In many senses time is relative.

In many senses time is relative.

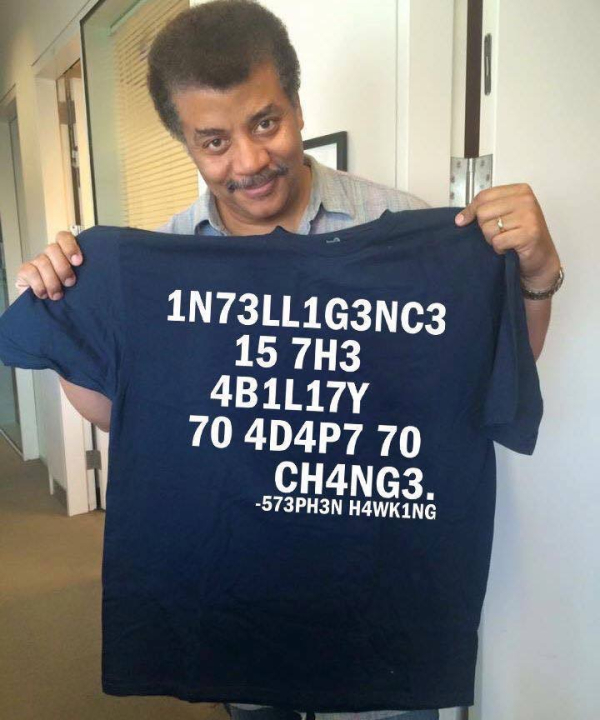

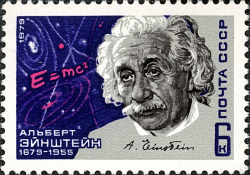

You don't have to be a rocket scientist to understand this quote from Einstein.

"When you are courting a nice girl, an hour seems like a second. When you sit on a red-hot cinder, a second seems like an hour. That's relativity."

It is about more than perception.

Here is something that highlights the relative value of time.

The Value Of Time:

- To understand the value of a year, talk to a student who has failed an important exam.

- To understand the value of a month, talk to a mother who has given birth to a baby a month prematurely.

- To understand the value of a week, talk to the publisher of a weekly newspaper.

- To understand the value of an hour, talk to a couple in love who are separated and want only to be together again.

- To understand the value of a minute, talk to someone who has just missed their train or plane flight.

- To understand the value of a second, talk to someone who has lost a loved one in an accident.

- And to understand the value of a millisecond, talk to someone who won the silver medal at the Olympic Games.

Time waits for no one. So it is important to remember to make the best use of the time you have.

That Doesn't Mean Time Is Scarce Or Has To Be A Constraint:

Time is often thought of as a constraint or a scarce resource. There are lots of phrases that highlight this type of thinking. For example: I don't have enough time; I'm running late; I'm up against a deadline; There are only 24-hours in a day; or, I’m going as fast as I can. As you might guess, that list goes on further. Yet, time does not have to be that way … it can be a tool instead.

Time is often thought of as a constraint or a scarce resource. There are lots of phrases that highlight this type of thinking. For example: I don't have enough time; I'm running late; I'm up against a deadline; There are only 24-hours in a day; or, I’m going as fast as I can. As you might guess, that list goes on further. Yet, time does not have to be that way … it can be a tool instead.

So, I started to think about how I used time.

Was I making the most of it … or taking it for granted? It didn’t take much introspection to notice a few of the ruts I fell into. I'm going to talk about one of them, here, because a small shift can have a massive impact.

To start, let's talk about pace.

A Change of Pace:

When I jog, the beginning and the end are the hardest for me. Yet, after I find that initial pace and I settle into a comfortable rhythm, the majority of the run is relatively painless. My mind and body switch to a nearly automatic mode and I have time to think about many things.

Work is similar in many respects. Once a team gets into a rhythm, work and progress are somewhat automatic. Breaking inertia is a challenge; but, people recognize that it's a challenge. The more insidious problem is to fail to recognize that the work rhythm that's comfortable, and which produces progress, is still a rut. It doesn't stretch and challenge the team to strive for more. Yet, this stretching is what drives innovation. It's the thought we haven't had yet … and a new perspective that changes everything.

Changing your pace can be an incredible catalyst to make that happen for you. For example, imagine that we put together a new portfolio in two weeks, on a wholly new tech platform, with new markets, and using new techniques. Then we tested, re-balanced and rebuilt that portfolio in one week. What we did, or the time in which we did it, wasn’t important. The important part is that it caused the team to work at a radically different pace than before. It was a sprint.

Moreover, this sprint caused us to re-think what we do, and more importantly, how we do it. Many of the innovations and new distinctions that we discovered through this process will work their way into other areas of our work (and will act as a catalyst for us to re-evaluate the way we do things).

A Challenge For You:

I challenge you to consciously change the pace of something that you are already comfortable doing a certain way. The pace can be faster, or the pace can be slower … it doesn't matter. Then notice what comes up for you, and what new opportunities and possibilities you discover.

Time is a valuable resource. Take this opportunity to re-examine how you can best view and use time to make the most of it.