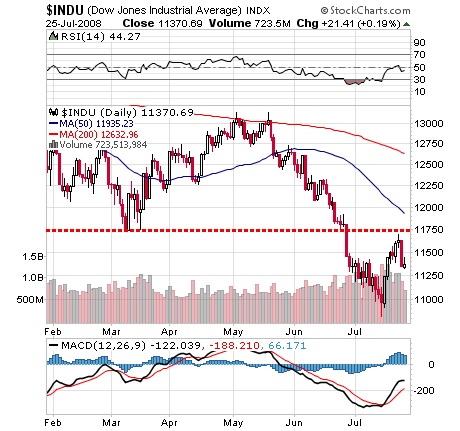

The bullish arguments are that we still have a series of higher lows off the July bottom; and that the market is performing relatively well in the face of negative news. The bearish arguments are still almost everything else.

On Friday, Oil was down 5 percent — great news? Not quite, it was still up on the week. The Dow was up 200 points — yet still managed to close down for the week. Also, the NASDAQ closed just below its 200-day moving average.

Here are a few of the posts I found interesting this week:

- With new lows in sight, is Lehman a takeover candidate? (BloggingStocks, Mish, NYTimes)

- Boone Pickens' Strategy is Water-Tight; form your own town and issue govt bonds (DealBreaker)

- Supermodels out-perform the Dow (TheStreet.com)

- Hewlett-Packard's profit climbed 14% to $2.03 billion (WSJ, MarketWatch)

- Corporate Insider Buying is strong (Hulbert in MarketWatch)

- Comparison of Bernanke's 2007 and 2008 speeches at Jackson Hole (Infectious Greed)

- Producer Prices jumped 10% this year, most since 1981 (NYTimes)

- Goldman Sach's warns of recession fears for half the Globe (UK Telegraph)

- Barry Ritholtz asks whether we are in a "Psychological Recession"? (Big Picture)

- Jittery investors redeemed $27 Billion in mutual funds this July (Investment News)

- Mortgage applications drop to lowest level in eight years (Bizjournals.com)

And, a little bit extra:

- Apple planning to make 40 Million iPhones in 2009 (BusinessWeek via MacRumors)

- Microsoft hires Jerry Seinfeld to tout Vista; but is he still "cool"? (Silicon Alley Insider)

- The dawn of intelligent machines; surpassing human intelligence by 2050? (BBC)

- Obama's social networking strategy, and who's behind it (MIT Technology Review)

- Educators urge lowering of drinking age to curb binge drinking (Washington Post)

- EBay undergoing Amazonification; moving to fixed price sales (BusinessWeek)

- Great graphic comparing Usain Bolt's record-setting run to history (NYTimes)

- Crumbling archives of texts get a new lease on life from an anti-spam tool (BBC)