Well, that was something you don't see very often … a nearly 2000 point swing in the Dow.

Here is what that looked like intra-day.

There has been unusual volatility for a while, but this was noteworthy.

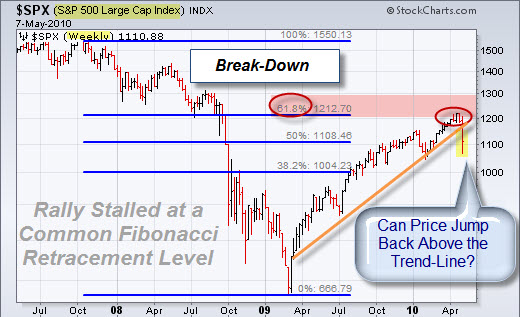

A Weekly View of the S&P 500 Index Shows the Bigger Picture.

The recent rally stalled at a well-known Fibonacci retracement level. In addition, it doesn't bode well for the bulls (at least in the short-term) that price just broke down through critical support, and on high volume.

When markets are ready to change course, we often see violent moves. The side that was enjoying the trend is fighting to keep it alive. The new side, taking over, will have nothing to do with that. Back-and-forth it goes … then all it takes is a massive move to spark a little fear and greed … and you saw what can happen.

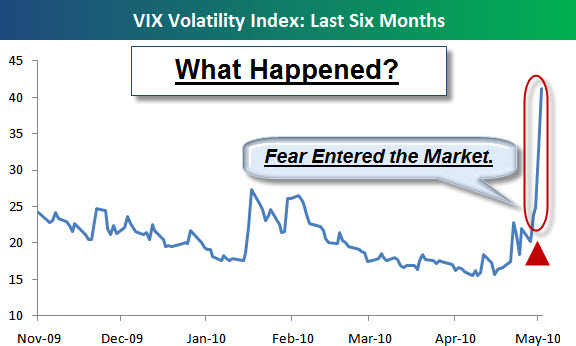

What Does the VIX Show?

Here is a chart of the Volatility Index ("VIX") from Bespoke.

Apparently, the VIX is not the only way to measure fear in the markets. Another way is to follow what "insiders" do. The idea is that if they believe the market will get stronger, then they hold their stock.

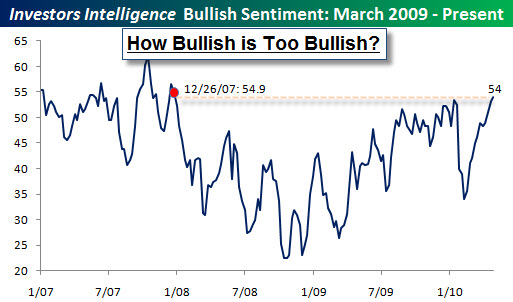

So, What Does Insider Activity Tell Us?

According to Trader's Narrative, insider selling continues to dominate buying by a wide margin. We’ve seen a continuously extreme reading from insider activity measures for the past 12 months. The market has – until recently – ignored this vote of "no-confidence" and plowed ahead. This sustained level of selling pressure by insiders is unprecedented in recent history. Usually we see the buy/sell ratio fluctuate between the two extremes.

NYSE CEO Explains the Sell-Off.

NYSE Euronext CEO, Duncan L. Niederauer, says his exchange slowed trades of stocks including 3M, Accenture and P&G during the 998 point drop. So, you'll be happy to hear that it was a "feature" … not an "error".

We are now pretty over-sold and due for a bounce. Throughout the recent rally, pull-backs triggered buying. It would surprise me if that happened again here.

Business Posts Moving the

Markets that I Found Interesting This Week:

- Questioning Whether the Recovery Can Be Sustained? (FTAlphaville)

- Unpalatable Choices re Euro for Germany & European Central Bank.

(WSJ) - Obama to Nominate Three to the Central Bank. (NYTimes)

- Merger Will Cause Continental-Size Problems for American Airlines. (WSJ)

- What Comes After Exhausting 99 Weeks of Unemployment Benefits. (LATimes)

- More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- Coming Soon to Your Home, a Personal Cell-Phone Tower. (TechnologyReview)

- YouTube is 5-Years Old: Here are 50 of the Best Videos. (Time)

- Military Planning: We Have Met the Enemy & It Is PowerPoint. (NYTimes)

- Stephen Hawking Warns – "Don’t Talk To Aliens". (TimesOnline)

- Naps Boost Memory, But Only If You Dream. (CNN)

- More

Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=5c75f536-760b-48fd-a19e-3754e4492781)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=30e63534-77d4-4e62-b9aa-c2c2a037ea4a)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=05248ddc-bd89-49cd-954a-42f96af9e1b5)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=76e1c64f-12c5-4465-a9f6-3beb5f9d9c65)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=2206e9c8-142d-4775-b2bf-449da0f3ae8c)

My recommendation: let go of your expectations and simply enjoy the

spectacle.

Even Freud has to agree, sometimes a cigar is just a cigar … and sometimes, a movie is just a movie.

Iron Man 2 was a fun and action-packed movie that I'm glad I watched on a big screen.

Does It Live-Up to Its Hype?

Before its release, there were a number of very negative reviews and predictions that it would be "unwatchable". Nonetheless, audiences are watching and, according to Rotten Tomatoes, enjoying the movie.

I had fun seeing it with my son this weekend. It was good enough in virtually every way.

The story held together well enough that I didn't think much about the plot (not that there was much of a plot to think about).

The graphics didn't "wow" me, the way that Avatar's did; but they were good enough that I didn't think about them (even though many of the special effects had to have been computer-generated).

Here is a Trailer so you can see it for yourself.

Here are more videos.