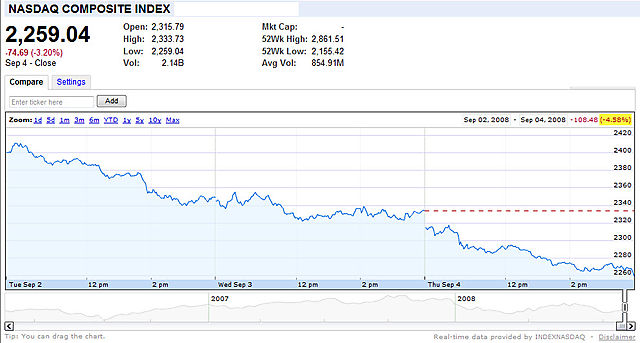

Volatility has been much higher than normal. For example, the S&P 500 index rose or fell by more than 2% on five of the nine trading days so far this month. There were only six such days during the last 4½-year bull run.

Yet, for all that violent flip-flopping and massive gaps in both directions, the stock market ended last week essentially flat.

We are back near the lows for the year. Bears had a great opportunity to plunge through important psychological levels. Everything turned red for the ride down; and then the market reversed again. Part of me wonders whether short-sellers didn't press their luck because they "fear" another Sunday bail-out (in some form or fashion).

The big news this week was about the fall of Lehman. Here is a simple chart showing what happened to their stock this year.

As I write this, it looks like Lehman is filing for bankruptcy and that Merrill Lynch is getting sold to Bank of America. Futures are down.

As I write this, it looks like Lehman is filing for bankruptcy and that Merrill Lynch is getting sold to Bank of America. Futures are down.

However, a big, quick, move down – here – might be the best thing to hope for if you are bull.

Here are a few of the posts I found interesting this week:

- U.S. Gives Banks Urgent Warning to Solve Crisis (NYTimes, WSJ, Clusterstock)

- Bank of America Buys Merrill Lynch (NYTimes, WSJ)

- Locusts: Shorts Moving On to AIG and Others? (Seeking Alpha, Naked Capitalism, NYTimes)

- Federal Reserve announces additional support for the markets (Federal Reserve)

- Is the latest bailout working? Someone thinks so (Bronte Capital)

- Russian Market Down 50% Because of War and Falling Oil Prices (NYTimes)

And, a little bit extra:

- Sweet Dreams in Hard Times Add to Lottery Sales (NYTimes)

- Niederhoffer's Ten Principles of Cricket and Market Power (Daily Speculations)

- Wisconsin man eats 23,000 Big Macs since 1972 (Chicago Tribune)

- Lehman Replaces Palin as Wikipedia Plaything (Infectious Greed 1 and 2)

- McCain leading Obama in prediction markets and polls (Kudlow, RealClearPolitics)

- Retailers Using Software to Increase Sales and "motivate" employees (WSJ)

- Has the large Hadron Collider destroyed the world yet? (Click)

- Biologists on the verge of creating a new form of "life" (Wired)