When Peter Thiel gives a talk, people listen — even when the topic sounds absurd. His recent four-part lecture series on “The Antichrist,” delivered quietly at San Francisco’s Commonwealth Club, wasn’t a theological confession. It was a strategy session hidden in plain sight.

Thiel, the billionaire co-founder of PayPal and Palantir, has always been more interested in shaping systems than following them. Despite the theological-sounding implications of “The Antichrist lectures, they were less about religion than about recruitment — turning controversy into capital, ideas into networks, and attention into influence. It was a masterclass in the the secret architecture of modern power.

This article is an opinion piece, but hopefully it provides some perspective and makes you think differently about his talks and the world we live in today.

The Power of the Spectacle

Thiel understands that spectacle builds infrastructure. What looks like provocation is often a mechanism for attracting talent, capital, and alignment.

When he labels critics like Greta Thunberg or AI safety advocates as part of a modern “Antichrist,” he isn’t preaching apocalypse. He’s reframing the narrative — turning complex policy debates into moral showdowns between “progress” and “stagnation”, “good” and “evil”, and “us” and “them”.

That framing does three things:

- Rallies allies who see themselves as defenders of innovation.

- Shuts down compromise by making opposition feel immoral.

- Creates pipelines of sympathetic people into his orbit — whether as investors, engineers, or policymakers.

Thiel has used this playbook for decades. His contrarian campus newspaper at Stanford laid the groundwork for the early network that later became the PayPal Mafia. Each “provocation” seeds something lasting: an organization, a company, or a political foothold.

From Theater to Infrastructure

The cycle is predictable but powerful (and he isn’t the only one using this playbook)!

- Make a bold statement that challenges an elite consensus.

- Generate media attention — some mocking, some intrigued.

- Convert that attention into loyalty, funding, or influence.

The “Antichrist” lectures follow that path. They signal to libertarian thinkers, anti-establishment technologists, and ambitious policy entrepreneurs that there’s an alternative network willing to reward dissent and action.

Over time, those recruits show up inside Thiel-backed ventures, think tanks, and government roles. The result is a quiet ecosystem of influence — people who share Thiel’s outlook but operate independently enough to give him plausible deniability.

Power by Proxy

Thiel rarely holds a formal title in politics, but his fingerprints are everywhere. His protégés hold key positions in the current administration, including Vice President JD Vance and tech policy advisor David Sacks.

The model is simple: invest early, cultivate loyalty, and let others hold the office. It’s a light form of proxy governance — influence routed through protégés, funds, and companies like Palantir.

That distance matters. Thiel can shape outcomes without being directly accountable for them. If things go wrong, the damage is absorbed by the proxy; if they go right, the structure persists and Theil’s systems endure and expand.

It’s the same logic that drives venture capital: spread bets, build leverage, exit before exposure.

Portfolio Politics

Thiel treats politics like a hedge fund manager treats a portfolio — invest when upside potential is high, step back when volatility rises, and re-enter when conditions are favorable.

He was one of the few Silicon Valley figures to back Donald Trump early in 2016. When that bet paid off, he quietly helped fill key tech roles in the administration. As scandals mounted, he withdrew from public view — protecting his brand while his network continued to grow.

That approach now defines a broader class of politically active billionaires. Rather than permanent loyalty, they practice situational alignment — entering and exiting political cycles the way investors trade around risk.

The result is a marketplace of influence that operates on financial logic, rather than ideological consistency.

Palantir: Power as Product

Nowhere is Thiel’s strategy clearer than in Palantir, his data analytics company that supplies intelligence systems to governments around the world.

Palantir’s tools merge disparate data sources into powerful surveillance and decision-making platforms. The irony is striking: Thiel often warns about government overreach, yet his company provides the very tools that enable it.

Palantir’s expansion shows how spectacle transforms into structure. While Thiel distracts critics with rhetorical fireworks, his firm embeds itself deeper into the machinery of government — turning influence into infrastructure.

By the time watchdogs notice, it’s not just a contract; it’s a dependency.

The Visibility Game

Thiel is a master of managing visibility — knowing when to provoke and when to disappear.

High-visibility moments (like the “Antichrist” lectures or his RNC speech) draw attention, attract recruits, and keep his ideas circulating. But he balances that with strategic opacity: dark-money nonprofits, off-the-record talks, and layers of intermediaries that make it difficult to trace influence directly back to him.

