All Revved-up and No Place to Go.

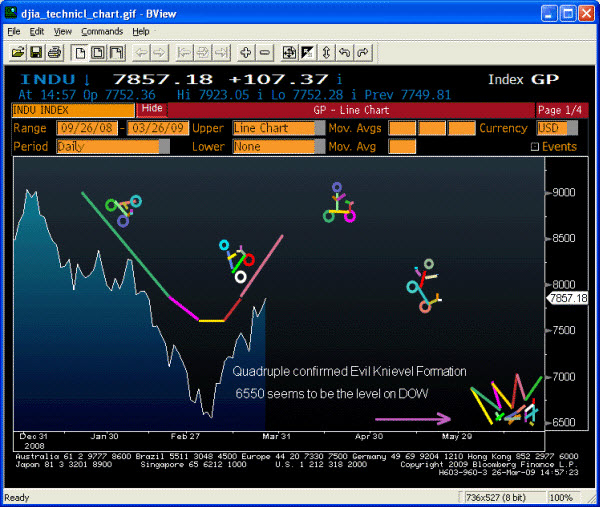

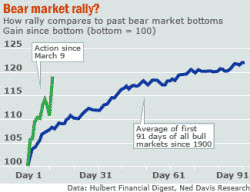

We just saw a 24% rally unfold in a little over two weeks. But a rally like that doesn't make too many people happy. For most, this is where fear and greed collide.

Prudence dictates that position size and risk should stay small while in a serious long-term downtrend, especially with a stock like Citibank recently trading under a dollar. Yet a rally that big and steep often makes people feel like they should have been in the market, and wish they would've traded "this, that, or the other" stock or sector that they noticed a week or two ago.

Don't Worry, This Little Bit of Mind Control Won't Hurt A Bit …

This week I saw several news reports using the phrase "The Great Recession". This might be part of an interesting strategy on the part of the International Monetary Fund, which used that phrase a few weeks ago. Naming something gives you control over it (or at least the appearance of control over it). And "Recession" sounds so much less severe than "Depression". If you can just get people to adopt that phrase, it might give them enough hope that you actually avoid a depression? But just as it's hard to call a recession until you're well into it, I think it's pretty hard to tell whether you come out of it than till you're actually out of it. Still, it is a nice try.

Likewise, I have been impressed by how the administration has played the financial crisis lately. There seem to be some sound ideas, talked about in ways that make sense to the public, which get announced at strategic times. Moreover, it seems to be working; and the market looks like it's responding.

However, the key word there might be "looks". I'm certainly not convinced that the worst is over yet.

Where Are We in the Cycle?

A few weeks ago I noted the spread between smart money confidence and retail investor pessimism was at levels that often indicated short or intermediate-term bottoms. In hindsight it worked again, and there was a pretty sizable rally. However, retail traders are becoming confident again, too quickly for my taste. And the spread is no longer significant. So I don't see an edge there at this point.

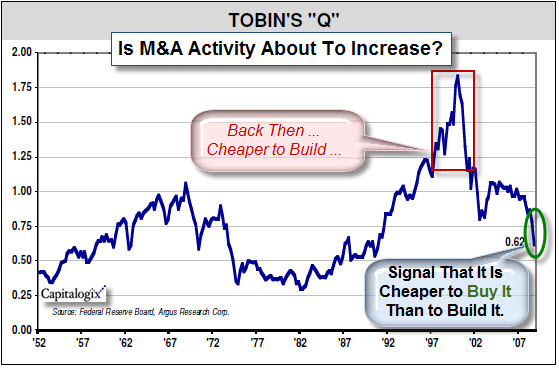

I don't believe this is the end of the bottom. Instead, I hope this is the beginning of the bottoming process. My sense is that there are many businesses hanging on by a fingernail, or sheer will. Some of them are getting tired, others are running out of money, while still others are finding it hard to sell something in this environment. The point is that I suspect we're due for another round of culling the herd. That's not necessarily a bad thing, either.

What I'll be looking for, this time, is that I think we'll see a number of deals get done as prices get lower again. The companies that are going to survive, the companies that are going to thrive, the companies that are going to become new leaders in this next phase of our economy are going to start moving forward again.

Business Posts Moving the Markets that I Found Interesting This Week:

- Bears Are Wary as Bull Returns – Dow Up 21% in 13 Days. (WSJ)

- Is it safe to go back in the water? Best to figure out what went wrong first. (Andy Kessler)

- US economy falls 6.3% in fourth quarter; fastest rate since 1982. (Financial Times)

- Explanation of the Fed's $1.1 Trillion Public-Private Investment Program. (The Big Picture)

- More Posts Moving the Markets (My List)

Lighter Ideas and Fun Links that I Found Interesting This Week

- Friedman: What Distinguishes the Best Leaders, is that they learn from crashes. (NYTimes)

- Mind Control Goes Mainstream – Gadget offer working digital telekinesis. (Forbes)

- Growing-up Online Shapes Work Expectations of the Facebook Generation. (Gary Hamel)

- Nice Introduction to Twitter Use and Best Practices. (Twitips)

- More Posts with Lighter Ideas and Fun Links (My List)