Year-to-Date, the Dow is UP for the year. It has been a long time since you've heard that phrase. There was no point in 2008 when the Dow was up for the year (at the close of a trading day). According to Bespoke, since 1900, 2008 was only the fourth year where the Dow (1910, 1962, and 1977) never had a single day where it closed up for the year. So, as of now, we officially suck less than last year.

Last week the major market

averages moved above their 50-day averages for the first time since late August.The Dow is over 9,000.

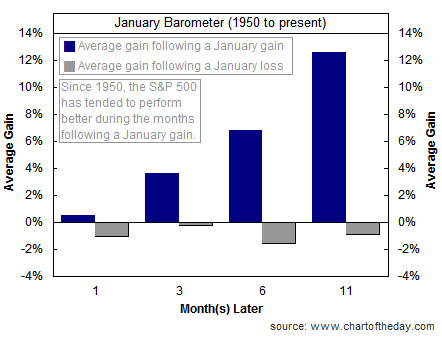

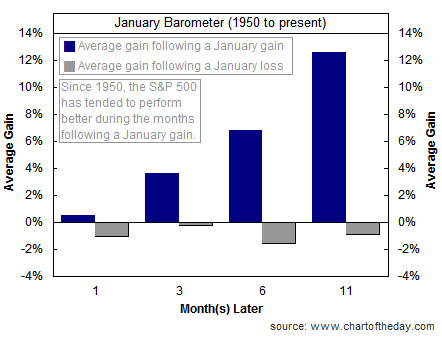

The January Barometer:

Does a market rally in January imply anything for the rest of the trading year? "As goes January, so goes the year." This particular phenomenon is what is referred to as the January Barometer.

Is it true? I don't know; but it is fun to examine.

Is it true? I don't know; but it is fun to examine.

Many reputable services report the January Barometer's recent-history success rate at around 75%; so it is worth watching.

I was going through some research and found this chart from Chart of the Day. It illustrates that the S&P 500 has performed much better (on average) during the months following a January gain. The chart is a few years old, but recent years have followed this trend.

John Murphy has a slightly different perspective; he says that what the market does during the first week of the new year often gives a clue about direction for the remainder of the year.

Murphy cites the Stock Trader's Almanac, "S&P gains during January's first five trading days preceded full-year gains 86% of the time". The predictive ability of the month of January is nearly as impressive. "The January Barometer predicts the year's course with a .741 batting average. 12 of the last 14 post-election years followed January's direction" (Almanac).

The market dropped during the first week and month of 2008 and correctly warned of a bad year ahead. We had a good start to that first week of January here in 2009. Let's hope it keeps up.

Here are a few of the posts I found interesting this week:

And, a little bit extra:

- Twitter users grew 6X last year, and 10X more is expected in 2009. (Financial Times)

- The day Microsoft Zune stayed still; caused by a leap-year glitch. (NYTimes)

- Apple OS market share tops 10% as MS drops (TUAW)