I thought that the Fed jumped in at a very appropriate time, this time. Panic was everywhere.

Moreover, I like the fact that they have not simply been reducing rates. We’re seeing a new form of global coordination with economic allies and novel approaches to serve as a catalyst for stable and growing markets. I know that is not a popular stance.

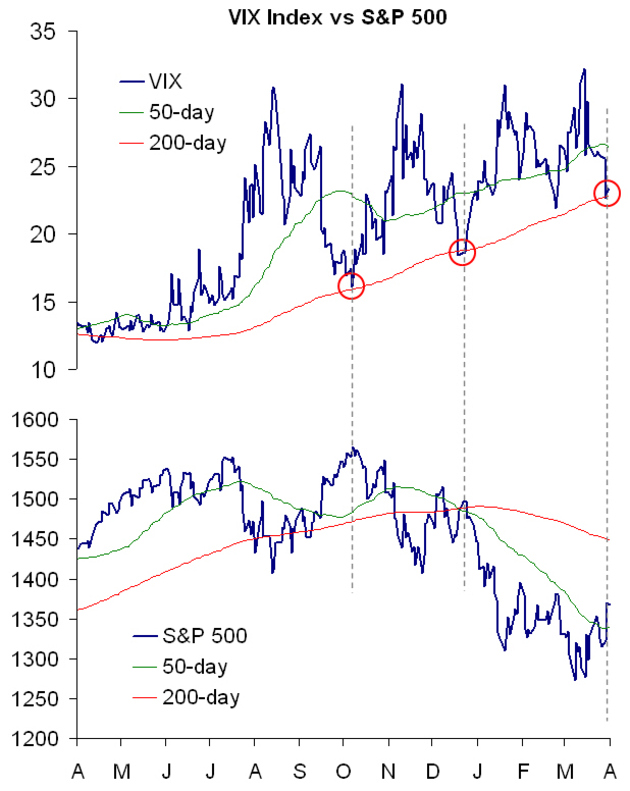

- The 25-plus-year trend in the S&P index was in danger of being broken;

- Bear Stearns was about to fail; and

- We were about to break through the January intraday lows.

I don’t know about you, but as these things happened, I sensed that a cascading series of bad events could take the market down much further than where we currently stand.

graphic from FT

Sentiment has been so bearish and fear has been so pervasive, that

my sense is that people were looking for a reason to get out of the

Markets to avoid an apocalypse. Believe or not, that’s the fuel needed

for the next big up-move in the market.

We’ve been seeing extraordinary levels of fear. It doesn’t matter which

sentiment indicator you look at, we’re seeing readings that have only

been seen at market bottoms of a significant degree. Yet, sentiment is a secondary indicator. Price is primary.

This brings me to another good sign in the markets this week. While I

would stop short of calling what happened in the broader markets

"capitulation" – in my opinion, capitulation-selling happened in many

of the financial stocks. Specifically, take a look at Lehman (LEH),

Goldman Sachs (GS), and MF Global (MF). Each of these stocks lost

incredible amounts of money and came back. This is a very good sign.

In my experience, big volatility (like we’ve seen recently) is followed by much smaller volatility. My sense is that as long as the line in the sand on the S&P holds, then we’ll see an intermediate move upwards without too much scariness for the time being. That’s going out on a limb because we’re really not much different than where we were at the end of last week. Yet there is a difference, in the battle between bulls and bears, for the moment, it looks like the bulls have a little bit of momentum.

In my experience, big volatility (like we’ve seen recently) is followed by much smaller volatility. My sense is that as long as the line in the sand on the S&P holds, then we’ll see an intermediate move upwards without too much scariness for the time being. That’s going out on a limb because we’re really not much different than where we were at the end of last week. Yet there is a difference, in the battle between bulls and bears, for the moment, it looks like the bulls have a little bit of momentum.