GameStop has been on a steady decline (both as a stock and a company) for many years. It has been like watching Blockbuster get replaced with Netflix all over again. Why would people go to a retail store when they can consume a wider range of products from the comfort of their home? Obviously, the pandemic made things worse for them. As a result, short sellers lined up to bet on their demise.

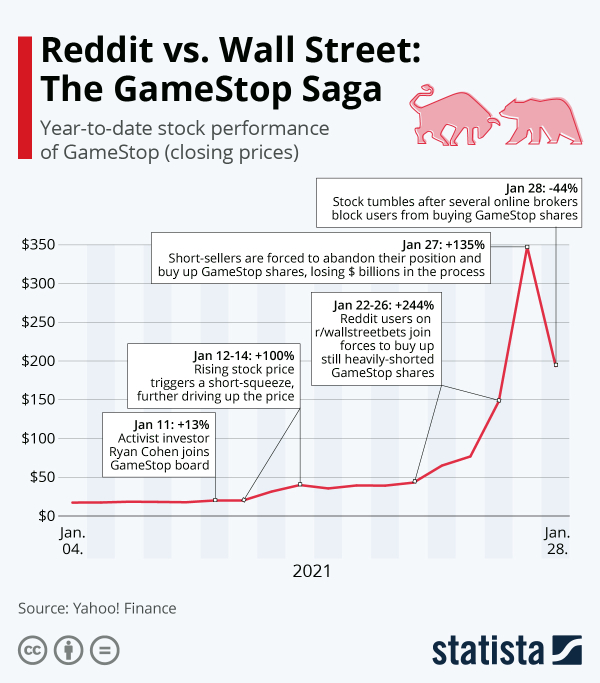

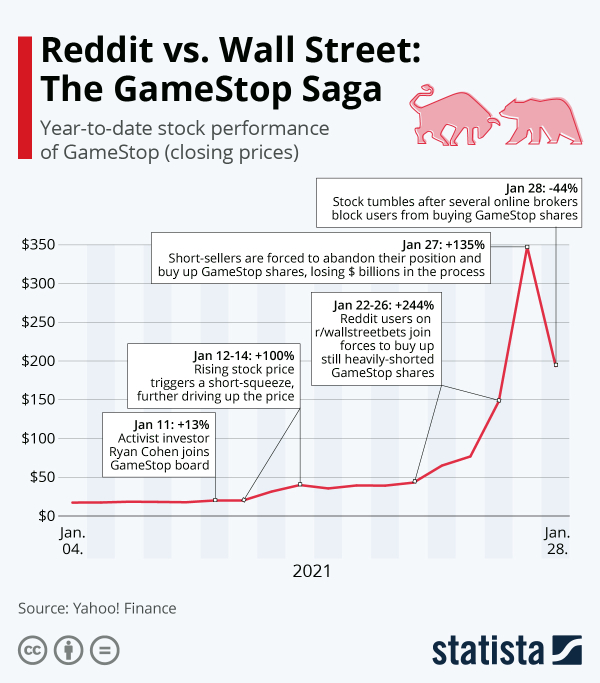

So, how can you explain the jump in GameStop's share price from $17.50 at the beginning of 2020, to almost $400 on Thursday?

You could argue it started with new leadership from Ryan Cohen and their surprisingly stable financials despite the turmoil. Nonetheless, it would be hard to justify a sudden $28 Billion dollar valuation based on that alone.

The real reason for the price jump, and the story everyone is talking about, is the war of the retail investor (fueled primarily by a Reddit forum called r/wallstreetbets) on Wall Street.

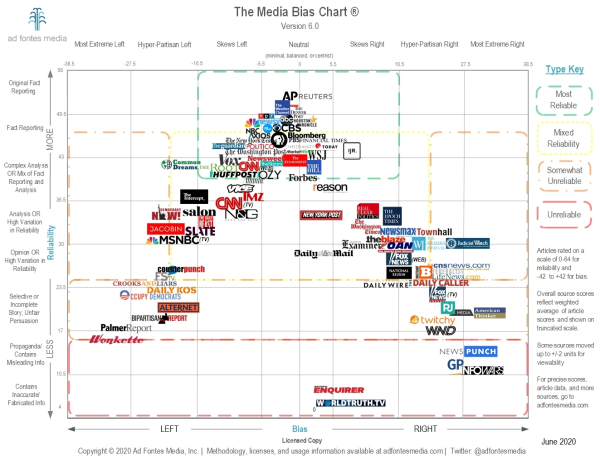

It's a complicated situation, and news stories tend to have their own biases and agendas, so I thought I would bring you up to speed on what happened, the legality, and the potential ramifications.

