The idea that the market is not the economy has been made very clear over these past months. While businesses continue to shutter or (if they're lucky) slowly re-open, the stock market has rallied immensely since the initial crash – in large part due to governmental efforts. The markets are so confusing right now that CNBC has given up and created a new type of market – the kangaroo market … I assume implying "jumpy" volatility.

The rally has only served to increase the uncertainty as people hold their breath waiting for the drop… For all that waiting, "dumb money" has been beating a lot of "intelligent" investors.

I found an interesting visualization that shows the performance of the S&P through the performance of its underlying stocks.

via Chartfleau

As you watch the video you can see that most of these underlying stocks are struggling – but they're being propped up by a relatively small number of stocks, including the likes of tech giants, the gold mining company Newmont Corporation and the HVAC company Carrier Global.

While many funds still struggle, novice investors and day traders listening to the advice of "buy low, sell high" have made staggering gains.

I'm not encouraging a back-to-basics approach to trading, but I think it is a good reminder that sometimes, as Da Vinci said, "simplicity is the ultimate sophistication."

Being in Fintech, I'm always paying attention to the newest "sophisticated" technologies, looking for a new edge – and that's valuable – but you can't throw out the baby with the bathwater.

So, I find myself looking for what's timeless (instead of timely) in what others are doing.

At a Genius Network meeting recently, Brian Tracy mentioned two key questions he asks himself (before writing a book) that I think are very insightful.

Would this work 20 years from now? Would this have worked 20 years ago?

Tools and techniques change… why often doesn't matter.

The truth is, if you don't know what your edge is … then you don't have one.

On a related note, if nothing is working … doing nothing is an option!

Hope that helped.

