Something's got to give – job growth and spending swing in the balance.

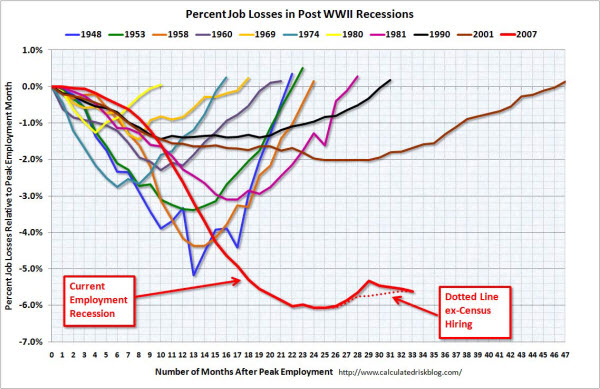

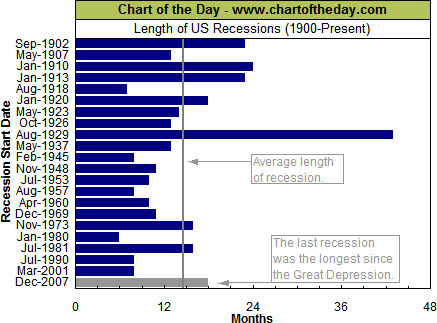

The job loss situation continues to get worse. This is still one of the scariest charts I've seen. And the numbers continue their trend of downward revisions.

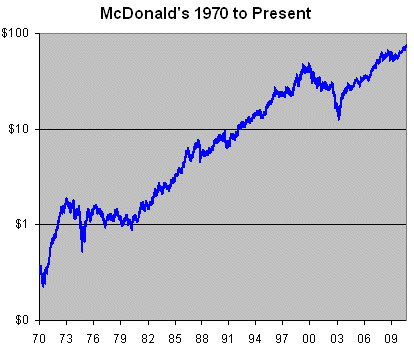

The markets continue higher despite concerns about the economy. Remember, the markets do not reflect what is happening in the economy (nor are they supposed to). Markets reflect the expectations and speculations about the markets themselves.

There is a lot of money sitting on the sidelines, and if we don't get selling pressure — then it doesn't take much to push things higher.

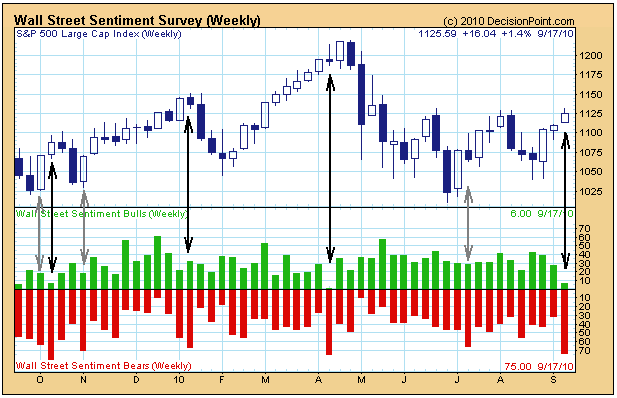

The S&P 500 Has Risen Back to Its Down-Trend Line.

The bigger picture shows that the S&P 500 Index has rallied back up to the trend-line from its 2007 highs. Bulls will likely feel more confident if price can stay above this level.

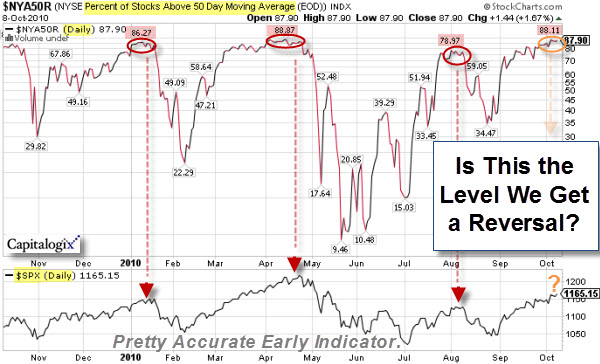

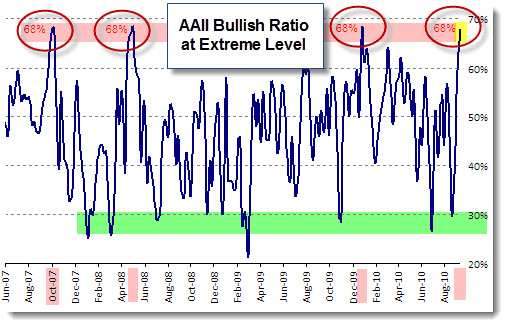

How high can it go? This is a likely area for Bears to try to sell. Not only are we at overhead resistance, but the market is getting overbought.

How Can You Measure Whether the Market Is Overbought?

More than 88% of all stocks traded on the NYSE are above their 50-day moving average. We have seen similar levels three times in 2010, all resulted in large sell-offs.

The push higher will continue until sellers get more bold.

Business Posts Moving the Markets that I Found Interesting This Week:

- Propelling the Profit Comeback – Big Earnings From Lower Revenue. (WSJ)

- Wall Street’s Profit Engines Are Slowing Down. (NYTimes)

- Bernanke Says Fed's Additional Asset Purchases Improve Economy. (Bloomberg)

- Where Every Major Country Is in the Global Debt Cycle. (BusinessInsider)

- Just Manic Enough – Seeking Perfect Entrepreneurs. (NYTimes)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- A Genuine 'Elixir of Life' Extends Mouse Lifespans 12%. (Telegraph)

- Billionaires' Ball: 7 Intriguing Facts From the 'Forbes 400'. (TheWeek)

- Why Larry Kudlow Is Angry About The Obama/Rahm Hug. (Dealbreaker)

- 'Glee' Topples Beatles Record for Most Hit Singles. (RollingStone)

- The Photo Making People Rethink Chicken Nuggets. (Salon)

- More Posts with Lighter Ideas and Fun Links.