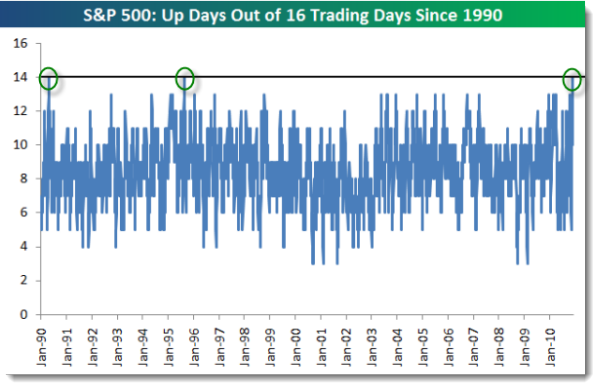

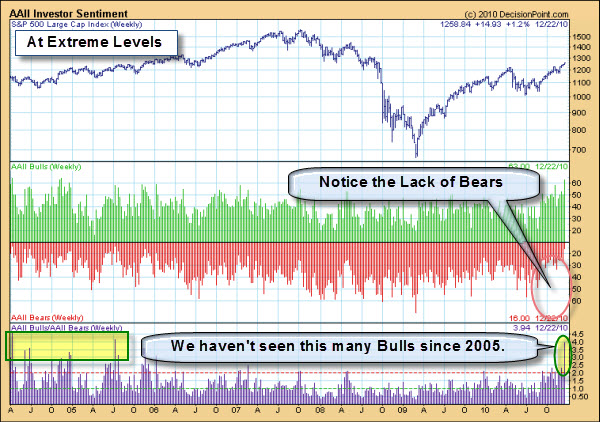

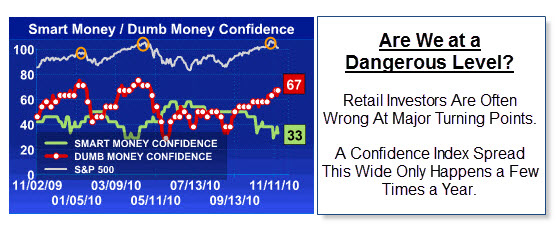

Why are the markets going up? Does it matter? Clearly, there has been virtually no selling pressure; and it's been that way for months.

Jim Cramer said: "Really bad markets go down on the same news over and over again. Really good markets just keep going up on news that is well-known and is, well, hardly, news." By that definition, we are in a good market.

Respect the Trend.

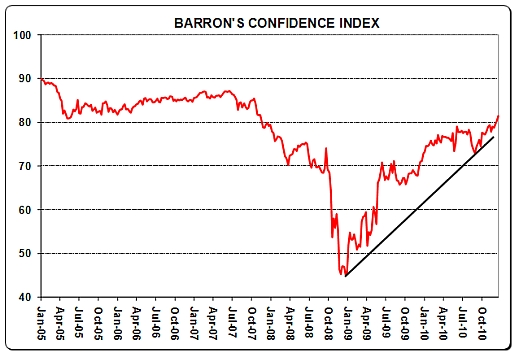

The primary trend is higher. Higher highs and higher lows is the definition of an up-trend. Until price tells you otherwise, the key message is that Bulls control the market.

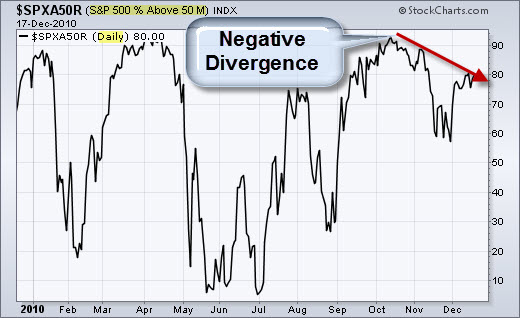

Imagine how frustrating it has been to be a Bear (because they simply haven't caught a break, and classic bear setups just aren't working). Will there come a time when Bears control the market again? Of course there will. Before that there will probably be a few nasty selling episodes. For now, though, all they know is that the market simply won't fall, no matter what the readings say, and no matter how overbought the daily index charts happen to get.

The Markets are a harsh teacher … and the hard lesson to learn is to avoid front-running a move. Over the long-term, it is safer to respect the primary trend.

A Condensed Restatement of the Bullish Case.

One of the StockTwits columnists posted this excerpt from a post in Barron's written by Michael Santoli.

