The Swine Flu made headlines again. Apparently, no one cares that the the U.N.'s World Health Organization officially declared the outbreak to be a "pandemic" this week. If you don't know what to look for, this picture illustrates some symptoms.

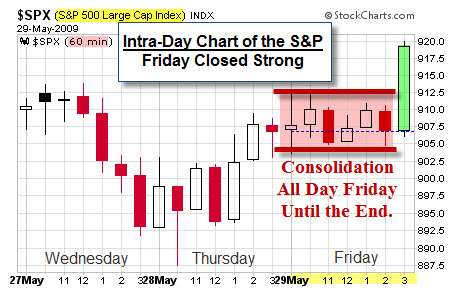

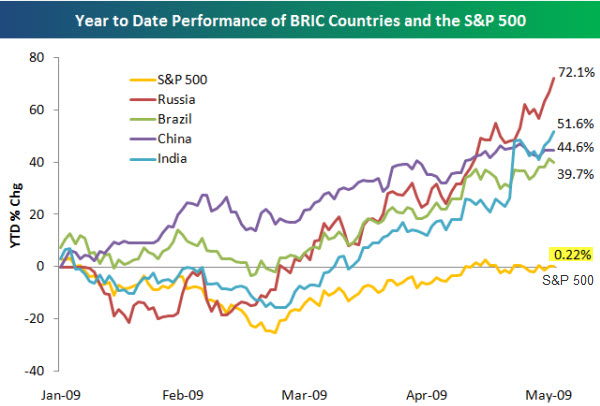

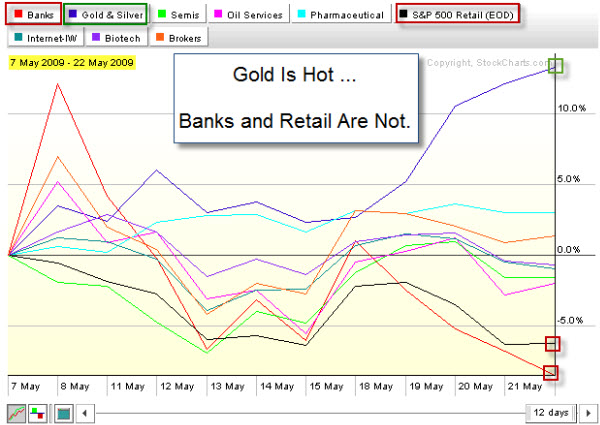

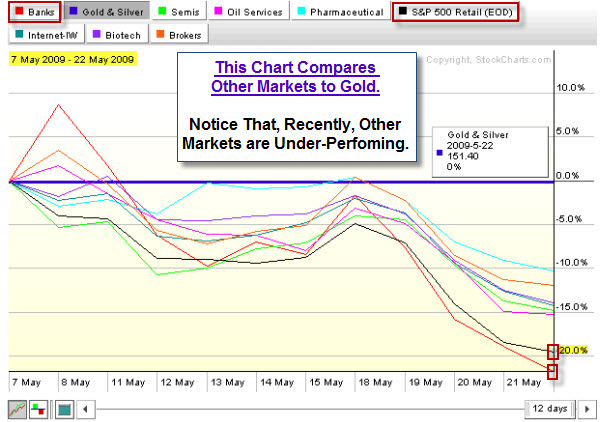

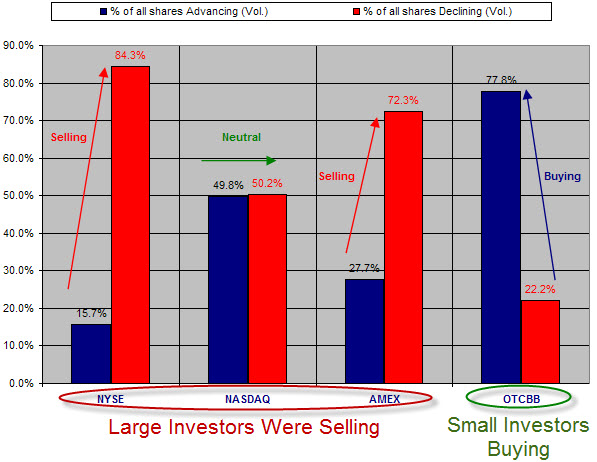

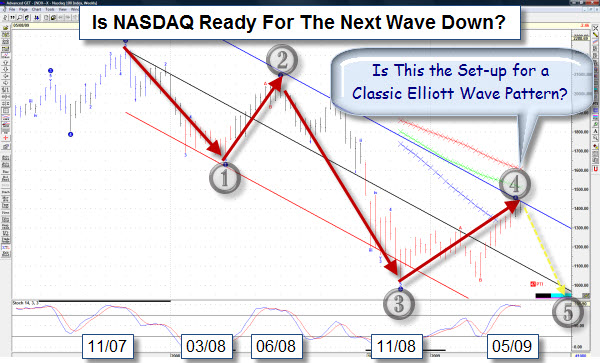

If the Markets' continued rally is taken as evidence, then it also appears that people don't care about the threats weighing down the economy. The Major U.S. Index Averages are holding above their 200-Day declining moving averages and overhead resistance. Also, Bespoke notes that eighty-four percent of the stocks in the S&P 500 are trading above their 50-day moving averages. With that said, momentum is waning … three months into the rally.

Of course, the length and staying power of the rally says something about how crowds work, and why the majority of traders are often wrong at turning points in the market. The following video makes the same point, a different way. On the surface, it starts with a lone male, dancing at a music festival. It is fascinating to watch what happens when other people feel the urge to get in on the fun. It takes about one-minute for people to start joining in. By two-minutes, there's a crowd. And by three, it's a mob.

Here is the direct link to the video on YouTube. This says something about human nature, doesn't it?

Business Posts Moving the Markets that I Found Interesting This Week:

- Ritholtz's Graphic: 7 Factors that Led to Crisis. (Big Picture)

- Sentiment Overview: Bulls Rushing in at Alarming Rate. (Seeking Alpha)

- Optimistic Unemployment & Housing Forecasts Looking Silly. (Global Economic Analysis)

- Poking Holes in Efficient Markets Theory. (NYTimes)

- If Volume Is Rally’s Fuel, We’re Running On Fumes. (Traders Narrative)

- Ranks Of Active VCs Dwindling By Any Measure. (WSJ)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- The Top Twelve Funny Indicators That The Economy Is Bad. (Big Picture)

- Why Microsoft Windows 7 XP Mode is a Major Advancement. (eWeek)

- Making Fat Disappear with a Genetic Strategy from Bacteria. (Tech Review)

- When Sleep Leaves You Tired: It's the Quality, Not Quantity. (WSJ)

- When a 'Chosen' Tibetan Lama Says "No Thanks". (Time)

- How Twitter Will Change the Way We Live. (Time)

- More Posts with Lighter Ideas and Fun Links.