Wall Street is expecting another volatile week. In addition to our regular complement of oil price spikes, Dollar worries, inflation fears and economic reports on home building and wholesales prices … this week, the biggest news might be the quarterly earnings reports from Morgan Stanley (MS), Goldman Sachs (GS), and Lehman Brothers (LEH).

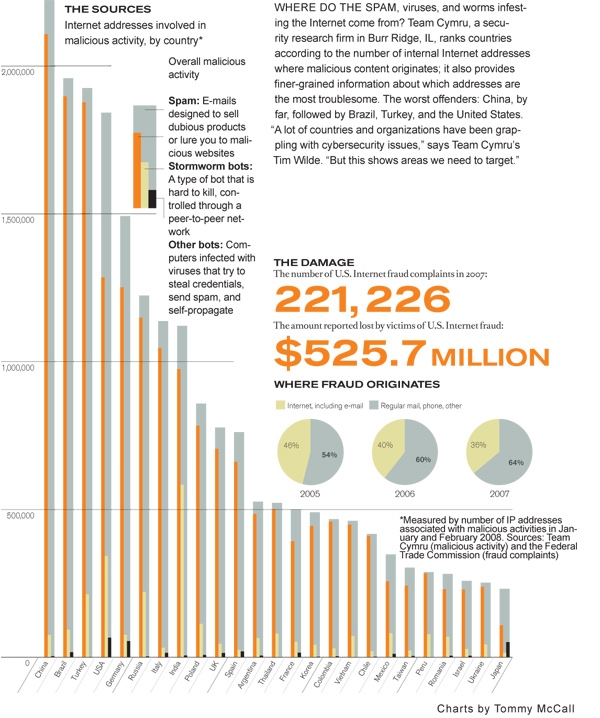

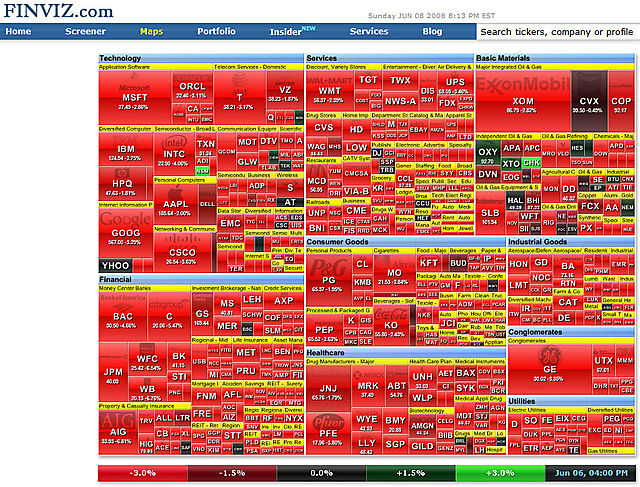

Currently, just 33% of stocks in the S&P 500 are above their 50-day moving averages. Much of this weakness has come from the Financial sector. Only 17% of Financials are above their 50-day moving averages. To see how ugly that sector has been, take a look at the charts of the Financial Sector SPDR (XLF) and the Banking Index ($BKX). Both are back at, or near, their lows.

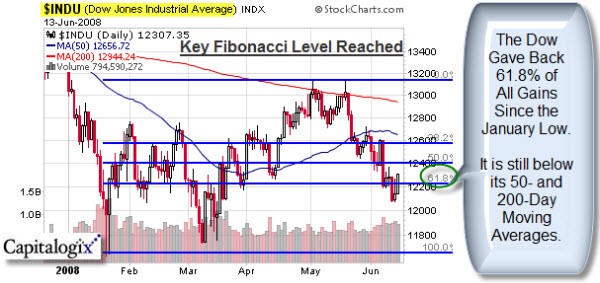

But, next week also has Phi Day. What? Your friendly Fibonacci traders may note that June 18 is 6-18 (and everyone knows how important .618 is in trading). If not, then you haven't spent time at Prechter's site. Even if you don't believe it, enough traders watch the 61.8% retracement level, it is worth monitoring. For example, check out the current chart on the Dow.

Of course, not all US Equity Indices have fallen that far. In contrast, note the relative strength of the S&P MidCap Index.

Here are some of the things that caught my eye this week:

- What's $3BB among friends? Loss catalyst for shakeup at Lehman.

- Lehman's share price might be a better proxy for fear in the market than the VIX.

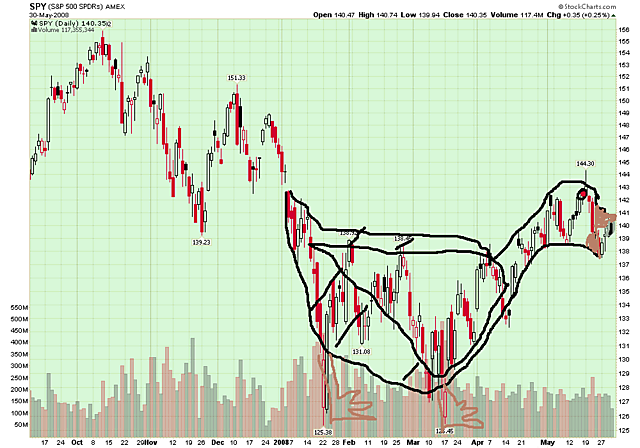

- Signs of a Market Bottom from a Humble Student of the Markets.

- Kudlow thinks Fed will raise rates in July.

- An updated "Misery Index" shows consumers are in as much pain as the early 80s or 90s.

- NYTimes notes a negative 12-month change in private sector jobs is a "Perfect Recession Indicator".

- Infectious Greed notes Exchanges now make more money selling their trade data than on the trades.

- Apple announced their new iPhone and EndGadget has details.