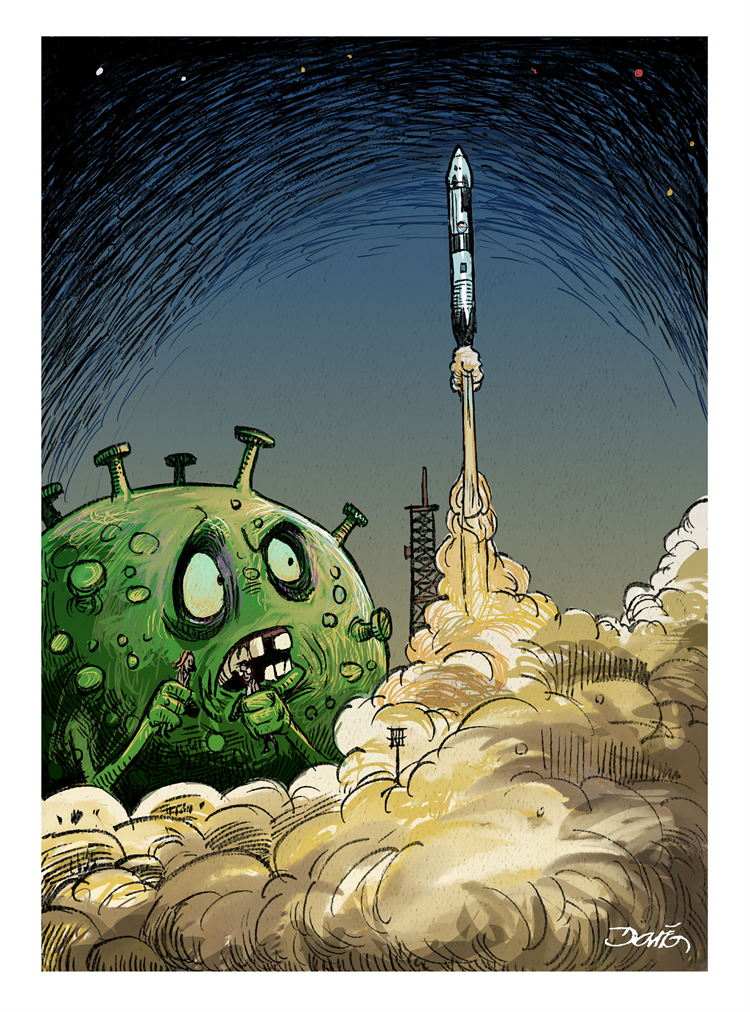

via

via  via

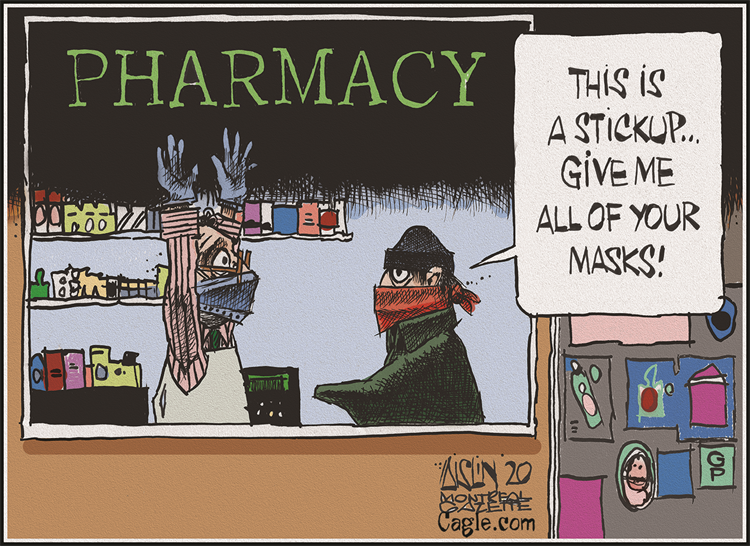

via  (April 17th, 2020) via

(April 17th, 2020) via  via

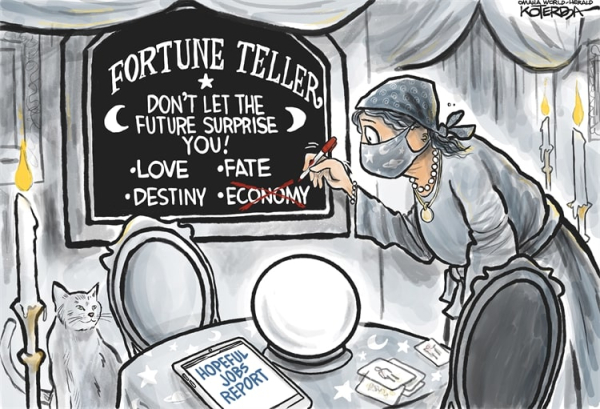

via

via

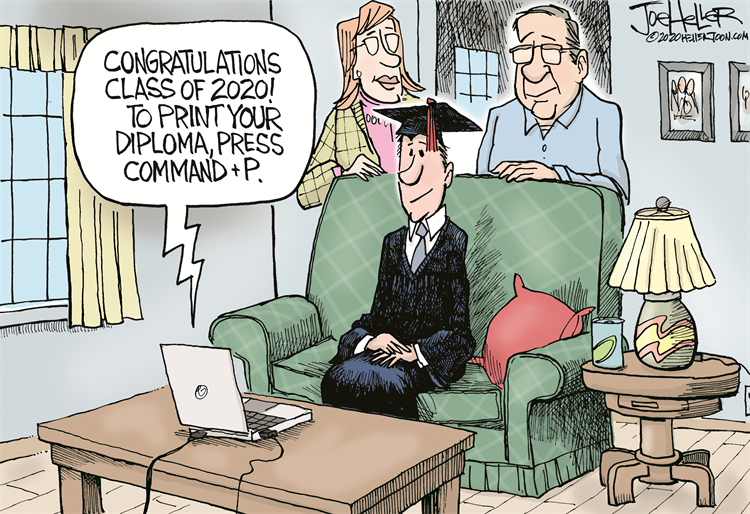

via