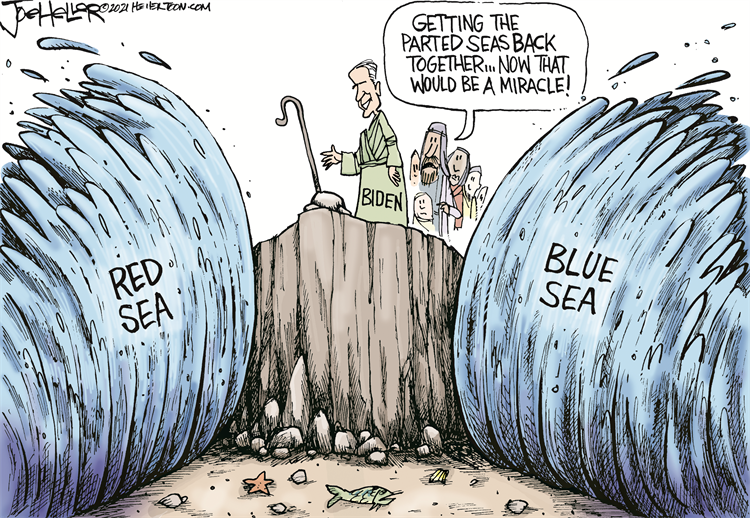

During the Robinhood & Gamestop debacle, I wrote an article about r/WallStreetBets where I essentially said that most of the retail investors that frequent the site don't know what they're doing, but there is the occasional real post with strong research you would see at a real firm.

As an example of good research done by the subreddit, here's a link to a post where a user (nobjos) analyzed 66,000+ buy and sell recommendations by financial analysts over the last 10 years to see if they had an edge. Spoiler: maybe, but only if you have sufficient AUM to justify the investment in their research.

There are also posts that show a clear misunderstanding of markets, and more jokes than quality posts, but I saw a great example of correlation ≠ causation.

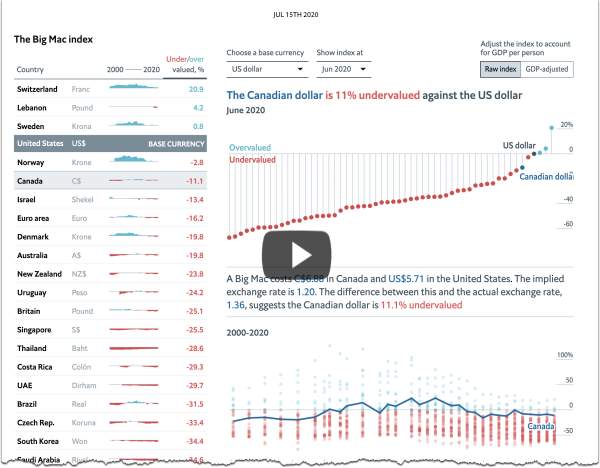

In the past I've posted about the Superbowl Indicator and the Big Mac Index, but what about Oreos?

The increasingly-depraved debuts of Oreos with more stuffing indicate unstable amounts of greed and leverage in the system, serving as an immediate indicator that the makings of a market crash are in place. Conversely, when the Oreo team reduces the amount of icing in their treats, markets tend to have great bull runs until once again society demands to push the boundaries of how much stuffing is possible.

https://en.wikipedia.org/wiki/List_of_Oreo_varieties https://en.wikipedia.org/wiki/List_of_stock_market_crashes_and_bear_markets

1974: Double Stuf Oreo released. Dow Jones crashes 45%. FTSE drops 73%.

1987: Big Stuf Oreo released. Black Monday, a 20% single-day crash and a following bear market.

1991: Mini Oreo introduced. Smaller icing ratios coincide with the 1991 Japanese asset price bubble, confirming the correlation works both ways and a reduction of Oreo icing may be a potential solution to preventing a future crash.

2011: Triple Double Oreo introduced. S&P drops 21% in a 5-month bear market

2015: Oreo Thins introduced. A complete lack of icing causes an unprecedented bull run in the S&P for years

2019: The Most Stuf Oreo briefly introduced. Pulled off the shelf before any major market damage could occur.

2021: The Most Stuf Oreo reintroduced. Market response: ???

- LehmanParty via Reddit

It's surprisingly good due diligence, but also clearly just meant to be funny. It resonates because we crave order and look for signs that make markets seem a little bit more predictable.

The problem with randomness is that it can appear meaningful.

Wall Street is, unfortunately, inundated with theories that attempt to predict the performance of the stock market and the economy. The only difference between this and other theories is that we openly recognize the ridiculousness of this indicator.

More people than you would hope, or guess, attempt to forecast the market based on gut, ancient wisdom, and prayers.

While hope and prayer are good things … they aren’t good trading strategies.

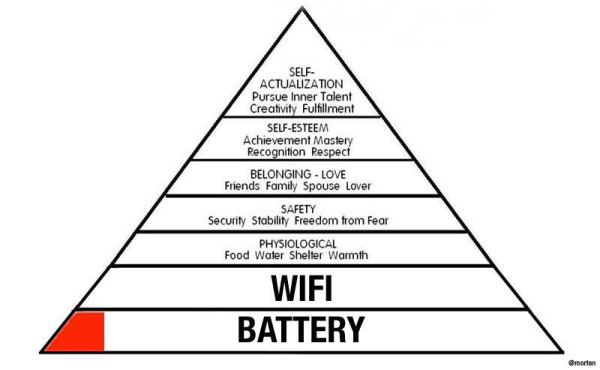

A good reminder that even if you do the work, if you're looking at the wrong inputs, you'll get a bad answer.

Garbage in, garbage out.

via Joe Raedle/Getty Images

via Joe Raedle/Getty Images

via

via  via

via

via

via