What Happened?

Earlier this month, Redditors realized that GameStop's stock ($GME) was shorted to 140% of tradable shares due to positions by several funds including Melvin Capital. Most of those positions are passively held, so the short-interest accounted for 300-500% of the float (actively traded shares). Theoretically, this shouldn't be possible – but it was allowed by the brokerages and market makers.

This allowed the Redditors, and other retail investors, to buy the stock aggressively, raising the stock price, and forcing the shorts to cover. This is called a short squeeze.

By Wednesday, retail investors' actions raised the price 700% to over $300. Melvin Capital was out ~3 Billion dollars and ultimately got bailed out by Citadel and Point 72.

On Thursday, after calls for help from Wall Street grew louder, several online brokers blocked the buying of GameStop and other stocks that were trending on Reddit (like $AMC, $NOK, and $NAKD) and canceled some trades. Those brokers still allowed users to sell their shares.

via Statista

via Statista

The stock price of GameStop and AMC tumbled as a result and the media went into an uproar.

Questions of legality were raised toward the potential market manipulation of Robinhood, but also r/wallstreetbets.

Were Robinhood's Actions legal?

Separate from legality, the optics of the situation are very bad for Robinhood. First, Citadel, who bailed out Melvin Capital, is one of Robinhood's vendors. Second, Robinhood's motto is about access to all, and it heavily markets brand beliefs consistent with the ideals of the fictional heroic outlaw, Robin Hood (who took from the rich to give to the poor).

Voices like Mark Cuban, Elon Musk, AOC, and Ben Shapiro all came out against Robinhood for limiting retail's ability to trade. An odd show of unity in these divisive times. There are also several class-action lawsuits and the SEC is reviewing the situation.

Robinhood justified its actions by claiming they were forced due to increased volatility, and risk management with their brokers. Both Robinhood and Citadel strongly denied any market manipulation claims.

Legally, these brokers state in their contracts that they are allowed to restrict trades for almost any reason. As well, they have liability and protection obligations to their consumers, market makers, and clearinghouses.

The situation with $GME is undeniably risky. Trading is a zero-sum game, and for every crazy win story you see of someone paying their mortgage, someone is losing their house. As $GME gains popularity, or r/wallstreetbets tries to replicate this success with other securities, the late majority are (almost by definition) going to be the least qualified and the most at risk of losing money they probably can't afford to invest.

This episode shined a light on clear issues with the Stock Market.

However:

- Robinhood only limited the ability to buy these stocks, which by design lowers stock prices.

- Before retail investors capitalized on the situation, these same brokerages let institutions short 140% which would have been a death sentence for GameStop.

- It's on the NYSE (in this case) to shut down the trading of a security, and they only do it for fraud or if there is material information a company hasn't disclosed yet.

- The timing and relationships bring good reason to question the validity of Robinhood's statements.

While the theoretical action of limiting trading is legal for Robinhood – this specific case is questionable at best.

Were r/wallstreetbets actions legal?

Many big-time bankers have been arrested for market manipulation in the past. It's a point of many of the regulations in Wall Street today.

This specific example is very complicated. On Reddit, a public forum, many users urged each other to buy stock and to hold in the face of adversity. The initial logic behind buying $GME was based on solid fundamentals, and the observation about Melvin Capital's position – but quickly became a momentum play capitalizing on the mania. You could argue it was collusion, which is bolstered by the disparity between the future value of GameStop as a business and its current stock price.

