Are we in a Recession or Depression? From my standpoint, I don't think it matters much. Naming the disease doesn't fix it if you still don't know the cure. Regardless of what you call it, we're still faced with the symptoms: the credit collapse, carnage in the financial sector, higher prices but less money to spend, and rising unemployment.

The kicker is this has been happening worldwide. Yet, most commentary I read treats this like the cause and effect happen here. If you look around, though, there haven't been many safe havens. And I suspect that we have less to do with the start or end of this mess than we give ourselves credit or blame for.

It Is Not What Happens, But What You Do. You see it repeated through history … Times like these are the catalyst to great wealth for some, and the poor-house for others. If someone were looking back on this time from 10 or 15 years in the future, this is probably early in the new cycle. This is a good time to figure-out what you believe will work going forward.

The party isn't over. It is just a new dance, with a different rhythm and a faster pace. So, maybe it is time to be nimble and to learn some new steps?

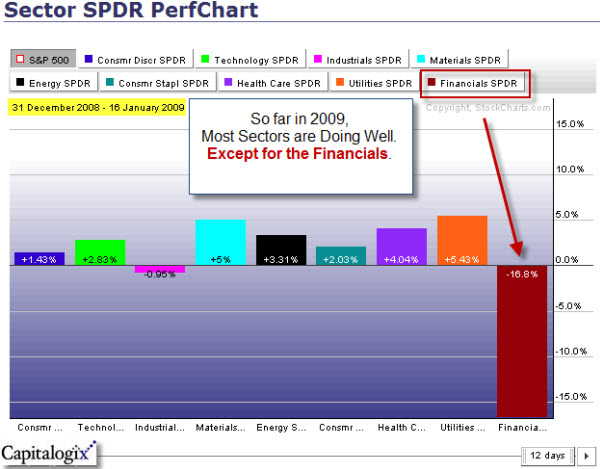

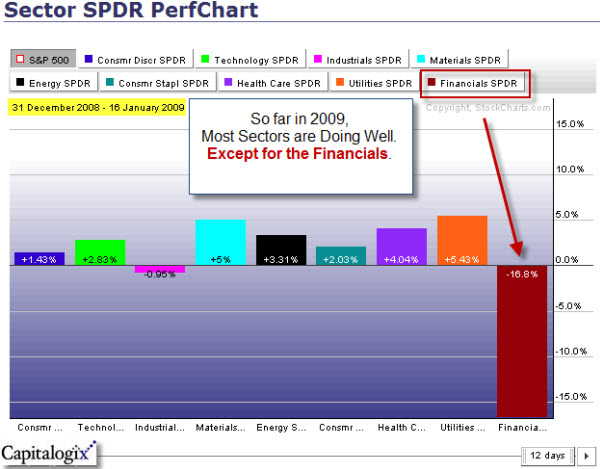

A Look at the Markets: A few weeks ago, 80% of stocks in the S&P 500 were trading above their 50-day moving averages. With the declines we've seen since then, that percentage has moved down to 40%. Financials have led those declines

This chart shows 2009 performance, by sector. So far most sectors are doing well. The exception has been Financials, which look a bit oversold.

Nonetheless, with the S&P 500 approaching its November lows, it's comforting to see 40% of stocks still trading above their 50-day moving averages. At the prior lows, the number got down nearly to zero. The fact that the overall declines have been limited to a smaller area of the market is a positive for those hoping that the lows will hold.

Here are a few of the posts I found interesting this week:

- Is so much bad news good news for you? A Bullish forecast. (Dash of Insight)

- Bank of America gets another $20 Billion from the Fed (Federal Reserve)

- Yahoo has a new CEO, how did Wall Street react? (TechCrunch)

- Sony looks set to lose $1.1 Billion in Fiscal 2008 for first loss in 14 years. (Gizmodo)

- Circuit City Pulls the Plug. They are liquidating and closing over 500 stores. (Huffington Post)

- Disney seeing some positive signs? (Jim Hill)

- Great Visualization showing GM's woes, the least of which is lack of cash. (WallStats)

- Twitter's New Status as an Investment Tool. (MSN Money Central)

And, a little bit extra:

- Size Does

Matter: Finger length may reveal your financial acumen. (New

Scientist & Telegraph)

- Your inner voice never lies. But does it know what it is talking about? (Psychology Today)

- Schools get futuristic face scanners to identify students and strangers. (Telegraph)

- In retrospect, this was a huge marketing boner. Funny. (YouTube)

- MS’s new Songsmith product adds music to any vocal track. "Epic Fail". (Blog & Gizmodo)

- The taxman cometh? IRS urged to tax virtual worlds, economies. (Ars Technica)

- Surprise, surprise … research shows Facebook still mostly for the young. (MIT Tech Review)