I've been spending time with more vegetarians lately. I'd be one too if meat grew on trees.

Meanwhile, it is getting to be Halloween …

On a more serious note, here are some of the posts that caught my eye. Hope you find something interesting.

- Apple's Siri Is as Revolutionary as the Mac. (Harvard Business Review)

- Hacked! The Perils Of Cloud Computing & How to Avoid Them. (TheAtlantic)

- Japan Offering 10,000 Free Round-Trip Tickets to Boost Tourism. (Consumerist)

- A Different Type of Stimulus Package: Oxytocin as a His & Her Sex Drug. (TheDaily)

- 72 Years of Marriage Ends in Holding Hands. That's how I'd want to go! (Newser)

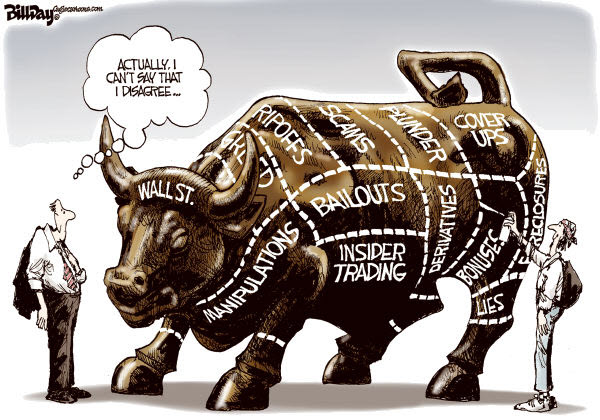

- Has There Been Enough “Blood in the Street” To Get Bullish on Financials? (CNBC)

- Traders Warn of Stock-Market Cracks and Lack of Liquidity. (WSJ)

- Quant Trading: How Mathematicians Rule the Markets. (BBC)

- Here Are Four Charts that Explain What the Protesters Are Angry About. (BizInsider)

- A “Jack Welch” Portfolio Algorithm. Interesting concept. (ETFProphet)