Despite some early selling, the Bears were not committed their positions – and prices held up well again last week. Going into the long Memorial Day weekend, it didn't make much sense for Bears to press their bets without a selling catalyst.

Still, the mood seems 'gloomy'.

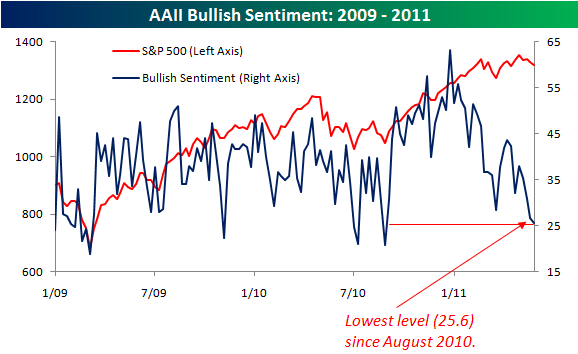

The S&P 500 is down less than 3% from its recent closing high. Nevertheless, based on the latest sentiment figures from the American Association of Individual Investors (AAII), you would think a lot more damage had been done. Bespoke reports that Bullish Sentiment is at its lowest level since August 2010, and a far cry from the 60%+ levels we saw as recently as February.

If you have contrarian instincts, you've got to be bullish right now. Remember, a few bulls is enough to push things higher if there are even fewer bears willing to press their bets.

A Public Service Reminder From the Bear's Den.

A Public Service Reminder From the Bear's Den.

Of course, not everyone is a contrarian. Some see smoke and warn of fire.

With that in mind, here is a list of the 7 major risks David Rosenberg sees brewing:

- China hard landing (PMI down to 51, perilously close to contraction mode)…equity market may have begun to price in some probability of such.

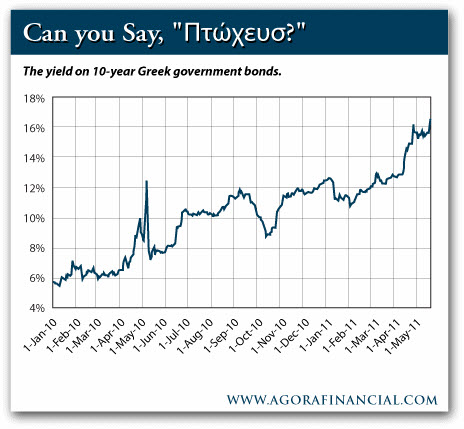

- Contagion sovereign credit risks in Europe (the rating agencies have already begun to take action against Spain, Italy and Belgium).

- Countertrend rally in the US dollar – this is crushing the risk-on carry trades: the unwinding of net speculative short positions in the dollar and long positions in the Euro seem to have further to go based on the latest CFTC data.

- Deepening recession in Japan – still one of the world’s largest economies; spill-over on global production schedules still to be felt.

- US fiscal policy is becoming more radically austere at all levels of government.

- The end of QE2 will be a very big deal given the 89% correlation between the Fed’s balance sheet and the movements in the S&P 500 over the past two years.

- US leading economic indicators are rolling over. The Conference Board Index fell in April for the first time since June 2010; the coincident-to-lagging indicator is down three months in a row; and the ECRI smoothed index is down now for four straight weeks, a streak last seen in July 2010.

Source: Gluskin Sheff (with a hat tip to Pragmatic Capitalism)