At the end of the week, the markets were pretty much where they started. So nothing happened, right?

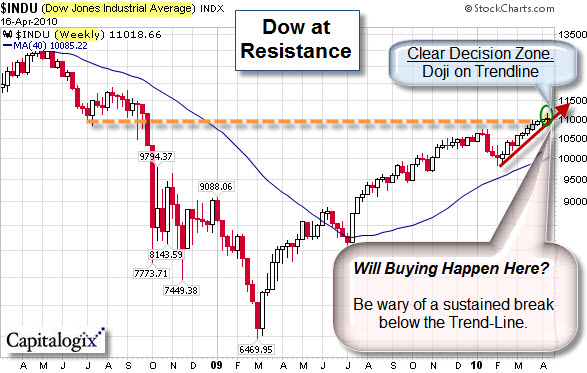

Sometimes weeks like this are important. The Japanese candlestick chart pattern this type of action produces is called a Doji. After a long up-trend, this pattern often marks a turning-point.

Here, there is a Doji resting on the recent up-trend line (drawn with the red arrow) and the support-resistance level (noted with the orange dashed line). This creates an easy decision-zone to watch.

From my perspective, a little pull-back would be welcome here.

Earnings Season Is Here.

During the past few quarters, companies have shown that they can cut-back and save money. Now may be the time investors want to see some sales growth.

The results are not as important to me as the market's response. Are people going to keep buying, or start selling the news? Here are a few items that caught my eye this past week.

- JPMorgan Earns $3.3 Billion in 1st Quarter, a 55% increase of Profits. (DealBook)

- GM Posts $4.3 billion Loss, Says 2010 Profit Possible. (Reuters)

- Intel Profits and Outlook Blow Past Expectations (DailyFinance)

Of course, the news that the government was suing Goldman Sachs also moved the market. How it ultimately moves Goldman is still to be seen. Again, though, what I'll be watching is whether this will become a buying opportunity or a trigger for further selling. That will likely tell us how healthy the rally remains.

Of course, the news that the government was suing Goldman Sachs also moved the market. How it ultimately moves Goldman is still to be seen. Again, though, what I'll be watching is whether this will become a buying opportunity or a trigger for further selling. That will likely tell us how healthy the rally remains.

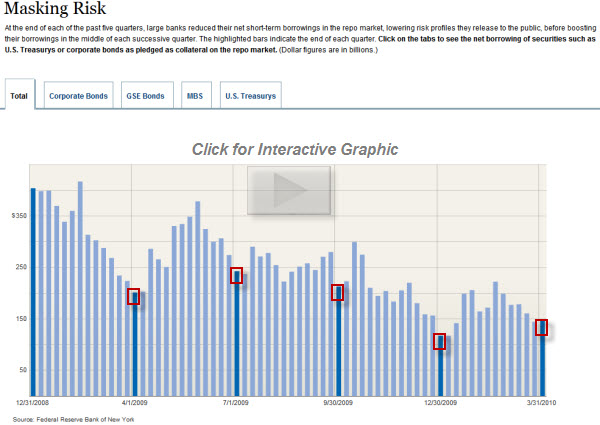

Banks Were Masking Risk Levels From the Public.

On a related topic, according to the WSJ, major banks have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public. Here is an interactive graphic to illustrate what happened.

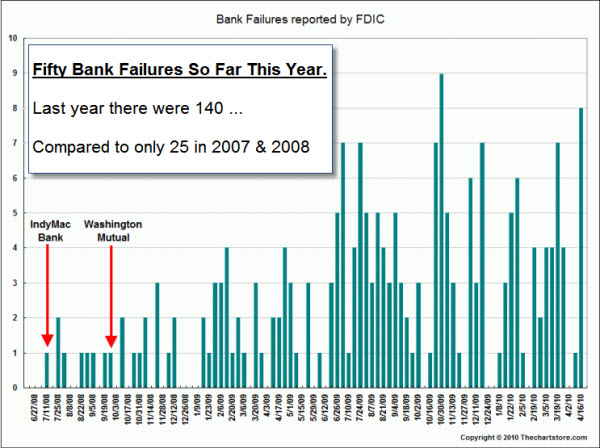

More Banks Are Closing.

