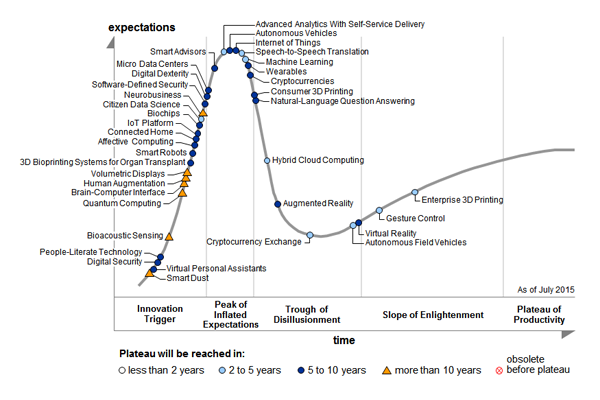

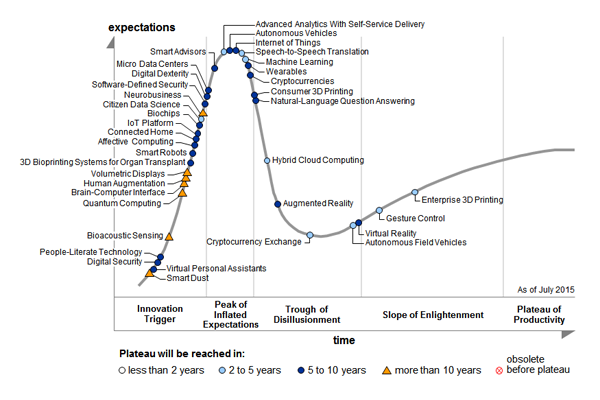

Which are the most hyped technologies today? Check out Gartner's latest 2015 Hype Cycle Report, which illustrates the market excitement, maturity, and benefit of various technologies.

What's the Hype Cycle about?

As technology advances, we tend to get over-excited about new buzz-words & trends in technology and then disappointed when expectations of results go down.

This year, Autonomous Cars and the Internet of Things stay at the peak – while big data has matured past the hype stage.

Here is the chart.

Figure 1. Hype Cycle for Emerging Technologies, 2015

Source: Gartner (August 2015).

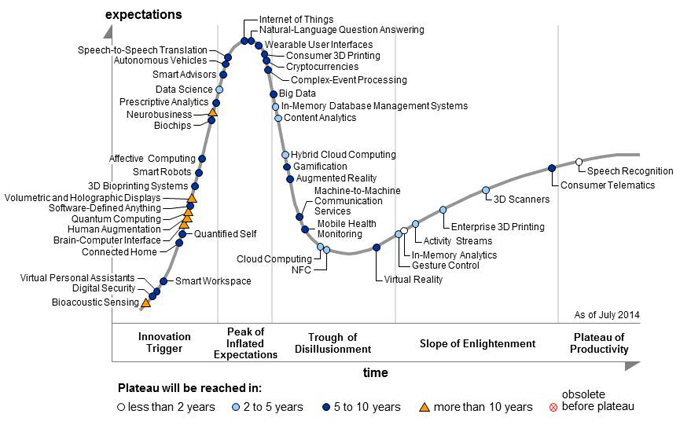

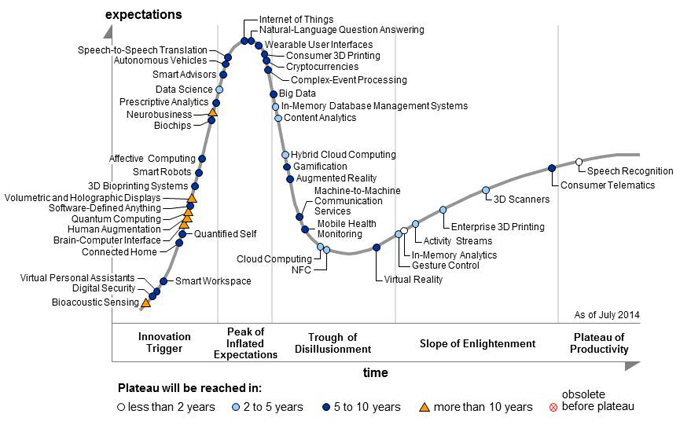

For comparison, here is the chart from last year.

Fig. 2: Hype Cycle for Emerging Technologies, 2014.

Source: Gartner (August 2014).

The hype cycle gives us an idea of which of these technologies survive the market hype and have a potential to become a part of our daily life.

Here are the five regions of Gartner's Hype cycle:

- Innovation Trigger (potential technology breakthrough kicks off),

- Peak of Inflated Expectations (Success stories through early publicity),

- Trough of Disillusionment (waning interest),

- Slope of Enlightenment (2nd & 3rd generation products appear), and

- Plateau of Productivity (Mainstream adoption starts).

Here are some of the key Big Data-related technologies:

- Autonomous vehicles, their placement is shown to have shifted from pre-peak 2014 to peak 2015 of the Hype Cycle. According to Gartner, "while autonomous vehicles (like driverless cars) are still embryonic, this movement still represents a significant advancement, with all major automotive companies putting autonomous vehicles on their near-term roadmaps".

- Internet of Things (Network of Intelligent objects around us coordinating activities) remains consistently almost at the Peak in both years. It is thought of as the most disruptive technology in decades – once widely deployed.

- Natural Language Process Question Answering, last year’s winner, is on its slide down to the Trough. It is still questionable how quickly it will make it through.

- Big data is nowhere to be seen in the 2015 hype cycle; whereas, last year, it was entering the trough of disillusionment. This may mean that the most talked about big data related technologies are now into practice … and are no more a 'hype'.

- Machine Learning made its first appearance on the chart this year, but already past the peak of inflated expectations – and now takes the place of Big Data.

- Digital Humanism, as Gartner defines – makes people better, not technology better. Wearables and the Internet of Things are at the top of the "peak of inflated expectations" on the cycle, along with machine learning and advanced analytics. All those trends are expected to plateau in between two and five years.

- Citizen Data Scientist: Gartner added this new class (in the innovation trigger region) and is expecting it to reach a plateau in 2-5 years. Think of it as Data Scientist Lite, as businesses cultivate people who may have some data skills (possibly from a math or even social science degree) and put them to work exploring and analyzing data.

- Enterprise 3D Printing and Gesture Control Technologies are heading for the plateau fast, but are currently placed in the "slope of enlightenment".

- Digital Dexterity is new. "Today's employees possess a greater degree of digital dexterity," said Matt Cain, research vice president at Gartner. "They operate their own wireless networks at home, attach and manage various devices, and use apps and Web services in almost every facet of their personal lives. Gartner has outlined several ways in which the IT organization should exploit employees' digital dexterity.

- Data Security, which is aready a critical priority today, seems to be surprisingly less of a hype – and is shown as "Digital Security" in pre-peak and close to the trigger region of the hype cycle.

- None of these technologies entered the plateau of productivity, unlike Speech Recognition last year. This may change in the upcoming years with more technologies growing mature.

Which technologies do you think are over-hyped … and which ones might survive the hype?

Additional information is available in Gartner's "Hype Cycle for Emerging Technologies, 2015." This report is part of Gartner's Hype Cycle Special Report for 2015. This Special Report provides strategists and planners with an assessment of the market hype, maturity, business benefit and future direction of more than 2,000 technologies, grouped into 112 areas.