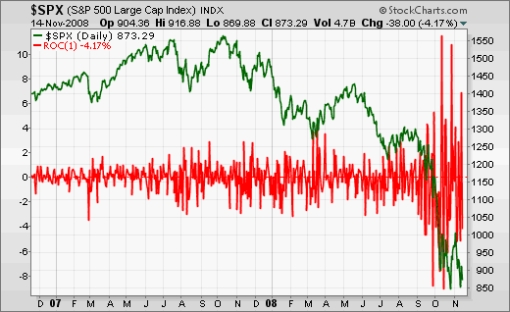

The market is weak right now. How do I know? Aside from the near-audible moan of the world's collective unconscious, price going down is a pretty good primary indicator. Kidding aside, other indicators are worth looking at here too. One of them is the NYSE High-Low line.

The following chart shows this market breadth indicator. It is calculated at

the end of each day by taking the number of NYSE stocks making New 52-week

Highs and subtracting the number of stocks making New

52-week Lows. What is important to notice is the shape of the line – up is strong (or

bullish), down is weak (or bearish). Sometimes a picture is worth a

thousand words.

You can view updated versions of this chart anytime on StockCharts.com at this link.

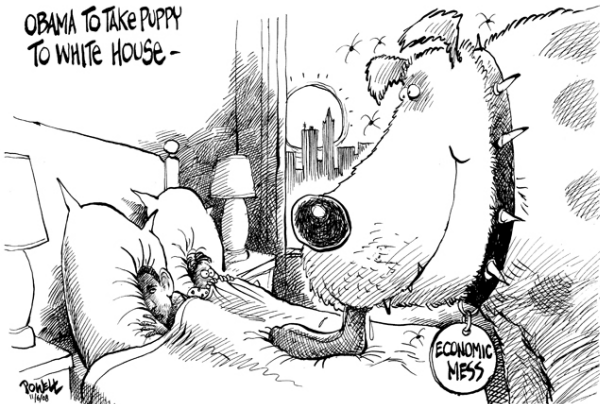

Advice For the Markets: Stop It!

So, what should the markets do next? At this point, humor seems appropriate. I saw this clip of Bob Newhart from Mad TV, last week, and it made me laugh.

Sometimes laughter is the best medicine.