In order for our electoral process to work, voting has to happen.

For as long as I can remember, voting has been an issue – but this year turns that on its head.

If you believe the current counts, Trump is behind Biden but still has more votes than he received in 2016.

In this election, Biden tallied almost 79M votes while President Trump received 73M. In comparison, going back to 2016, Hillary Clinton won the popular vote with 66M votes to President Trump's 63M votes.

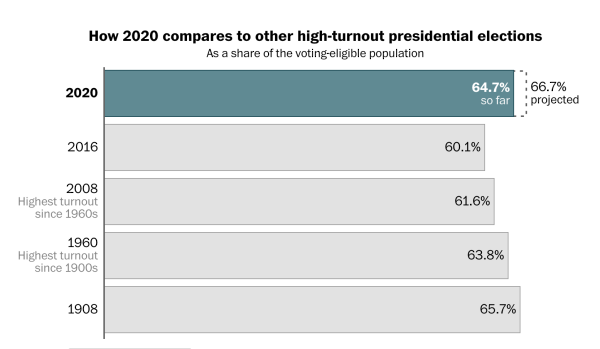

via Washington Post

via Washington Post

This year’s election had a massive difference in voter turnout. In fact, more Americans voted in the 2020 election than in any other in more than 100 years.

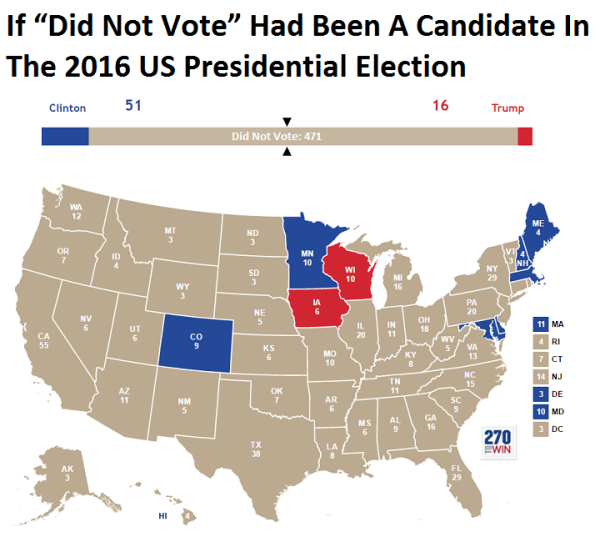

To put that in context, if "Did Not Vote" had been a candidate in the 2016 Presidential Electioni, it would have won by a landslide.

Only 8 states and Washington D.C. had high enough voter turnout to elect an actual candidate.

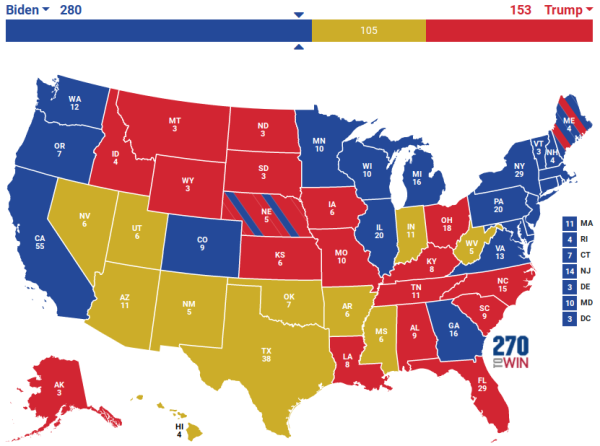

For comparison – here's what 2020's results currently look like under the same circumstances.

via Reddit (As of November 12th, 2020)

In 2016, "Did Not Vote" would have received 471 electoral college votes, but in 2020, it only grabs 105 votes.

As an interesting side note, in 2016 neither candidate won a majority of the vote due to support for third-party candidates. In 2020, it seems Biden has narrowly grabbed a majority of the popular vote with 50.8%.

The numbers vary slightly from source to source, but the data for these numbers primarily comes from the United States Elections Project.

via

via  David Fitzsimmons via

David Fitzsimmons via