Also, Regulators shut down eight more banks last week; that makes 50 so far this year. Last year saw 140 bank failures, the highest annual number since the 1992 Savings & Loan crisis. In comparison, only twenty-five banks failed in 2007 or 2008. Another chart to put this in perspective is here.

Expect to

Hear A Lot More About the Need For More Regulation.

Business Posts Moving the

Markets that I Found Interesting This Week:

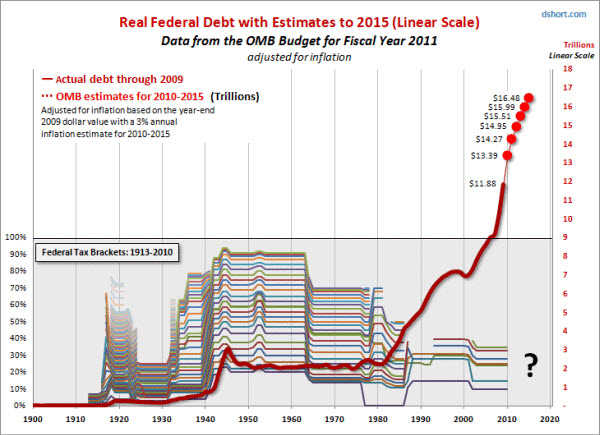

- Bernanke's Dilemma: Hyperinflation and the U.S. Dollar (SeekingAlpha)

- A Dangerous Omen Looms for Bonds. (Money)

- Three Ring Circus: Labor Statistics, Treasury & Commerce Dept. (Sutton)

- Firesales Being Held By Bankrupt

States: What Can We Learn? (BusinessInsider) - Innovation,

by Order of the Kremlin – Russia's Silicon Valley.

(NYTimes) - More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- Twitter Predicts Box-Office Sales – Will It Soon Predict Markets? (FastCompany)

- Is the EMP the Next Weapon of Mass Destruction? (Time)

- Cosmic Archaeology – Looking for New Ways of Finding Signs of Life. (Economist)

- 21st Century Makeover: Shakespeare's Romeo & Juliet in Twitter

Twist. (Reuters) - Fighting Allergies by Mimicking Parasitic Worms? (TechnologyReview)

- More

Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=da9d7dfa-af7e-4332-b703-41d4c43aea27)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=6366a327-851e-47f5-ad36-08549d559ee4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=7db38659-beb8-4b87-a5ae-518dad450b81)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=2b40f39f-7eb0-4621-b690-ee732ba0257c)

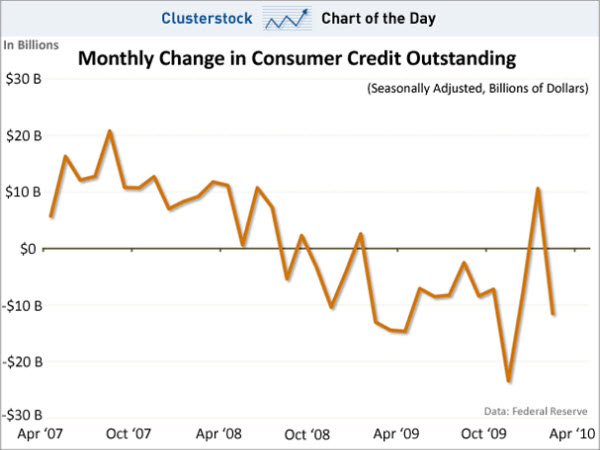

It brings up two questions:

It brings up two questions: With consumers mostly out of the market, institutions figured-out how to buy and sell from each other, making relatively easy profits with minimal risk.

With consumers mostly out of the market, institutions figured-out how to buy and sell from each other, making relatively easy profits with minimal risk.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=62e82373-7ee2-427f-8389-bae872622dc9)