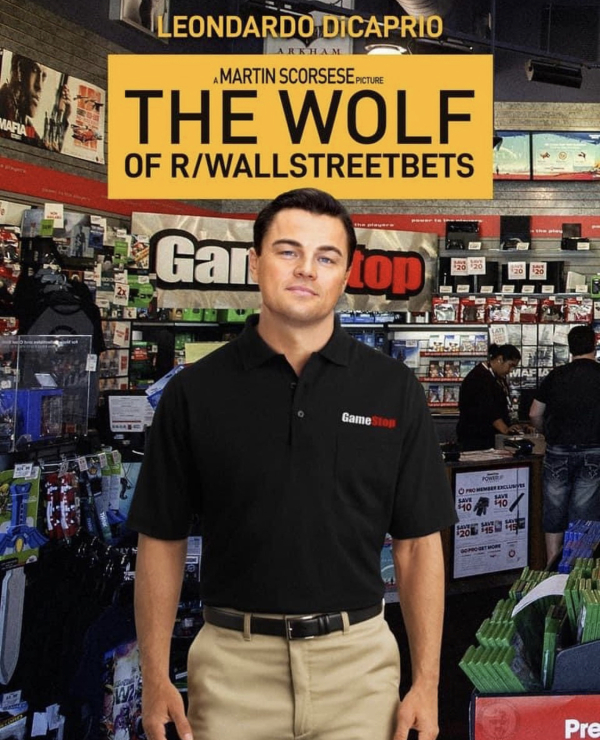

It's hard to prove that there was a coordinated effort to manipulate stock prices here. To me, it looks like a mob of uninformed investors following the advice of an educated investor and creating a trend. A common theme. Some claim it resembles a classic "pump-and-dump" scheme that you would find by the likes of Jordan Belfort and the penny stock market.

I think it's very unlikely you see anyone charged here – but I do think it's likely you see new regulations as a result of this.

While the industry is already heavily regulated, the world is changing, and we have to keep up or deal with the consequences.

New strategies or capabilities push boundaries and test limits in new ways. In the short term, someone has a new advantage, but in the long term, the system evolves and gets stronger.

The Bigger Picture

I've seen many people concerned with the decision-making behind retail's investment in $GME. As a practical matter, it doesn't really matter.

The initial posts on Reddit showed a good understanding of fundamental trading, but most traders who followed that advice wouldn't know the difference.

I'd argue it's not that different from most of Wall Street. Many don't have an edge, they simply piggyback off of the success of the ones that do, whether by following their trades or starting a new firm with the lessons they learned at a bigger firm.

The market is not the economy, and while GameStop is a great case study to prove that, at its core, it's not really a unique or new phenomenon.

Value is an important part of a stock price. But for many speculators, it is only part of the calculation. And beyond speculators, there are many types of market participants (e.g., governments, institutions, hedgers, etc.) and reasons to buy or sell things (including fun, excitement, a social belief, etc.), and rationales for their decisions (including systematic approaches, momentum, reversion to the mean, etc.) that combine to form the free market.

A free market isn't necessarily a smart market … and it doesn't need to be. But, part of what creates a growing and thriving market is the belief that it is safe, reasonably transparent, and reasonably regulated. Consequently, I would expect regulators to re-visit this and for them to re-look at the regulation of margin and other things.

Expect increased volatility and noise. Expect more runs like this. Plan accordingly.

Conclusion

Helping the average person take advantage of the Stock Market is a good thing. With that said, the "democratization of access" comes at a time when tech asymmetry is growing. The advantages to Hedge Funds and Institutional Investors are growing – regardless of regulation – due to better tech stacks, smarter algorithms, and teams of PhDs. Information asymmetry is decreasing, but data is only valuable if you can digest it.

The Stock Market is not just a game, and some believe it's worrisome that some retail investors feel like it is.

In trading, there is a rule of thumb that says a trend continues until it stops. Well, expect the bubble to pop for $GME (and the other stocks that may follow this pattern). Why, because trends do stop … and to quote Stein's Law – if something can't continue it won't.

Actions have consequences. Many intelligent investors will be fine, but many other investors will be hurt. To some extent, that is the consequence of a zero-sum market. But with Democrats in power, I expect to hear more about this.

Perhaps it shouldn't have taken Wall Street getting hurt to start this discussion. Now the discussion has started. At some level, it's not about what happened … it is about what you do.

It's unclear whether r/wallstreetbets will have the win they're looking for or whether Robinhood will get penalized.

What do you expect to happen?

via Joe Raedle/Getty Images

via Joe Raedle/Getty Images

via

via  via

via

via

via