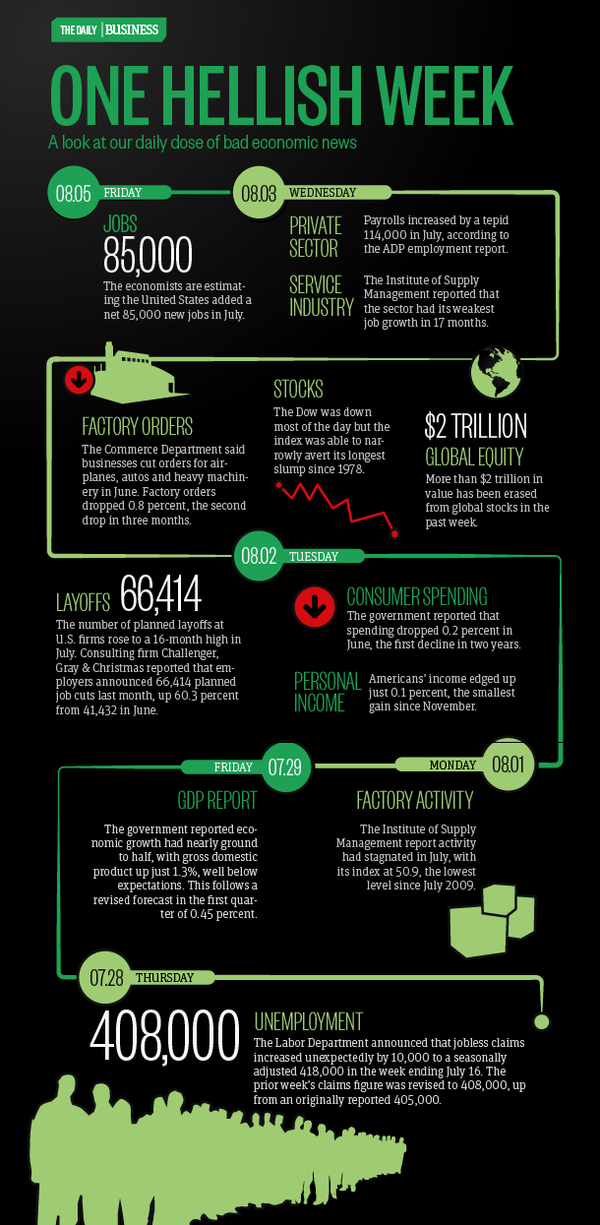

Only some of the heat traders felt this week came from a volatile week in the markets.

Here are some of the posts that caught my eye. Hope you find something interesting.

- Buffett: The Lower Stocks Go, The More I Buy. (Fortune)

- The 4 U.S. Companies Now Rated Higher Than The Government. (BI)

- Porn Doesn't Sell Like It Used To. (WSJ)

- Hackers Disrupt Hong Kong Stock Exchange Trading. (HuffingtonPost)

- Man vs Machine: Robot Trader Beats All Humans at AI Conference Challenge.

The winner, a Bot using adaptive aggression (SmarterTech)

- Think “Different” – Rules for Innovators. (Economist)

- Don’t Worry, Sesame Street Says Bert and Ernie Aren’t Gay. (Slate)

- Saliva Can Tell Scientists How Old You Are (Video). (Reuters)

- How To Drink Gatorade: It Might Be Better If You Don’t Swallow. (Wired)

- Predictions of the Future – From the 1960s! (video). (Singularity)

via

via