I wrote this back in 2008. With minor updates, it seems relevant again.

Some dogs run fast; other dogs do tricks … my 100-pound lab, Duke's best talent was his ability to remain immobile in almost any situation (some call it "laziness" … I prefer "calm" or being "even-tempered").

Some dogs run fast; other dogs do tricks … my 100-pound lab, Duke's best talent was his ability to remain immobile in almost any situation (some call it "laziness" … I prefer "calm" or being "even-tempered").

At the other end of the spectrum are our two small dogs, Boo and Jasper. Boo, our 20-pound mix between a Beagle and a Boston terrier. Let's just say that he has a higher metabolism than Duke.

When Boo hears a noise, he lets out an involuntary, barely audible, sound. His body becomes rigid and his head cocks. He becomes alert and carefully tunes his ears to their most sensitive setting, seeking any information that will help identify the "danger." He's now primed for the next intrusion.

Usually, there are no other disturbances to follow, and the noise is cataloged and soon forgotten. His alertness level slowly subsides over the next 10-15 minutes or so. He'll go back to napping, a little more fitfully this time … and just a little bit on edge.

Things get a little more interesting when another noise surfaces shortly after the first one. What could once be dismissed now must be treated as a threat – and just to be safe, a threat of the highest order. Now the appropriate response is a series of barks, nervous glances, pacing, rushing off in the direction of the noise to investigate, and a barrage of barks meant to sound more menacing than the source of the noise. Who or what is it? How much harm can they cause? How grave is the threat?

Jasper, our high-anxiety mutt, is never off alert. He doesn't know what's a threat, and what's not, so he's always creating threats out of nothing and riling up our other dogs.

Duke is a different story. Nothing upsets Duke more than Boo or Jasper getting on high alert. The same noise that prompted Jasper and Boo to become alert does nothing to Duke. However, the first time that they make noise, Duke becomes alert. The second time they make noise, Duke starts vocalizing; and the third time, all 4 of our dogs start yapping. Once they start yapping, then the neighbor's dogs start yapping, and suddenly our neighborhood is a cacophony of dog barks.

Duke is a different story. Nothing upsets Duke more than Boo or Jasper getting on high alert. The same noise that prompted Jasper and Boo to become alert does nothing to Duke. However, the first time that they make noise, Duke becomes alert. The second time they make noise, Duke starts vocalizing; and the third time, all 4 of our dogs start yapping. Once they start yapping, then the neighbor's dogs start yapping, and suddenly our neighborhood is a cacophony of dog barks.

The same thing happens in the market with people.

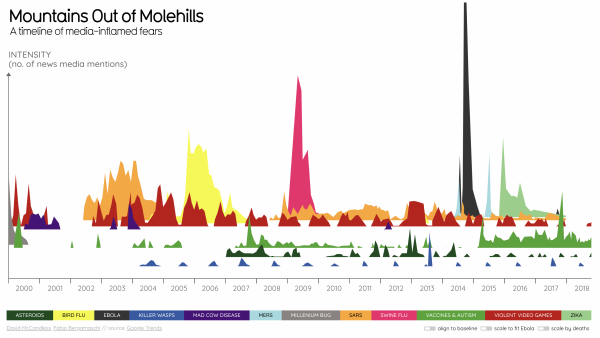

In the market, it is the second noise – and subsequent noises – that creates the equivalent of the Homeland Security "Red Alert." Once an elevated level of alertness has been established, it takes a long period of relative calm for it to subside. And when on "Red Alert" … any additional noises (for example, the responses of the other market participants) – big or small – will highlight, magnify, and further validate the issue.

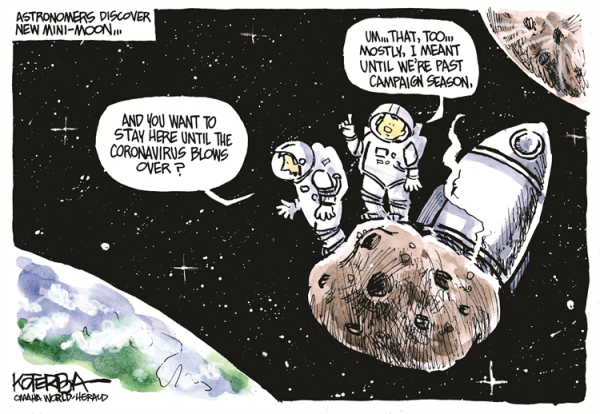

But, like in the story "The Boy Who Cried Wolf," even legitimate threats are ignored after too many false alarms (or prolonged periods of constant alert). So, bad news about the economy isn't as likely to get people excited after the past few weeks.

As people (or bots) become "used" to today's new normal, It'll be interesting to see what sprouts up. The longer away from the initial episode, the more real the effect can be attributed.

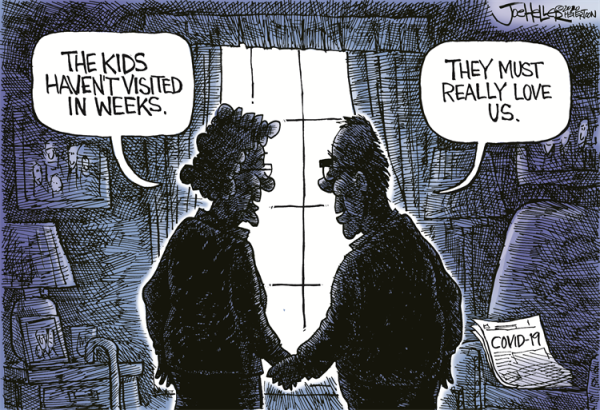

The unfortunate reality is that the Boo and Jasper style "overreaction" to a crisis can exacerbate the long-term effects of the crisis. To balance that, on the macro level, a stronger pandemic response has been shown to increase economic recovery.

This has been the theme from the beginning. Don't personally panic, but respond aggressively on the city, state, and national level.

Food for thought.

via

via