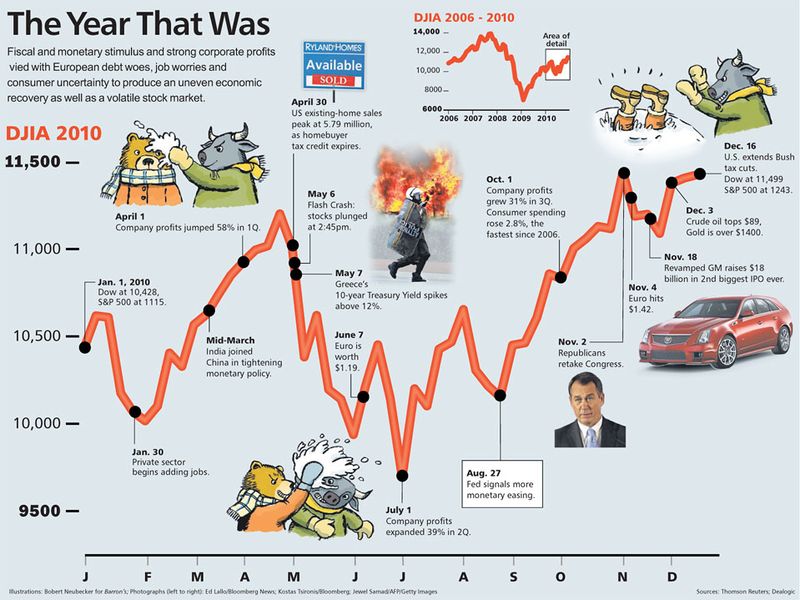

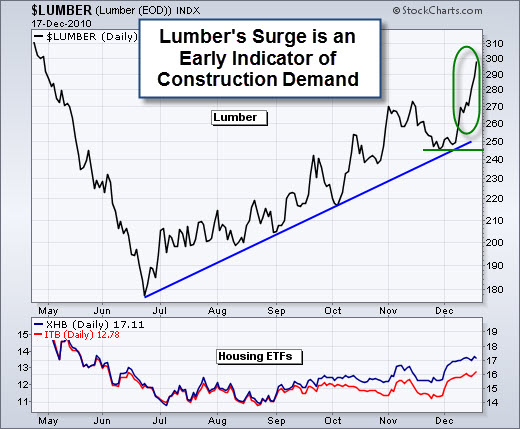

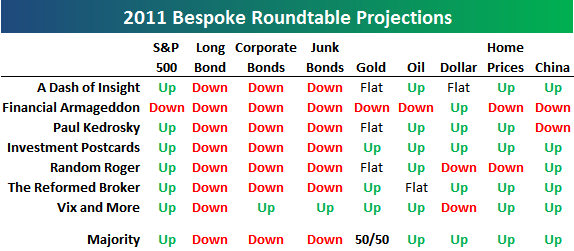

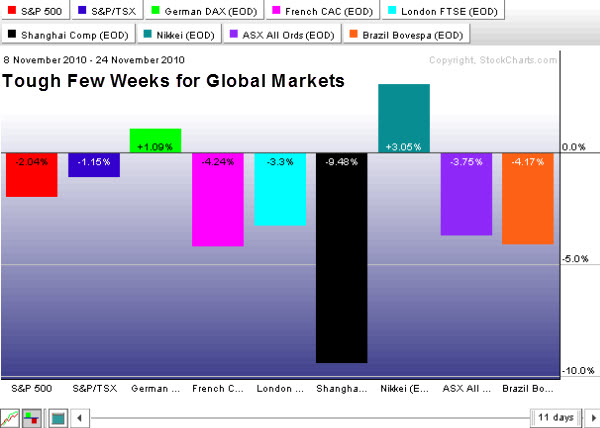

The reasons the bulls are bullish are also pretty universally agreed upon. The industrial economy has gathered some momentum, the emerging markets are surging, companies are flush, profits look set to rise decently again, the Federal Reserve is seeking new ways to penalize risk aversion, taxes won't go up and the market tends to do well in the year after a midterm election.

And we can add to the list the likelihood that another financial-engineering cycle is just getting into gear, so expect lots of equity-friendly refinancings by stretched companies, re-leveraging by cash-rich ones and buyouts hither and yon.

The thing is, it's all pretty much true. And because of that, and given that stock valuations are not excessive, it's tough to think a likely pullback or worse would signal some major top.

That pretty much says it … Hope you have a great week.

Business Posts Moving the Markets that I Found Interesting This Week:

- Birinyi's S&P 500 Prediction a Jaw-Dropper. (InvestmentNews)

- Byron Wien's Ten Surprises for 2011. (CreditWriteDowns)

- Wealth & Fitness Secret: Success is Often a Matter of Getting the Ratios Right. (Forbes)

- Machines Are Taking Over: Electronic Trading Creates a New Financial Landscape. (NYTimes)

- Goldman Invests in Facebook at $50 Billion Valuation. (Dealbook)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- The Selfish Secret to a Happy Marriage (TheWeek)

- Using Google to Tell Real Science from Fads. (BigThink)

- Amazon Reveals the Most Popular Products of 2010. (Mashable)

- Six Apple iOS Exercise & Dieting Apps Worth Checking-Out For The New Year. (TUAW)

- Read "What Matters Now" – a Great Way to Start the Year. (SethGodin)

- More Posts with Lighter Ideas and Fun Links.