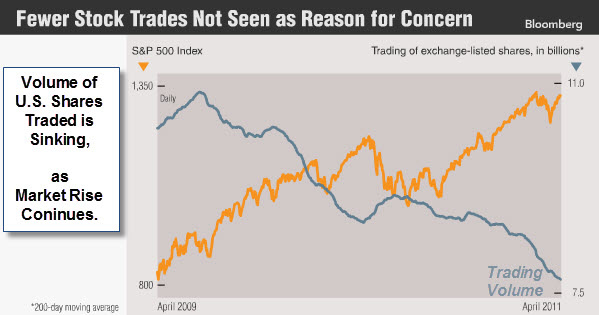

While the US Equity Indices have broken out above recent highs to continue their up-trend, I hear traders complain that this hasn't been an easy market to trade.

Here is a daily chart of the S&P 500 Index.

On one hand, you'd think that a straight-shot bull run higher would feel as safe as the kiddie rides at the amusement park. On the other hand, sagging internal breadth, divergences, and the impending end of QE2 have triggered cautious instincts in many professional traders. As a result, many are selling strength, and end up under-invested during the next push higher.

It's been even more challenging for the Bears, who keep trying to identify and sell a top in this market. However, there's been little selling follow-through. My guess is that because so few people are fully invested in the equity markets, each dip (no matter how small) seems like a buying opportunity to someone.

So, how long can the markets continue to produce these straight up moves to new highs? While the answer would seem to be "indefinitely", we know that's not realistic either. This seems a lot like the market did from December through February, where we barely saw a red day; but you couldn't help wondering each day if this was the top.

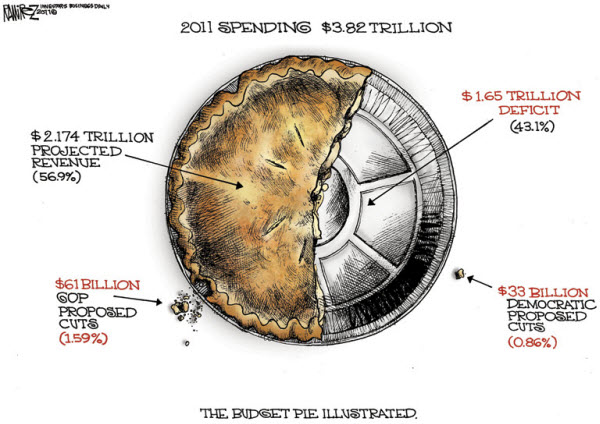

A Little Politics and Economic Policy.

On a side note, Fed Chairman Bernanke held a press conference last week. It was the first ever press conference immediately following a Federal Reserve meeting. Historically, the Fed has released minutes of their meetings about three weeks afterwards. Now, they expect to hold these sessions after every meeting.

On the surface, Bernanke's comments reiterated that the Fed was resolute in their intent to stop QE2 and doesn't desire to reverse the current trend of inflation or a weakening dollar. What caught my eye, however, was how Gold and Silver spiked as he spoke.

It is worth noting that the U.S. Dollar has fallen 31% so far this year compared to Gold. Likewise the Dollar has fallen 25% against the Swiss Franc (which many consider the gold standard of Fiat Currencies). For what it is worth, the Dollar Index is barely a percentage point above the all-time lows set before the financial panic in 2008.