to be. Regardless, you will probably get there faster by building momentum and confidence by focusing on the improvements and progress you're making. If you change your perspective – you may realize you've made more progress than you thought.

Tough times are great opportunities to discover character. I'm often amazed at the innovation and insight that occurs at times like these!

Don't pay so much attention to what you think you have to do that you forget the reason you're doing it in the first place.

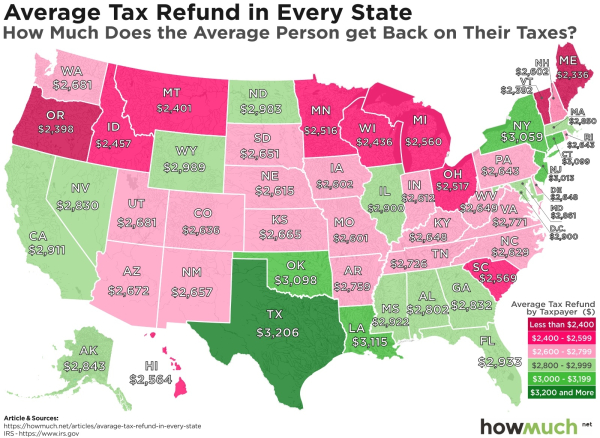

via

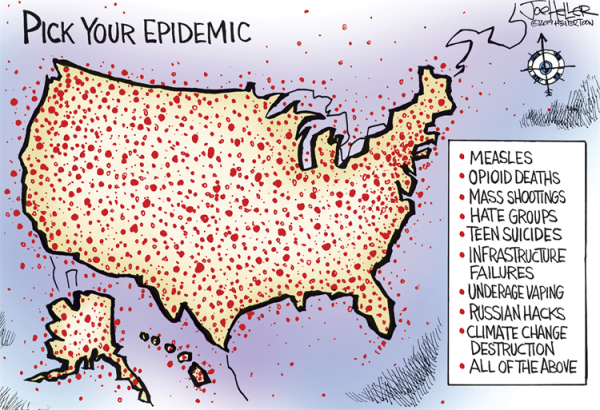

via

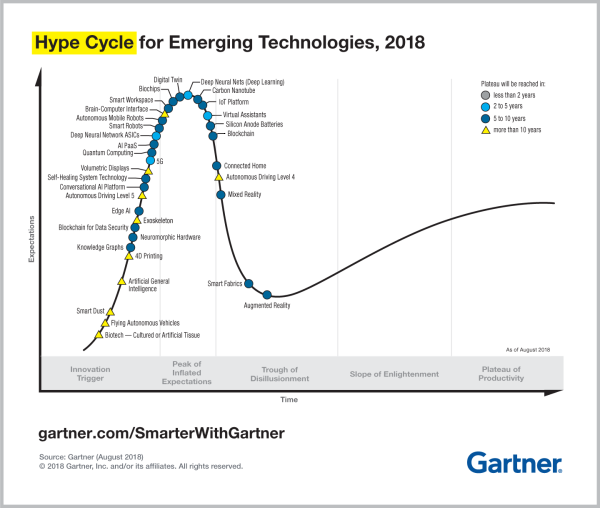

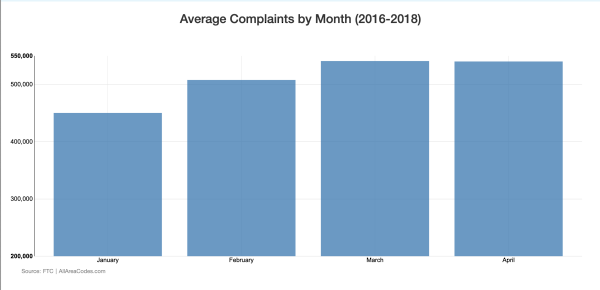

Each generation of traders finds new ways to play the game and to generate Alpha (the excess return generated by manager skill, rather than luck or excess risk). As soon as enough people adopt a strategy (or figure out a way to combat it), the edge begins to decay.

Each generation of traders finds new ways to play the game and to generate Alpha (the excess return generated by manager skill, rather than luck or excess risk). As soon as enough people adopt a strategy (or figure out a way to combat it), the edge begins to decay.

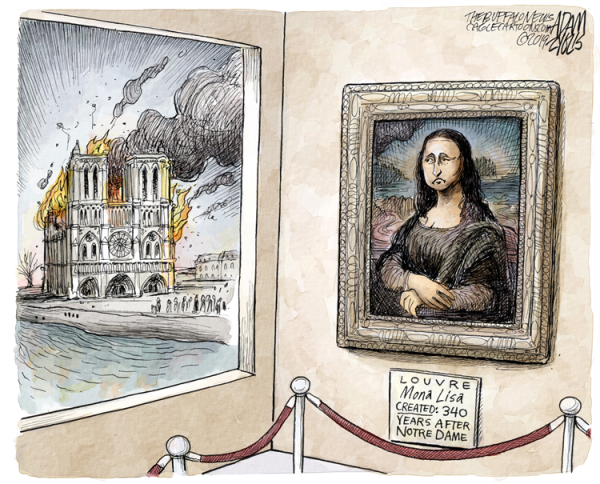

via

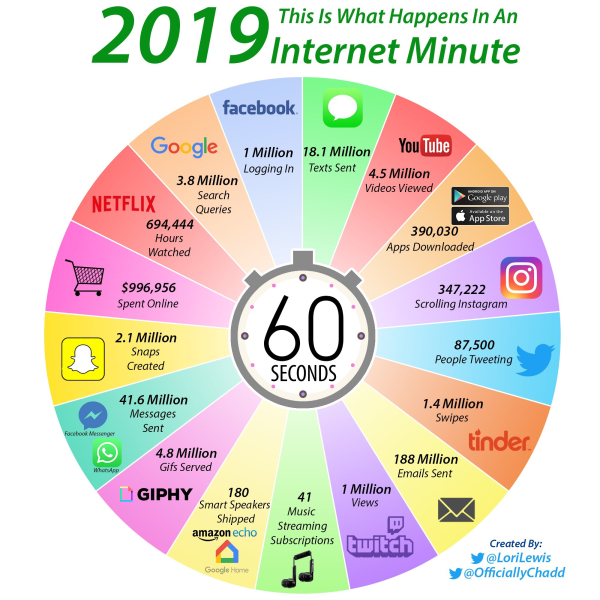

via