October was the worst month for the S&P 500 since October 1987. The current bear market, which made its most recent low this past Monday,

is now the fourth longest decline in the S&P 500 without a 20%

rally (on a closing basis). Besides the 1973/1974 bear market, the only

other times this has occurred was during the 1929-era Depression.

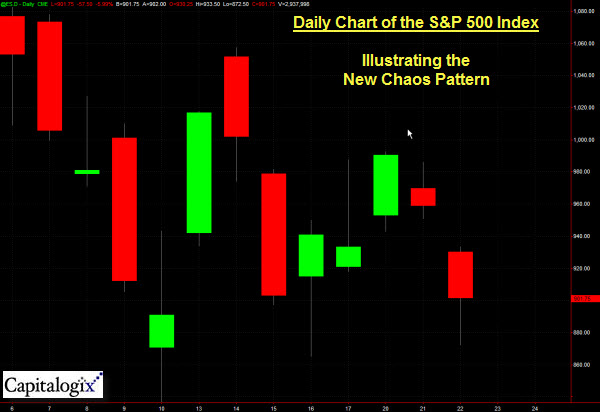

But that doesn't tell the whole story. It was a month that witnessed the second worst week ever, as well as one of the best. It had two days where the S&P 500 was up more than 10%; along with one of the market's worst ten days ever too. To sum it all up, "Volatility" was the word of the month.

In terms of daily moves, the S&P 500 had only three trading days in October where the one-day change was less than 1%. Looking back over the last 50 trading days, the average daily change in the S&P 500 has been a move of 3%. Unfortunately for the bulls, most of those moves were down. Historically, the only period where the average daily move in the S&P 500 has been higher was during the Depression.

The volatility affected traders significantly. If you summed the intra-day zig-zags, the daily range has been much higher. This put many trading models into unseen territory.

Barry Ritholtz put together a list showing just how bad October was. I enjoyed it, and think it is worth the click; here is a link to that post on the Big Picture.