There's a popular quote by Jim Rohn that states that you are the average of the 5 people you spend the most time with.

I think there's a lot of truth to that statement, but I also think it's true of larger groups.

The people and groups you spend time with influence who you are in the moment and over time. We all act differently within different groups of people, and that's part of why surrounding yourself with the right people is so important.

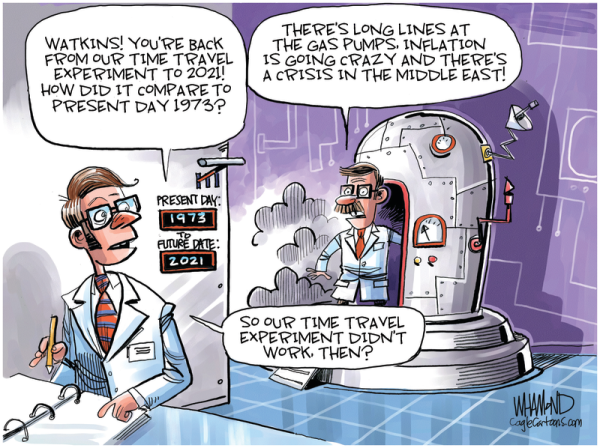

You can see this when you visit your childhood home after many years, or spend time with your parents, or visit your old college. It is easy to revert to who you were when you were most influenced by that person or environment.

A few weeks ago, I spent a couple of hours speaking to Dan Sullivan and Steven Krein to record two podcasts. The first was about building your own future and the second discusses surrounding yourself with the right people. Here is a link to listen to the second podcast, "The Right People to Raise Your Thinking."

For decades I have believed that you can predict a lot about your future based on who you choose to spend your present with.

That is why I think participation in quality peer groups is critical. Peer groups help us set higher standards for our behavior, aim higher in our aspirations, and they help us stay better focused and committed to big-picture goals.

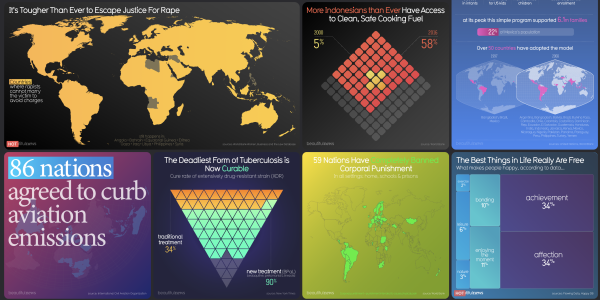

I belong to several executive and business leader peer groups — groups that double as advisory boards, counselor’s offices, and idea factories. They allow me to see, hear, and discuss things I don't normally think about, talk about, or even notice. Peer groups bring blind spots to my attention and keep me fully connected to trends that are transforming the world on a global scale.

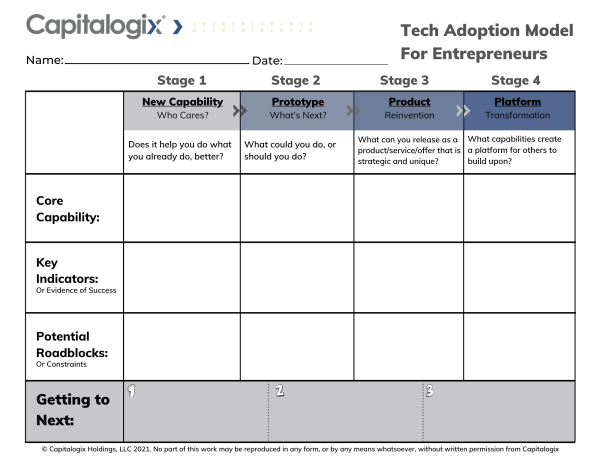

I love going to Strategic Coach because it has a unique approach to challenging people about how they think. After years in the program, the frameworks have unconsciously become a part of how I work and live day-to-day.

If I could challenge you to do one thing based on the lessons in this podcast, I'd encourage you to lay out the framework for where you will be in 25 years. Who do you want to be? How do you want to live? What are you committed to building? Who are you going to be spending more or less time with?

The next part is easy. With those things in mind, start taking steps in the right direction today.

Onwards!

via

via  via

via