I spend a lot of time doing research … not the way data scientists do, but I enjoy keeping an eye on the pulse of things.

Recently, I've noticed increasing talk about bubbles. One of the most obvious potential "bubbles" being the relatively stable bullish performance of the markets, despite the lack of a full economic recovery.

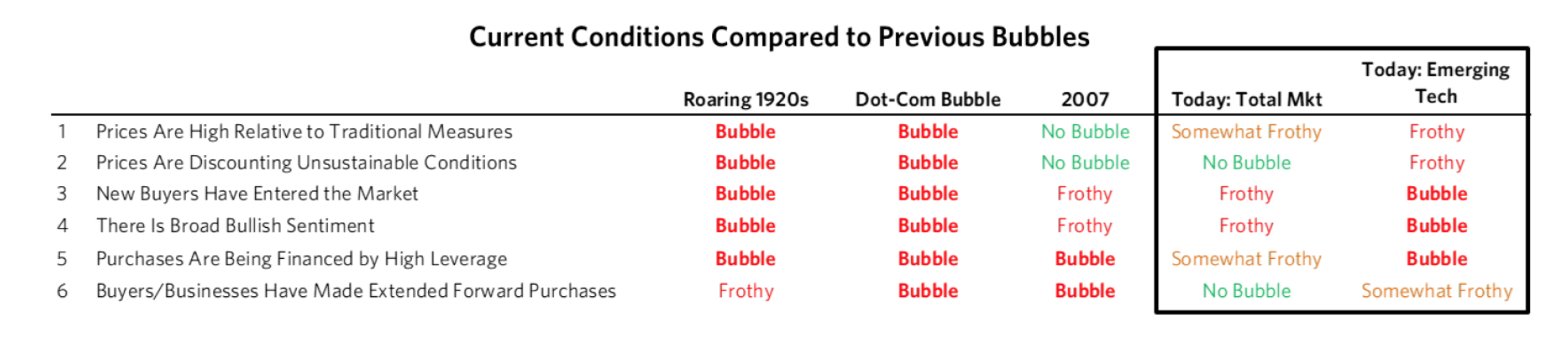

Interestingly, Ray Dalio's bubble indicator says that stocks aren't at dangerous levels, though it does say the top 5% of the top 1,000 US companies are in an extreme bubble. Many of those companies are emerging technology companies.

via Ray Dalio

via Ray Dalio

So, without making a prediction, caution is probably fair, but recognize that people aren't blaring sirens and running with their arms flailing in the air.

Instead of focusing as much on today's bubbles, I thought I'd share a great summary on "how to spot a bubble" by Barry Ritholz.

He suggests 10 elements:

1. Standard Deviations of Valuation: Look at traditional metrics – valuations, P/E, price to sales, etc. — to rise two or even three standard deviations away from the historical mean.

2. Significantly elevated returns: The S&P500 returns in the 1990s were far beyond what one could reasonably expect on a sustainable basis. The years around Greenspan’s “Irrational Exuberance” speech suggest that a bubble was forming:

1995 37.58

1996 22.96

1997 33.36

1998 28.58

1999 21.04And the Nasdaq numbers were even better.

3. Excess leverage: Every great financial bubble has at its root easy money and rampant speculation. Find the leverage, and speculation won’t be too far behind.

4. New financial products: This is not a sufficient condition for bubble, but it does seems that each major bubble has new products somewhere in the mix. It may be Index funds, derivatives, tulips, 2/28 Arms.

5. Expansion of Credit: This is beyond mere speculative leverage. With lots of money floating around, we eventually get around to funding the public to help inflate the bubble. From Credit cards to HELOCs, the 20th century was when the public was invited to leverage up.

6. Trading Volumes Spike: We saw it in equities, we saw it in derivatives, and we’ve seen it in houses: The transaction volumes in every major boom and bust, almost by definition, rises dramatically.

7. Perverse Incentives: Where you have unaligned incentives between corporate employees and shareholders, you get perverse results — like 300 mortgage companies blowing themselves up.

8. Tortured rationalizations: Look for absurd explanations for the new paradigm: Price to Clicks ratio, aggregating eyeballs, Dow 36,000.

9. Unintended Consequences: All legislation has unexpected and unwanted side effects. What recent (or not so recent) laws may have created an unexpected and bizarre result?

10. Employment trends: A big increase in a given field — real estate brokers, day traders, etc. — may be a clue as to a developing bubble.

11. Credit Spreads: Look for a very low spread between legitimately AAA bonds and higher yielding junk can be indicative of fixed income risk appetites running too hot.

12. Credit Standards: Low and falling lending standards are always a forward indicator of credit trouble ahead. This can be part of a bubble psychology.

13. Default Rates: Very low default rates on corporate and high yield bonds can indicates the ease with which even poorly run companies can refinance. This suggests excess liquidity and creates false sense of security.

14. Unusually Low Volatility: Low equity volatility readings over an extended period indicates equity investor complacency.

There are many ways to make money trading … and even more ways to lose money trading. If it were easy, everyone could do it. There is a mix of art and science combined with hard-to-quantify factors at play.

But, survivorship bias is big in trading because hindsight is 20/20. It's easy to look at a popped bubble and say "oh, obviously that was a bubble" … but if it was that easy, trading wouldn't be so hard.

Trends continue until they don't … but at some point, they don't, and that's where people get hurt.

My gut tells me it is time to pay closer attention.

Onwards!

How can you maximize the time you have left? Fill it with the best experiences, activities, and people you can.

How can you maximize the time you have left? Fill it with the best experiences, activities, and people you can.