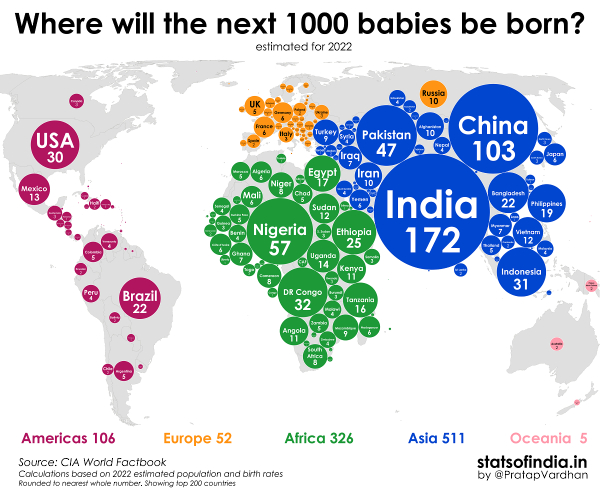

Everyone knows that children are our future. They're the next generation of innovators, entrepreneurs, and workers. Countries that are having a natural decrease in population due to families not having children will likely find themselves becoming less important on the geopolitical stage.

While the future is often hard to predict, here is easy “prediction” (that is much less of a prediction than it is simple math). In order to predict how many 18-year-olds there will be in a particular country in fifteen years, simply count the 3-year-olds there now. Yes, there will be some death or migration … but it is an easy way to get a sense of some important mega-trends.

With that said, the U.S. saw many states with more deaths than births in 2020 and 2021.

So, where are children being born?

India, China, and Africa all are seeing massive population growth. America is still net positive. It's also worth noting that India and China are topping the list because they already have such large populations. Their birth rates are actually slightly below average.

On a longer term scale, it's also worth noting that population growth has been declining since the 1960s. Partly due to education, wealth, and the move from rural to urban living.

Slowing population growth means a larger portion of the population is older. As median age increases, there are lots of potential economic consequences.

It's an interesting compounding of consequences.

We'll see if the countries with the largest population growth have the economy and infrastructure to support that growth.

via

via

via

via

via

via

via

via

via

via  via

via