When people think about CERN, they generally think about nuclear research, the Large Hadron Collider, and other physics research.

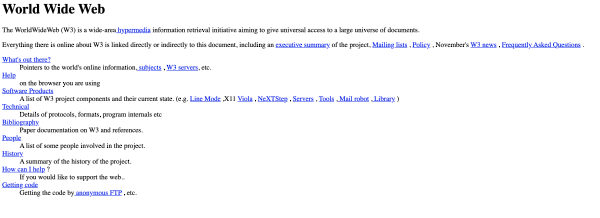

But, CERN was also where Tim Berners-Lee invented the World Wide Web. In March of 1989, he published “Information Management: A Proposal” which outlined his vision for what would soon become the World Wide Web. CERN also had the first website to ever exist. Luckily, they kept the site up and will let you view it in the old school line mode.

via CERN

via CERN

It's been 32 years since the release of the World Wide Web (the internet is said to be invented 6 years earlier with the invention of TCP/IP). Think how much that one invention has had on the world.

Information Gathering

I remember being in law school, going to the library and scanning through microfiche (or actual books) to study or do research.

I remember reading encyclopedias (and photocopying relevant articles).

I remember paying for newsletters that were mailed to me (or paying extra for fax delivery).

Having access to more data or faster delivery was a huge advantage.

Today, you have all the information you could ever ask for at the tip of your fingers … Google and Wikipedia are just the tip of the iceberg.

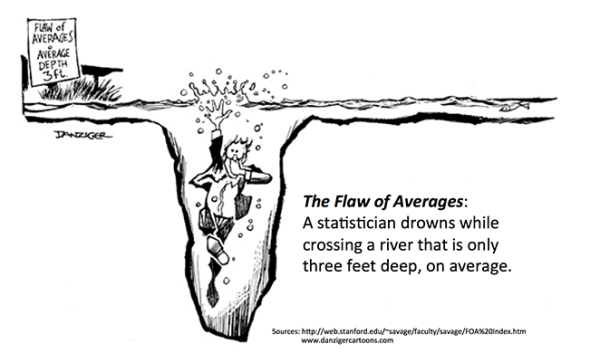

There is almost too much information now. It is hard to separate the signal from the noise. It seems like anyone can find justification for almost anything. The result is lots of data, but too little knowledge.

Part of what is needed is a way to help people make better decisions about what to trust, what it means, and what to use.

Social Interaction

People record every moment, every intimate detail of their lives online, contrasted by a fear of strangers and letting children roam.

While riding around the neighborhood on your bike to see if your friends could come out to play is by no means outlawed – it does seem passé.

Chat rooms, Facebook, Online multi-player … many people's key friendships are born and kept online.

I remember my son, 13 years old at the time, sending 10,000+ texts a month and thinking it was a phase. I was wrong.

The internet has radically changed the structure of relationships – for better, or often worse.

Privacy ( … or the lack of it)

One of the biggest changes is that we as individuals have become productized. We take advantage of all these free resources at the cost of being pixeled and cookied into oblivion. We've chosen convenience over safety.

Remember, if you’re not paying for a product – you are the product.

Little bits of our private information, demographics, and psychographics are sold to advertisers to create smarter ads, new offers, and realistically we have very little control over that.

It’s been proven time and time again that these giants like Google and Facebook will find ways to sneak your data to advertisers even when it’s “illegal” with a slap on the wrist.

Data protection is a massive issue not only for corporations but for individuals. While many companies are trying to manage your privacy while still monetizing your data, there are just as many companies who couldn’t care less.

The GPDR - while frustrating for many – is a step towards protecting individuals.

Every action has a reaction, and every benefit has a cost. The internet is an amazing tool – but it can also be a weapon.

What will the next 30 years of the internet hold?

"The Internet will disappear. There will be so many IP addresses, so many devices, sensors, things that you are wearing, things that you are interacting with, that you won't even sense it. It will be part of your presence all the time. Imagine you walk into a room, and the room is dynamic. And with your permission and all of that, you are interacting with the things going on in the room." — Eric Schmidt

It has been 30 years since its inception, and there's still radical growth coming.

We’ve gone from bit speeds to megabyte speeds. We’ve gone from crappy-quality video taking hours to download to streaming HD quality video live.

How do imagine that the internet will evolve?

What influence do you think the Internet of Things will have?

It’s hard to foresee how innovation and regulation will change the internet, but it’s clear there will be change.

We live in exciting times!

via

via  via

via