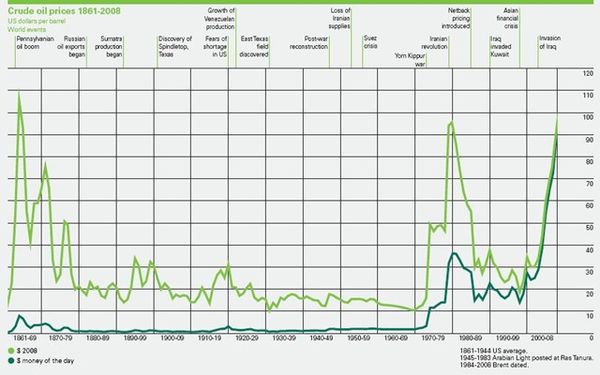

Rolling Stone is not where I typically read insightful Market commentary. Nonetheless, Matt Taibbi wrote a piece for them you should read. The article is called "The Great American Bubble Machine", and it details Goldman Sachs' role in engineering every major market manipulation since the Great Depression. Take a look.

Also, here is a link to the text of the article.

Other Asset Classes.

This chart caught my eye. It shows the top-ten residential real-estate markets, and let's just say none of them are around here. Click the picture to go to Reiden's site for more data.

I guess Goldman Sachs isn't the only one who can create Bubbles.

Also, I'm hearing a lot more rumblings from experienced traders about buying a little gold. Richard Russell, of Dow Theory fame, says: “The way the world is going, ‘gold will be the last man standing’. Gold will be wanted because unlike everything else, gold can not go bankrupt. Gold has no debt against it, gold is not the product of some nation’s central bank. Gold is pure intrinsic wealth. It needs no nation to guarantee it. Gold is outside the paper system.”

Confidence In the U.S. Equity Markets.

The VIX closed at 25.93 today, down more than 16% from Monday’s close of 31.17 to the lowest closing level since September 12, 2008 – the last trading day before the Lehman Brothers bankruptcy was announced. A rise in volatility from these levels would likely be bearish.

Bespoke notes that the Michigan Confidence joins the growing number of indicators that are now at or better than Pre-Lehman levels. It is currently at its highest level since January 2008. This month's reading is also the fourth consecutive month-over-month increase in confidence.

Market Metaphor?

This NYC hotel claims that one of its rooms is not only a tourist attraction, but is “art”. Art that starts to smell bad in warm weather.

Business Posts Moving the Markets that I Found Interesting This Week:

- Why Isn't The Stimulus Stimulating? Seems Like Speed Will Matter. (Forbes)

- World Economy Tracking or Doing Worse than the Great Depression. (VoxEU)

- Morgan Stanley Topples Goldman as M&A Leader this Year. (NYPost)

- List of Banks with the Biggest Profits and Losses Last Year. (Economist)

- Tech Sector Strength May Be Weaker than Claimed. (Barrons)

- Why Computers Can't – Yet – Consistently Beat the Market. (Forbes)

- Michael Jakson's Debt, Private Equity & His Hedge Fund Backer. (FinAlternatives)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- What Is Your Favorite Michael Jackson Song? Interactive Retrospective. (NYTimes)

- Windows 7 at Half Price: Why is Microsoft Offering Discounts? (InformationWeek)

- New Defense Industry Niche: Researchers Developing Tiny Flying Spies. (Forbes)

- New Book on the Secret History of the National Security Agency. (USNews)

- Super-Intelligence: When Will Computers Be Smarter Than Us? (Forbes)

- Google Voice: Smarter Phone Calls for Your Smart Phones. (NewScientist)

- Can You Get Fit in Six Minutes a Week? The Research is Promising. (NYTimes)

- More Posts with Lighter Ideas and Fun Links.