Visibility, for Thiel, is not about fame — it’s a control variable. When exposure threatens, he retreats into the shadows. When opportunity rises, he re-emerges to shape the conversation again.

Why It Works

The playbook works because it exploits how attention and trust now operate. In an era of fragmented media, a polarizing figure doesn’t need majority approval — only a committed minority who see opposition as proof of authenticity.

Mockery from one camp signals credibility to another. Every backlash becomes free marketing.

Thiel’s critics see demagoguery; his supporters see courage. Both drive the same outcome: a stronger network growing around him.

Hate it or love it, you’re playing into his hand.

The Broader Silicon Valley Pattern

Thiel isn’t alone in this model. Elon Musk, Marc Andreessen, and President Trump each use variations of the same pattern: build wealth, use contrarian rhetoric to shape public narratives, align with political movements that favor deregulation, and embed their companies into national infrastructure.

This isn’t traditional lobbying. It’s structural capture — designing systems so your interests and the public’s become indistinguishable. When a government depends on your software, influence no longer requires persuasion; it’s built in.

Implications for Business and Governance

For business leaders, there are three big takeaways from Thiel’s evolving strategy.

1. Spectacle Can Be Strategy

In the information age, attention is leverage. But attention only matters if it feeds a system — a company, a fund, a policy agenda. Thiel’s provocations aren’t distractions; they’re signals to attract like-minded talent and capital.

If your organization isn’t thinking about how to turn visibility into structure, you’re leaving value — and resilience — on the table.

2. Influence Flows Through Networks, Not Titles

Formal authority is less important than the networks that surround it. Whether in politics or business, power increasingly operates through proxies — advisors, think tanks, and companies that outlast any single election or CEO.

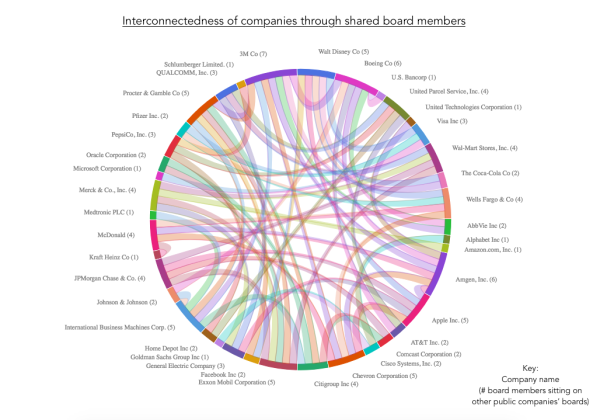

Understanding those relationships is now part of strategic due diligence. Who funds whom? Who sits on which board? Whose ideas are quietly shaping policy? Mapping those links can reveal more than any headline.

3. Transparency Is the Next Competitive Advantage

In a landscape built on strategic opacity, honesty becomes a differentiator. Companies that disclose their political relationships and governance structures early will earn trust faster than those forced into transparency later.

Building internal awareness — of funding sources, advisory roles, and ideological alignments — isn’t just ethics. It’s risk management.

What Comes Next

We’re watching a new architecture of power take shape. It’s decentralized, data-driven, and designed for anti-fragility. The traditional boundaries between business, politics, and media are dissolving.

Ten years from now, billionaire-funded policy ecosystems will be standard infrastructure. “Proxy governance” will be the norm. And moralized, apocalyptic rhetoric will be a mainstream political tool. Not that it‘s not already present.

That doesn’t mean the system is unstoppable. But it does mean leaders must adapt. Power today isn’t just about what you directly control; it’s about the systems you can influence, and the attention you can direct.

The Bottom Line

Peter Thiel’s “Antichrist” lectures weren’t really about religion. They were a masterclass in how modern influence works — how ideas, money, and media can align to shape the institutions that shape us.

It’s easy to dismiss such performances as fringe. It’s harder to recognize them as part of the operating system of 21st-century power.

For anyone running a business or managing capital, the lesson is simple:

- Pay attention to the networks behind the noise.

- Follow how spectacle feeds structure.

- And when possible, build moats where they are least expected.

History is written by the winners … and the real contest isn’t over who gets the microphone, it’s about who designs the stage.

Onwards!

P.S. Here’s a “response” from the actual antichrist. It’s pretty funny.

via

via