One of my go to claims about AI is that it can do almost anything … but it can't do everything. Specific AI systems are becoming incredibly robust. Last year, I wrote an article emphasizing how big of a jump GPT-3 was from past language processors. I also shared a Seinfeld sketch created by GPT-3 that was so good it was almost unimpressive … it just felt like a Seinfeld sketch.

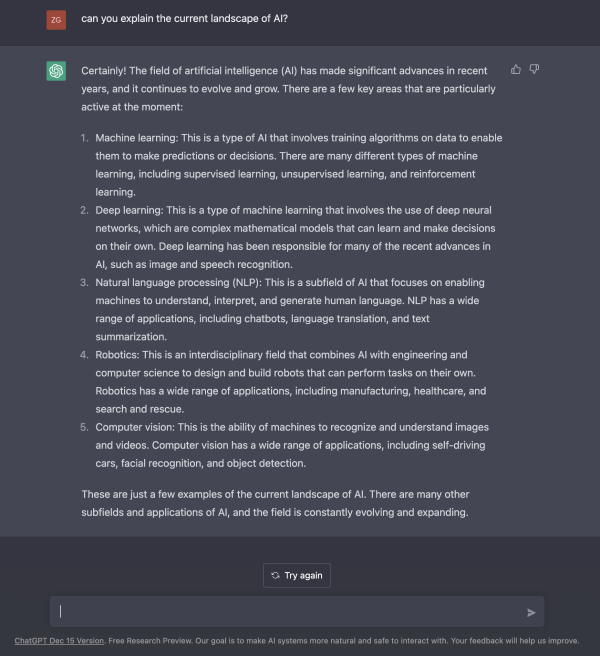

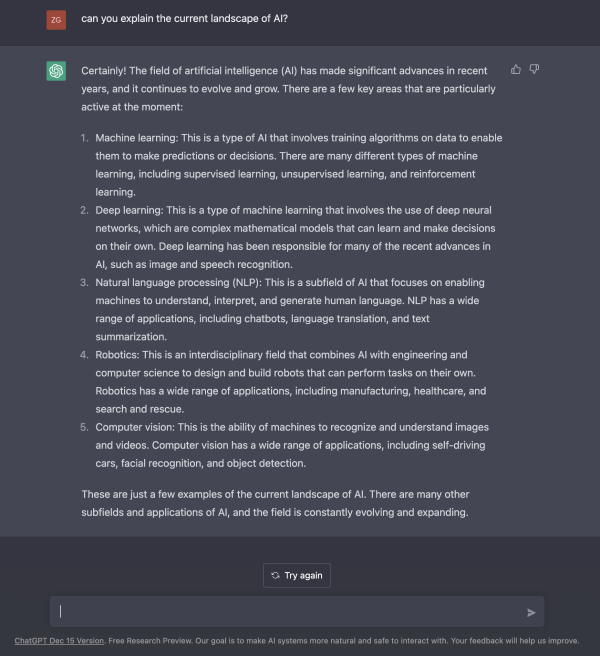

It feels like every week, there's a new breakthrough in pop AI. OpenAI just released ChatGPT (for free) to the public. The promise of ChatGPT is to give a cogent reply to conversational discussions. It can help you code, it can write a poem, can answer your questions, and more. The code it produces is stellar, and it can even create a convincing romantic comedy using characters from various famous shows. It does a lot very well, but it does have some failings.

ChatGPT via OpenAI

GPT-3 is 100x bigger than any previous language AI model and comes pre-trained on 45TB of training text (499 billion words). It cost at least 4.6 million US dollars (some estimated as high as $12 million) to train on GPUs. The resulting model has 175 billion parameters. This was impressive enough, but ChatGPT is actually not based on GPT-3 but GPT3.5 an even more robust model that improved on the ability to answer in a way that feels natural.

ChatGPT can talk about almost any topic you can think of, and even create prose that feels human; however, it's not perfect yet.

Unfortunately, this chatbot fails in many of the same ways as its predecessors. To start, it can present false information as true because it's essentially a "stochastic parrot" basing its answers on statistical regularities in its data sources, not on an actual understanding of the world. As well, a lot of its answers can include meaningless fluff that sounds good but doesn't actually answer the question meaningfully … almost like a high schooler that forgot to read the book before writing an essay. It also can't produce ASCII art despite the advancements in AI art we've recently discussed.

Regardless of ChatGPTs faults, it's a very impressive piece of software. It can answer trivia like Google, write poetry and dialogue, it can pretend to engage in philosophic discussion, and it can help you correct your code or improve your writing.

Here's a sonnet I had it write about Artificial Intelligence:

AI, the future's shining light,

A force that shapes our world anew,

A source of endless possibility,

A tool that cuts our burdens in two.

From language translation to deep learning,

AI's capabilities are vast and grand,

It helps us solve problems, find solutions,

And gives us new ways to understand.

But with great power comes great responsibility,

As AI transforms our world and lives,

We must ensure that it's used ethically,

That it helps, rather than subverts or deprives.

So let us embrace this technological marvel,

And use it wisely, for the common good,

For AI has the power to unravel

Our deepest mysteries, as well as hurdles.

It does what it is supposed to do very well. It is much more conversational and robust than previous chatbots. Obviously, it doesn't do everything well, and I doubt a chatbot will any time soon. Nonetheless, it is a step forward … and it will create ripples of progress.

What do you think?

via

via  via

via

via

via