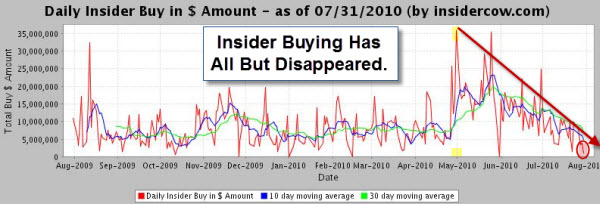

Insider Buying Has Dried Up Since May.

Insider buying and selling behavior offers a unique insight on the prospects of a company, industry, economic sector, or even the stock market in general. By definition, Insiders have a deep knowledge and understanding of the company, exclusive information on the company's performance and prospects … and if they are risking their own money on the stock, you might expect that they have good reasons, especially when several insiders buy or sell at the same time.

Well, since May, Insiders have certainly changed their buying habits. Here is a chart from Insidercow showing how bearish insiders are right now.

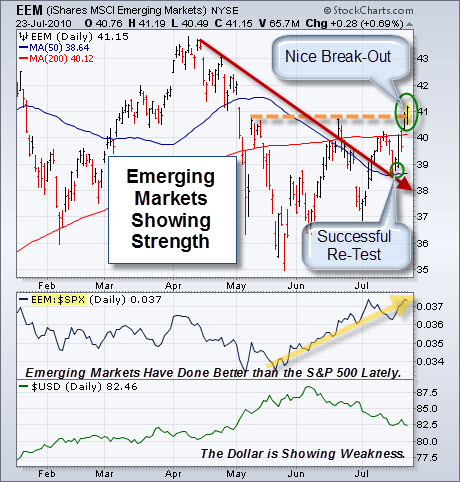

Another sign I've been watching has been the performance of China.

China's Shanghai Index Has Some Room to Move.

China's Shanghai Index has been in a downtrend for a while. It has under-performed most of the major world markets recently. However, in early July it bounced nicely off the downtrend channel. At this point, it is sitting right at the resistance zone. A sustained move above the 2700 level will likely give the index plenty of room to rally. On the other hand, a failure at this level could send a signal to other world markets.

This next chart shows a weekly view of gold. This is a market that I don't pay close attention to, normally. Nonetheless, its chart caught my eye this weekend.

Decision Time for Gold.

The price of Gold is sitting at the bottom of the up-channel. So, this where you'd expect to see buying come in from those expecting the up-trend to continue in Gold. The chart speaks for itself.

We'll see what happens. Hope you have a good week.

Business Posts Moving the Markets that I Found Interesting This Week:

- Where Does BP's $17B Loss Rank in the 25 Biggest Quarterly Losses in History? (Insider)

- EconoPhysics – A Richter Scale for Studying Financial Earthquakes. (NYTimes)

- Foreclosures Up In 75 Percent of Top U.S. Metro Areas. (Reuters)

- Sign of the Times: Someone Just Bought the Pontiac Superdome for $500K. (BizWeek)

- Goldman's Leading Indicator at 7-Month Low, Predicts ISM Collapse this Week. (Insider)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week:

- Chess Metaphors: Artificial Intelligence and the Human Mind. (NYBooks)

- Despite Human Expectations, the Future May Not Resemble the Last 6 Months. (NYTimes)

- Personal Details Exposed Via Biggest U.S. Websites. (WSJ)

- Study Confirms the Existence of the "Cougar" & Why They Have More Fun. (The Week)

- Neb. Town Giving Away Land for Free Hoping to Generate Tax Revenue. (Newser)

- More Posts with Lighter Ideas and Fun Links.