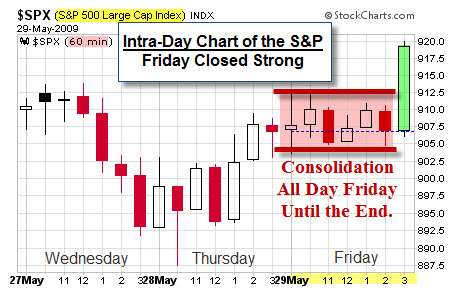

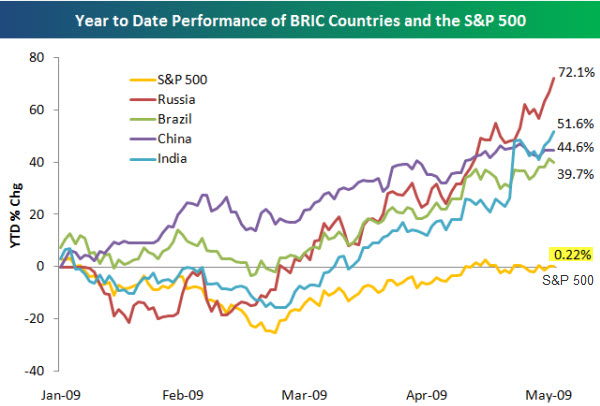

Last week, as the Markets approached their 200-Day declining moving averages and overhead resistance, I said that a sustained break-out to the upside would be significant here.

Well, the Markets gapped higher last Monday, and held their ground. From most logical and technical perspectives the action has seemed relatively healthy considering the circumstances … three months into the rally.

It is somewhat funny that unemployment continues to go up, but people focus on how the increase is slowing. This seems to be happening on several fronts.

Frankly, from a trading perspective, a bullish response to bad news is a bullish sign. And I don't want to look a gift horse in the mouth, either. This Market is quite well-behaved, and has acted as if "Bull-Rules" apply. So, trade what the market gives you. Still, from another standpoint, I'd like to see a pull-back.

Money Shot: A Commentary On Investing.

What is so funny about this video is that the people being interviewed don't know they are a satire of the investment market as a whole. It is worth watching. Hope you enjoy it.

| The Daily Show With Jon Stewart | M – Th 11p / 10c | |||

| Money Shot | ||||

|

||||

Business Posts Moving the Markets that I Found Interesting This Week:

- Jim Rogers 100% Long For The First Time Since '87. (Street Insider)

- New Bull: Does Rare Coppock Curve Pattern Signal the Next Move? (CNBC)

- Was 2008 an Outlier? Not as Much as You Might Think. (SeekingAlpha)

- Is Microsoft Repeating GM's Mistakes? (Infoworld)

- What Does Tivo's Patent Win Mean For Investors? (WSJ)

- Banks Raising Billions to Repay Government. (DealBook)

- Taleb's ‘Black Swan’ Hedge Fund Bets On Hyperinflation. (FinAlternatives)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Becoming a Savant: How To Unleash Your Brain's Inner Genius. (New Scientist)

- Why Meetings Suck: The Four Quadrants of Communication. (Integral Life)

- Will Google Wave Transform How You Communicate And Collaborate? (ZDNet)

- It Just Got Easier to Port Virtual Apps into the Cloud. (Tech Review)

- Microsoft Readies Incentives For You To Adopt Windows 7. (ZDNet)

- Personalized Medicine Could Be The Next Big Thing. (Forbes)

- How Casinos Find and Target Their Favorite Customers. (Wharton)

- More Posts with Lighter Ideas and Fun Links.

TXT